New cooling measures come very unexpectedly on 30 September 22 and it takes effect immediately. The main focus of the latest property cooling measures is meant to cool our current hot resale HDB market where we can see that the HDB resale prices are escalating with almost all transactions involving cash over valuation (COV). Not only that, the number of transactions on resale HDB with a million-dollar price tag is on the rise.

With more countries opening up their borders post-Covid pandemic, economies are recovering. Business activities are increasing at a rapid speed. Interest rates is expected to continue to rise.

Property prices in Singapore is rising at a pace that is faster than expected due to pent-up demand during the last two years. Rental prices have gone up significantly due to the influx of foreign expatriates. New launches have hit above $2,000psf even in locations that is Outside Central Region (OCR). Owners in the resale private property market enjoy high capital return after they sell their private properties.

These private property owners are downgrading back to HDB and they have no issue of paying slightly above a million dollar for a resale HDB.

With million-dollar price tag resale HDB transactions on the rise, our government is getting worried that prices will get out of hand and beyond the reach of most Singaporean.

Our new cooling measures are meant to tackle two challenges:

- To slow down the buying demand on the resale HDB

- Ensure prudent borrowing due to rising interest rate

How to Slow Down the Buying Demand of Resale HDB?

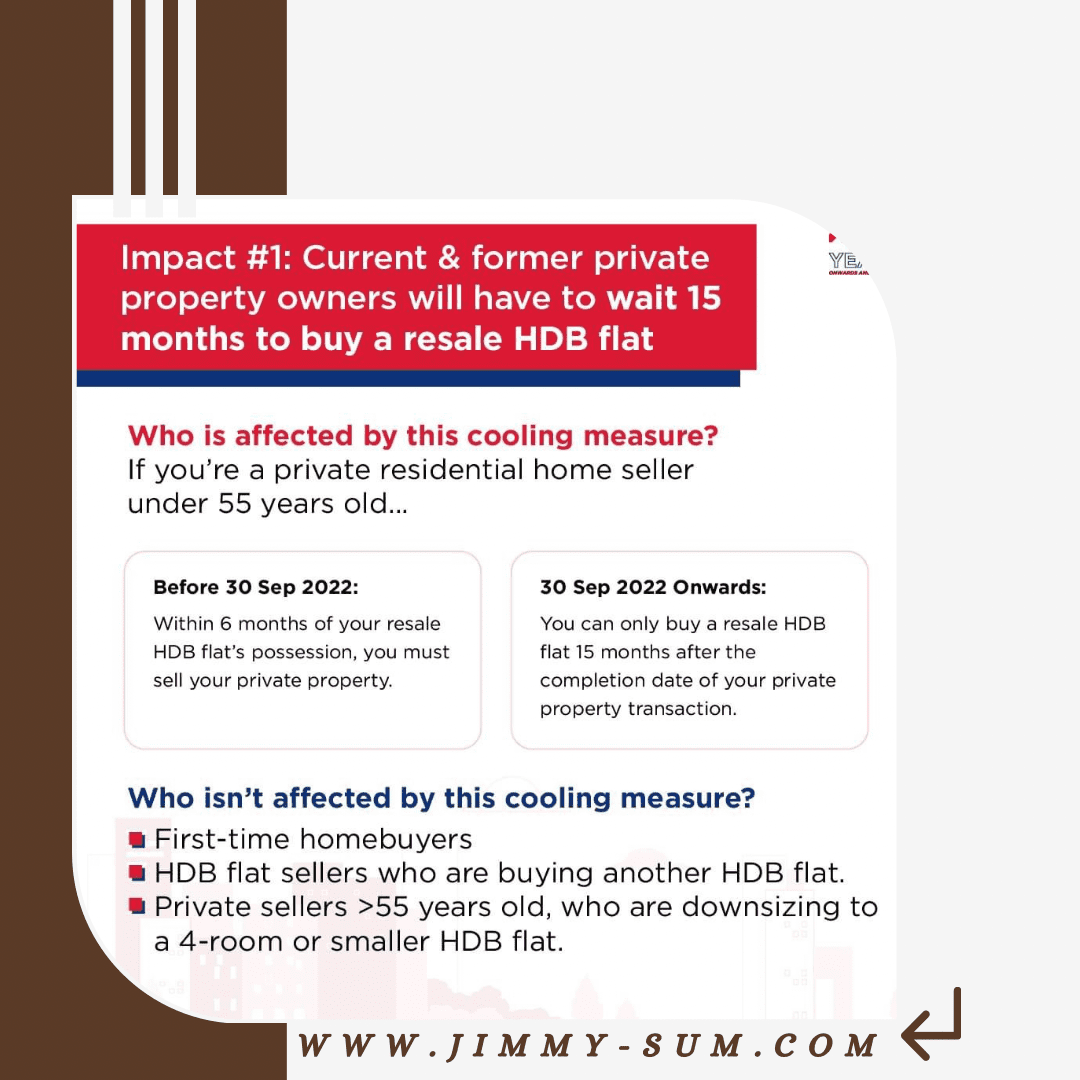

Cooling Measure #1:

- Private property owners (PPOs) who are less than 55 years old have a wait-out period of 15 months before they are allowed to buy a resale HDB.

The 15-month wait-out period will start upon the legal completion of their private property transaction.

Who is not affected by this new measure?

- First-time buyers

- HDB flat sellers who have sold their current flat and looking to buy another HDB

- PPOs who are 55 years old and above and want to downsize to a 4-room or smaller HDB flat.

In the past, PPOs are allowed to buy HDB and dispose their private property within 6 months after completion. However, from 30 September 2022 onwards, they are no longer allowed to do that. PPOs who have sold their current private property have to wait for 15 months before they are allowed to buy resale HDB.

This new measure came too unexpected and left many PPOs very unsure of what they can do next especially for those who have already sold their private property and ready to go ahead and buy a resale HDB.

Suggested options that these PPOs can consider are:

