Introduction:

District 2 in Singapore has been steadily gaining attention as an emerging investment hotspot. With its strategic location and exciting developments, this district is becoming a sought-after destination for property investors. In this blog post, we will explore the key factors contributing to District 2’s growing popularity and investment appeal. From upcoming developments to infrastructure projects and changing market dynamics, we’ll uncover the potential opportunities that make District 2 an attractive choice for savvy investors.

Changing Market Dynamics:

District 2 is experiencing shifting market dynamics that further contribute to its investment appeal. The district has witnessed a rise in demand for urban living, driven by its proximity to business hubs, cultural attractions, and lifestyle amenities. Many individuals, including young professionals and families, are seeking the convenience and vibrancy that District 2 offers.

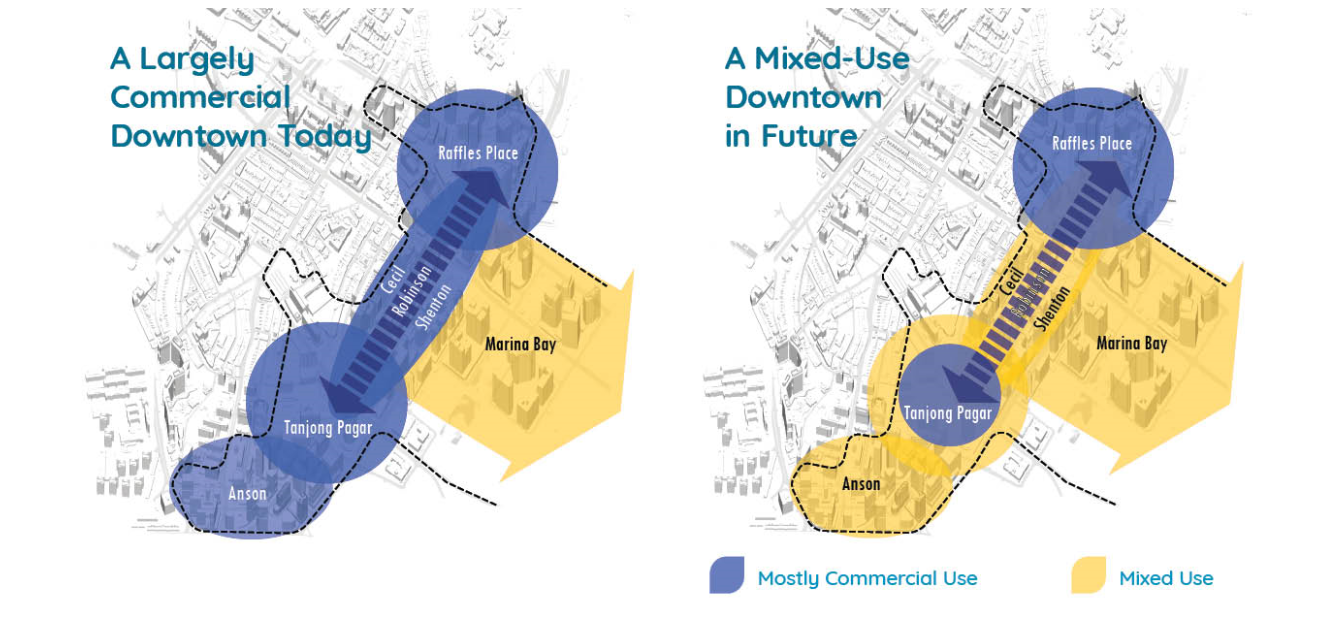

Image source: ura.gov.sg

The demand for residential properties in District 2 continues to grow, as more people desire to live closer to their workplaces and enjoy the plethora of recreational facilities in the area. The district’s central location and well-developed infrastructure make it an ideal choice for those who prioritize convenience and accessibility.

Moreover, District 2 has become an attractive destination for businesses and startups. The presence of vibrant co-working spaces, innovative hubs, and a conducive environment for entrepreneurship has led to an increase in the number of companies setting up their operations in the district. This trend has created a demand for commercial spaces, such as offices and retail outlets, presenting investors with opportunities to diversify their portfolios in District 2.

Upcoming Developments:

One of the primary reasons behind District 2’s emergence as an investment hotspot is the influx of upcoming developments. Renowned developers are launching exciting residential projects, mixed-use developments, and commercial spaces in the district. For instance, One Bernam by MCC Developers promises modern living spaces with top-notch amenities. The development features state-of-the-art facilities, lush green spaces, and convenient access to transportation networks. Such projects not only elevate the lifestyle offerings in District 2 but also present attractive investment opportunities for those seeking long-term capital appreciation.

Additionally, mixed-use developments like Newport Residences are set to transform the district’s skyline. These developments integrate residential, retail, and office spaces, creating vibrant communities where residents can live, work, and play in one place. The rise of these upcoming developments is a clear indication of District 2’s potential for growth and urban rejuvenation.

