Your Complete Guide to Understanding Stamp Duties on Property in Singapore

What is Stamp Duty?

Stamp duty is defined as the tax imposed by our local government, Inland Revenue Authority of Singapore (IRAS) on legal documents (such as property agreements, sale, purchase or tenancy agreements, etc) of property that is being purchased or on lease in Singapore.

When buying property in Singapore, there are two types of buyer stamp duty payable to IRAS:

- Buyer Stamp Duty (BSD)

- Additional Buyer Stamp Duty (ABSD)

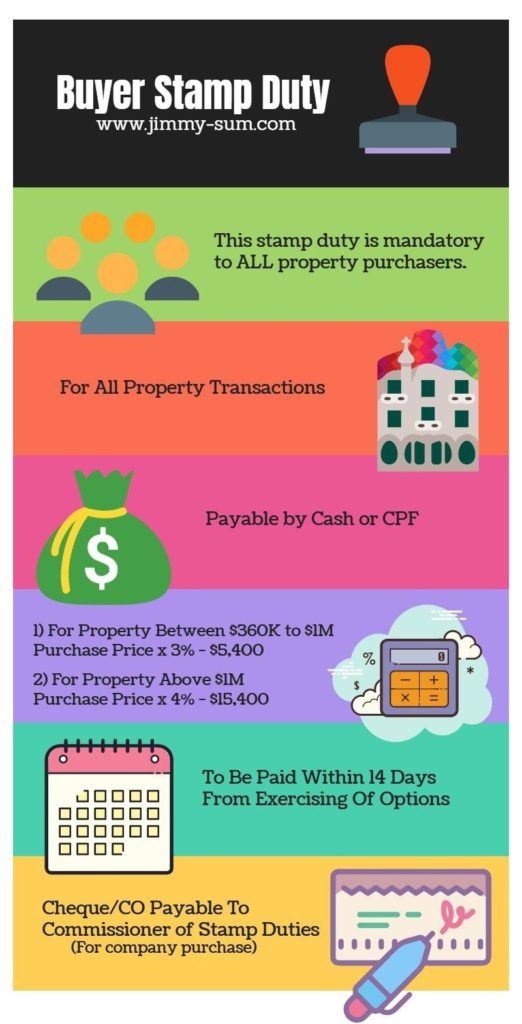

Buyer Stamp Duty (BSD) – Mandatory For All Property Purchasers

Buyer Stamp Duty (BSD) is the stamp duty imposed on property that are purchased in Singapore. The amount of BSD to pay is dependent on the purchase price or the current market value of the property. Whichever is higher, is considered for calculating BSD.

For property that is $1 million and below, the calculation will be:

- Purchase Price x 3% -$5,400

For property that is above $1 million, the calculation will be as followed:

Purchase Price x 4% – $15,400

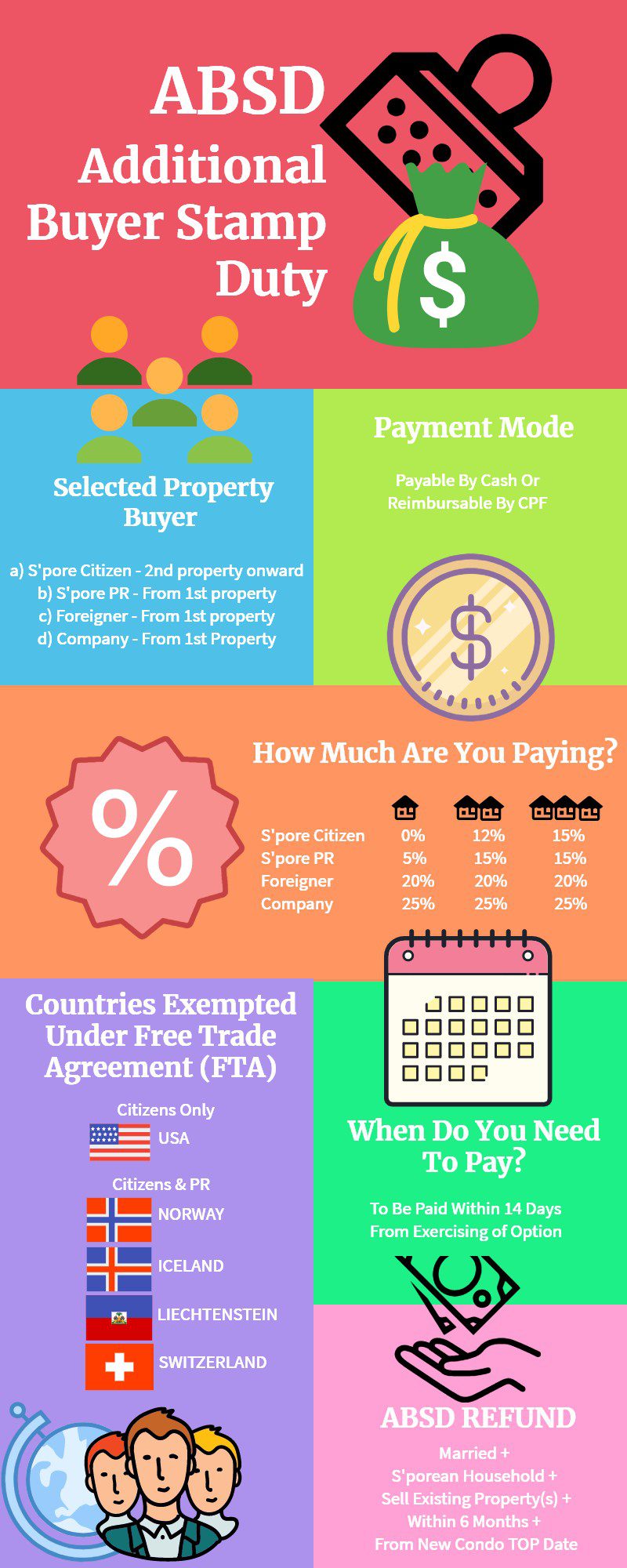

Additional buyer stamp duty (ABSD)