- Rent a place to stay for the next 15 months until they are eligible to buy a resale HDB.

- Go back to resale private property market to buy a suitable property for own stay.

- Buy new condo which have just TOP.

Some of you may have many burning questions in your head right now.

For instance, if you are above 55 years but your spouse is less than 55 years old, are you still allow to buy a resale HDB?

Technically speaking, you are not allowed to do so. However, if you have valid reasons that you need to buy to resale HDB pretty soon, you can definitely speak to a HDB officer and they will review your case.

How do we ensure prudent borrowing due to rising interest rate?

Cooling Measure #2:

The Loan-to-Value (LTV) for HDB housing loan has reduced from current 85% to 80%.

The new HDB loan structure:

| HDB Loan Structure | ||

| Before 30 Sept 2022 | After 30 Sept 2022 | |

| Loan-To-Value (LTV) | 85% | 80% |

| CPF + Grants (if eligible) | 15% | 20% |

As a result of the lower LTV, the loan amount will be reduced.

With a reduction in the loan amount and assuming that CPF grants remains unchanged, the rest of the amount needs to come from CPF ordinary account and/or cash and this amount has become higher after 30 September 2022.

By doing so, our government wants to ensure that there is prudent borrowing and well within their affordability.

From the below example, with an 85% LTV (before 30 September 2022), the loan is $510K based on a purchase price of $600K. However, with new 80% LTV, the loan amount has reduced by $30K to $480K.

Take note: The revised LTV will affect those resale application that is submitted to HDB on and after 30 September 2022.

For bank loan, the LTV remains unchanged at 75%.

Cooling Measure #3:

There is an increase in the interest rate floor for loan calculation.

For HDB loan

Interest rate floor has increased from 2.6% to 3%.

Take note: The increase in the interest rate floor from 2.6% to 3% will only apply to those Housing Loan Eligibility (HLE) received on or after 30 September 2022. There is no impact to existing HLE received before 30 September 2022.

Essentially, your HDB loan is affected by two new factors:

- Lower LTV from 85% to 80%

- Interest rate floor for loan calculation has increased from 2.6% to 3%

As a result, your overall HDB loan will reduce to ensure prudent borrowing.

For Bank Loan

Interest rate floor of 4% will be used to calculate for Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR)

As for TDSR and MSR, they remain unchanged at 55% and 30% respectively.

What does this mean?

With the increased in interest rate floor, it will cause the loan quantum to reduce, leading to a lower purchase price of the property.