Quick Details on Newport Residences

| Project Name | Newport Residences |

| Developer | CDL |

| Total Units | 246 |

| Site Area | 5,091sqm |

| Expected TOP | TBC |

| Address | Redeveloped formerly Fuji Xerox Tower |

| District | 02 |

| Tenure | Freehold |

Government Initiatives and Support:

District 2 benefits from various government initiatives and policies that are driving investment and growth in the area. The Singapore government recognizes the importance of fostering a conducive environment for businesses, residents, and investors alike. As a result, they have implemented initiatives specifically tailored to support the development of District 2.

One notable initiative is the Urban Redevelopment Authority’s (URA) master plan for the district. The URA has outlined strategic plans to enhance the livability and attractiveness of District 2 through schemes like the CBD incentive scheme. These plans include the creation of vibrant mixed-use developments, the preservation of heritage sites, and the improvement of public spaces. For instance, under the CBD incentive scheme, new and upcoming developments are built from the redevelopment of existing old commercial buildings that are at least 20 years old. A good example is the upcoming new condo launch Newport Residences where it is redeveloped from the former Fuji Xerox building.

Of course, there are certain eligibility criteria that they need to meet before redevelopment is allowed such as the minimum land size for old buildings to be redeveloped at Anson Road needs to at least 1,000sqm and there are pre-determined proportions of the mixed-use of the residential, commercial or hotel when they are redeveloped.

By revitalizing and rejuvenating the district, the URA is further positioning District 2 as a desirable investment location. Additionally, the government has introduced incentives and policies that encourage businesses to set up their operations in District 2. This includes tax incentives, grants, and support programs for startups and small businesses. These initiatives contribute to the district’s economic growth, attracting entrepreneurs and investors who are looking to capitalize on the opportunities available in District 2.

Infrastructure Projects:

A range of infrastructure projects that will definitely enhance the connectivity and accessibility within the district. The government has recognized the district’s potential for growth and is investing in initiatives to improve transportation networks and public amenities.

One significant infrastructure project in the pipeline is the construction of the Thomson East Coast MRT line. Shenton Way, the new MRT station that will be built in Tanjong Pagar, will connect District 2 to various key areas of Singapore, providing residents and investors with seamless access to public transportation. With convenient MRT connections, commuting within the district and to other parts of the city will become easier, making District 2 an even more attractive location for property investment.

In addition to the new MRT station, road expansions and infrastructure upgrades are also underway in District 2. The government is widening major roads and improving junctions to accommodate the district’s growth. These enhancements aim to improve traffic flow and ease congestion, making it more convenient for residents and visitors to navigate the district. Furthermore, the implementation of smart traffic management systems will optimize the efficiency of road networks in District 2.

These infrastructure projects not only enhance the connectivity and accessibility of District 2 but also contribute to its long-term growth prospects. Investors can expect increased demand for properties in the district as transportation options improve, making it an opportune time to consider investing in District 2.

Lifestyle Amenities and Attractions:

District 2 boasts a wide array of lifestyle amenities and attractions that add to its investment appeal. The district is home to vibrant shopping malls, world-class dining options, cultural landmarks, and recreational facilities.

For shopping enthusiasts, District 2 offers an abundance of retail destinations, including popular malls such as Marina Bay Sands and ICON Village. These malls feature a diverse range of international brands, trendy boutiques, and lifestyle stores, providing residents and visitors with a convenient and enjoyable shopping experience.

Food lovers will also find themselves spoilt for choice in District 2. The district is known for its diverse culinary scene, offering a wide variety of cuisines to cater to every palate. From stylish cafes to Michelin-starred restaurants, District 2 has become a food haven, attracting both locals and tourists seeking gastronomic delights.

In terms of cultural attractions, District 2 is home to several landmarks that showcase the rich heritage and history of Singapore. For example, the Kreta Ayer Heritage Gallery offers a glimpse into the district’s past, while the Tanjong Pagar Park provides a serene green space for relaxation and recreational activities.

The availability of these lifestyle amenities and attractions enhances the quality of life for residents in District 2, making it a desirable place to live, work, and play. For investors, the presence of these amenities contributes to the rental demand and potential for capital appreciation in the district.

Market Outlook

Generally, Singapore is divided into 3 regions: Core Central Region (CCR), Rest of Central Region (RCR) and Outside Central Region (OCR). Typically, price fluctuation in CCR is the most pronounced as compared to the other two regions due to:

- High Demand: The CCR is a prime and sought-after location in Singapore, attracting both local and foreign buyers. The high demand for properties in this region can lead to more significant price fluctuations as market conditions and buyer preferences change.

- Limited Land Supply: The CCR has limited available land for new developments. With a scarcity of land, new property launches in this region are relatively rare. As a result, any fluctuations in demand or changes in market conditions can have a more pronounced impact on prices.

- Luxury Segment: The CCR is known for hosting luxury properties and high-end developments. The luxury segment is typically more sensitive to market changes, economic conditions, and global factors. Therefore, price fluctuations can occur more frequently as market dynamics shift.

- Investor Activity: The CCR is attractive to property investors due to its potential for capital appreciation and rental income. Investor sentiment and market speculation can contribute to price fluctuations as investors respond to economic indicators, government policies, and market trends.