Additional buyer stamp duty, as the name has indicated, it is the additional stamp duty that is payable on the top of the BSD.

ABSD mainly affect Singapore Permanent Resident, foreigner and those buying under company name.

At a glance, this is the ABSD that is payable when you are:

| 1st Property | 2nd Property | 3rd Property | |

| S’pore Citizen | 0% | 12% | 15% |

| S’pore PR | 5% | 15% | 15% |

| Foreigner | 20% | 20% | 20% |

| Company | 25% | 25% | 25% |

However, you can get exempted from ABSD if you are from:

| Country | Status |

| USA | Citizen Only |

| Norway | Citizen + PR |

| Iceland | Citizen + PR |

| Liechtenstein | Citizen + PR |

| Switzerland | Citizen + PR |

Buyer stamp duty applies to all property purchasers, whether you are buying as an individual, non-married joint purchase or as a married couple and regardless of how many properties that you are holding to.

As for Additional buyer stamp duty, it depends whether you are buying as S’pore PR, foreigner or company and whether this is your 1st, 2nd or 3rd property etc.

ABSD Refund

Will You Be Subjected to ABSD If You Are Buying as A Married Couple?

If you are not holding any property in either of your names and one of you is a Singapore citizen, you are in for some sweet treat

| As Married Couple | ABSD Rate |

| S’pore Citizen + S’pore Citizen | 0% |

| S’pore Citizen + S’pore PR | 0%* |

| S’pore Citizen + Foreigner | 0%* |

| S’pore PR + Foreigner | 20%# |

*Based on the buyer’s profile with the highest ABSD rate, the ABSD can be remitted and can be applied for full ABSD remission via the E-stamping portal through your legal representative.

#ABSD rate is based on the buyer’s profile with the highest ABSD rate

To understand deeper whether you are subjected to ABSD if one of you hold property under your name at the point of purchase of another property under both names, you can’t miss this detailed writeup from IRAS

Do You Get an ABSD Refund If You Are Buying A Second Property?

Yes, this is possible but you ought to meet these conditions:

- One of you is Singapore Citizen

- Married to each other

- Holding your current home as your matrimonial home

- Sell the current home within 6 months from the new condo TOP date

- Both names are included in the new property

Then you are eligible to receive an ABSD refund. Click here to read on the commonly asked questions on ABSD.

Can I Use CPF To Pay for The Stamp Duties?

The answer to your question is YES.

You can use your CPF money in the ordinary account to pay for the BSD as well as the ABSD.

Payment of Buyer Stamp Duty and Additional Buyer Stamp Duty is required within 14 days from:

- Exercising your Option to Purchase for resale private property.

- Exercising your Sales and Purchase agreement for property that are under construction.

Or within 30 days of the receipt of the Option to Purchase/ Sale and Purchase Agreement in Singapore if it is signed overseas.

Payment for BSD and ABSD for your resale property can be in the form of reimbursement from CPF where you may need pay cash for the stamp duties first and get reimbursed from CPF at a later date.

However, if you are buying property which is still under construction, then stamp fees can be paid directly from your CPF account.

When You Are Using CPF for Second Property Purchase

It is important to take note when you are using CPF for your second property purchase, you need to set aside the Basic Retirement Sum (BRS). Amount from the Special Account (SA) can be used to form part of the BRS. Once the BRS has been set aside, the excess in your Ordinary Account can be used on your second property purchase, be it for payment of stamp duties or other payment relating to the property purchase.

What Else Can Your CPF Be Used On Your Property Purchase?

Do you know that your OA in your CPF can be used to pay for other things, besides stamp duties, in relation to property purchase?

- Legal Fees

- Installments of Bank Loan

- Part of the Purchase Price

Seller stamp duty (SSD)

The amount of tax payable on all the residential properties levied on the selling price or valuation (whichever is higher) of the property when a seller sells it within a minimum holding period.

| Between 14/11/11 to 10/3/17 (inclusive) | On & After 11/3/17 | |

| 1 Year | 16% | 12% |

| 2 Year | 12% | 8% |

| 3 Year | 8% | 4% |

| 4 Year | 4% | 0% |

| 5 Year | 0% | – |

When Do You Need To Pay?

To be paid within 14 days from exercising of option.

How To Pay SSD?

Payable by cash only

This guide is really useful if you have no idea what kind of stamp duty that you will need to pay when buying property in Singapore. Not only that, the infographic on BSD, ABSD, SSD is created especially for you guys to download and keep in handy on your mobile. Do refer to these infographics whenever you are in doubt.

Alright, that’s all for now. Appreciating your time in reading till the end.

Till next time…Jimmy Sum (9091 8188)