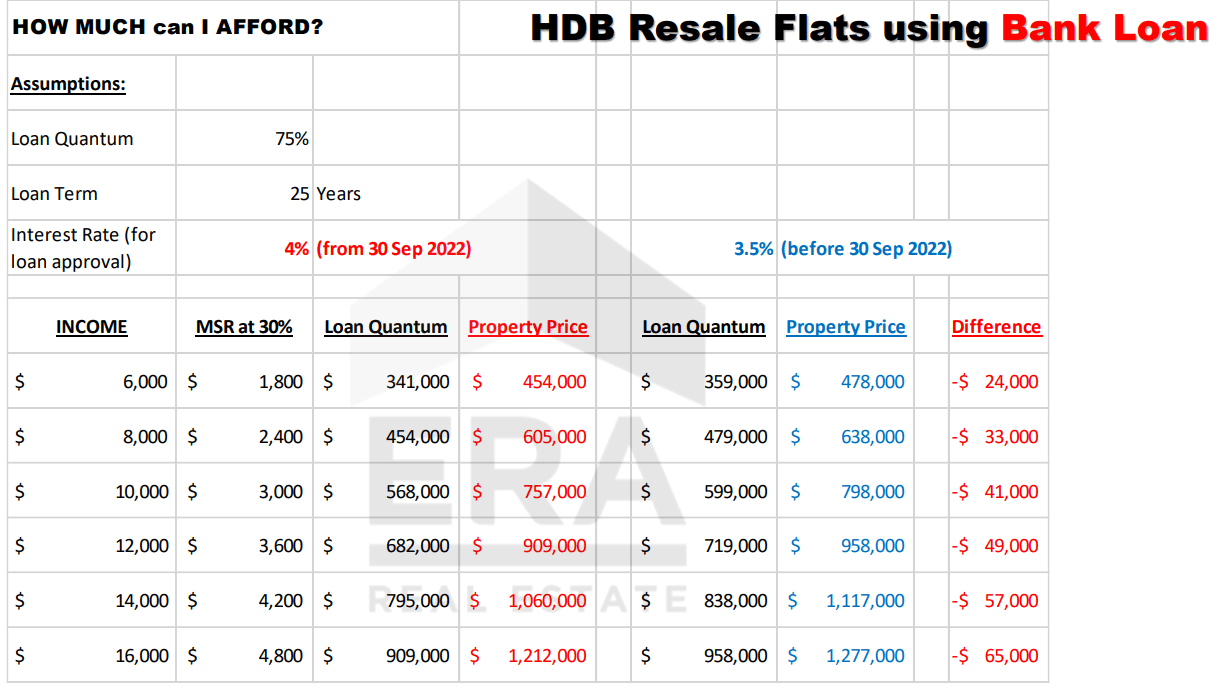

HDB flat Using Bank Loan

Based on different income with an interest rate floor of 4% and MSR at 30%:

- Before 30 September 2022, with an income of $6,000, you can get a loan of $359,000 and with the maximum property price at $478,000.

- On and after 30 September 2022, using the new interest rate floor of 4%, with an income of $6,000, the loan amount has reduced by $18,000 to $341,000 and the maximum property price that you can go has also dropped by $24,000 to $454,000.