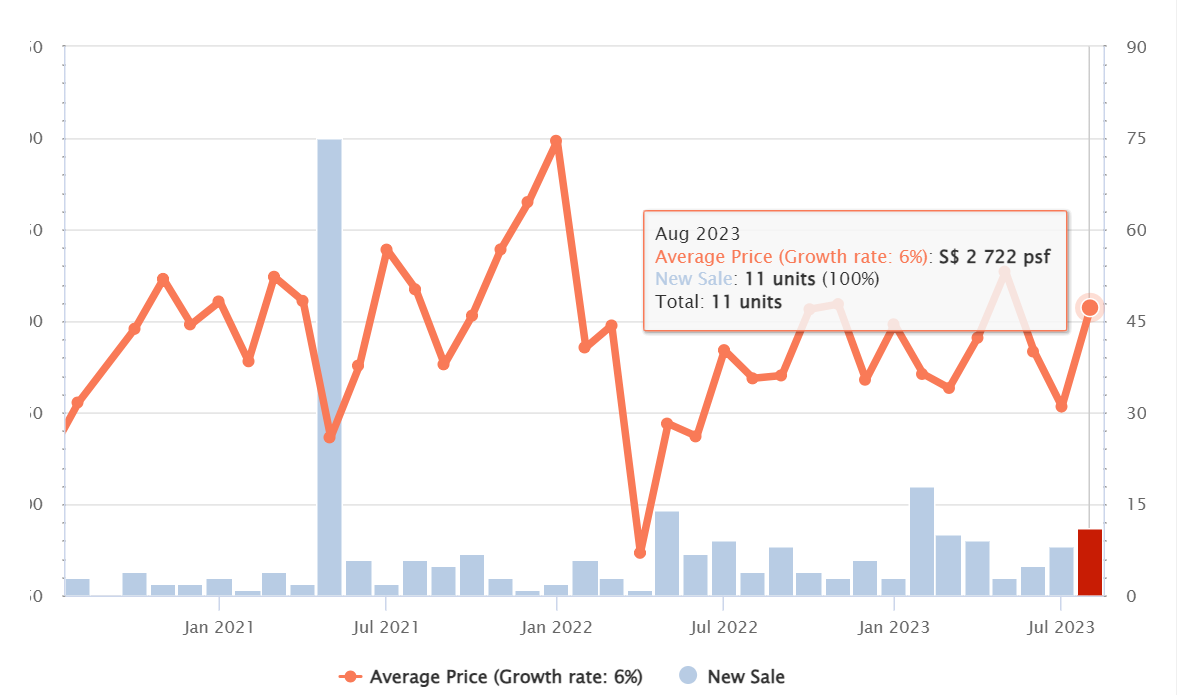

- Economic Factors: The CCR is more influenced by macroeconomic factors such as interest rates, inflation, and economic growth. Changes in these factors can impact property prices, particularly in the luxury segment, which is more susceptible to economic fluctuations.As District 2 is classified under CCR, it is no surprise to see greater price fluctuations in this district as well with the latest average transacted psf for new launches in August 2023 hovers around $2,722psf. I can say that such transacted psf of $2,722 in this district is considered very reasonable, given that there are other new launches in RCR that have gone above $2,800psf.

Based on the comparison below, it is evident that the gap between CCR (blue line) and RCR (red line) has narrowed even further recently. In other words, prices for properties in CCR have soften because purchase by foreign investors have dropped significantly due to the increased ABSD from 30% to 60% and higher interest rate.

Image source: Edgeprop

So, opportunities to invest in CCR are here for you to consider seriously if your budget allows. Right now, District 2 is undergoing rejuvenation. Such changes will bring a positive impact on the property prices along the way.

Conclusion:

In conclusion, District 2 in Singapore has emerged as an exciting investment hotspot, offering promising opportunities for property investors. The combination of upcoming developments, infrastructure projects, changing market dynamics, government initiatives, and lifestyle amenities contributes to the district’s investment appeal.

With the addition MRT station, Shenton Way in Tanjong Pagar and other infrastructure upgrades, District 2’s connectivity and accessibility are set to improve significantly. This, coupled with the government’s strategic plans and support, creates a favorable investment climate in the district.

Moreover, the presence of lifestyle amenities, such as shopping malls, dining options, and cultural landmarks, enhances the quality of life for residents and attracts tenants, further increasing the demand for properties in the area.

Investors who closely analyze market trends, seek expert opinions, and consider the district’s growth potential can identify attractive investment opportunities in District 2. Whether it’s residential properties, commercial spaces, or mixed-use developments, District 2 offers a range of options to suit different investment goals and budgets.

However, as with any investment, it is essential to conduct thorough due diligence, engage with real estate professionals, and carefully assess the risks and potential returns before making any investment decisions.

In conclusion, District 2’s emergence as an investment hotspot presents an exciting prospect for investors looking to capitalize on Singapore’s property market. By staying informed and making well-informed decisions, investors can unlock the growth potential and reap the rewards of investing in District 2.