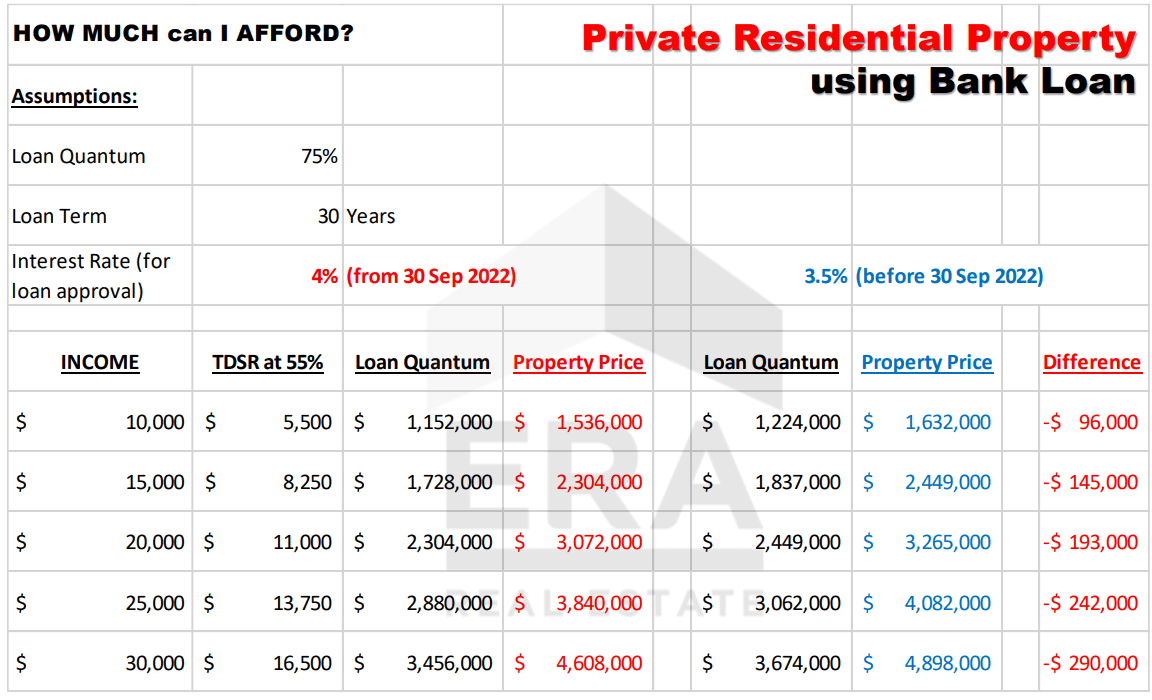

Private Residential Property Taking A Bank Loan

Similarly for private residential properties, we see a drop in the loan quantum and the property price that can be bought has dropped as well.

Take note: This new rule applies to loans for purchase where the Option to Purchase (OTP) is granted on or after 30 September 2022. Likewise, for Sales and Purchase Agreement, this new measure applies if the agreement is dated on 30 September 2022 and later.

Now, you have this question in your head:

“Does this mean that the interest rate charged for HDB loan has increased from 2.6% to 3%?”

Similarly, the interest rate for bank loan has increased to 4%?

The answer is no.

The interest rate on HDB loan remains at 2.6% until 31 December 2022.

As for bank loan, it will still be based on the package that you are taking up with the bank, which is most likely lower than 4%.

The main reason for using higher interest rate for loan calculation is because government foresees that interest rate will continue to rise. Given the current hot property market in Singapore, it is very important to make sure that overborrowing does not take place and being conservative in loan lending right now seems to be the right move. In the event of high interest rate hike, it can still be manageable for the borrowers and not resulting in any loan default.

What Are the Impacts of These New Cooling Measures?

With the new restriction on buying resale HDB, most likely that the demand for rental market will increase, causing the rental prices to go up even further. For those private property owners (less than 55 years old) who have sold their current properties, they may need to rent for 15 months before they are allowed to buy resale HDB.

If they are not able to wait for 15 months, they will need to go back to the resale private property market. With increased demand from this group of PPOs, rising resale private property prices may seem to be inevitable.

Government has stressed that these cooling measures are just temporary restriction to slow down the demand for HDB. Once the situation stabilizes, most likely these restrictions may be removed.

Conclusion

Honestly, nobody has expected this move from the government. A pretty harsh measure aims to cool the HDB market. Million-dollar HDB transactions is on the rise. Government is worried that HDB, being our public housing is getting out of reach for Singaporeans. By removing PPOs who have sold their private properties and looking to shift back to HDB, it will help to moderate the HDB high prices in the next couple of months.

This latest round of cooling measures is not meant to push the resale HDB prices down. Rather, it hopes that with these temporary restrictions, it helps to slow down the buying demand of HDB, hence stabilizing the prices and still making HDB prices well affordable.

Not only that, on hindsight of rising interest rate, our government wants to ensure that prudency is in place. Since the opening of borders worldwide, there is a huge demand for foreign talents and countries are using all means to attract this group of people. Singapore is no exception.

Rental prices have gone up significantly recently. New launches going beyond $2,000psf even in Outside Central Region has become the norm.

Increased demand for HDB has also increased with buyers paying for high COV without batting an eyelid.

However, come to think of this, these new cooling measures help to stabilize the resale HDB market but inevitably, it pushes up the rental demand, causing the already high rental prices to hike even further.

Not only that, for those PPOs who are not able to wait for the 15-month period, they have no choice but to go back to buying resale private properties. We will expect the resale prices to rise as demand increases.

I have no idea whether the resale private properties prices will get out of hand and expecting another round of ABSD looming behind. In case, you have no idea how ABSD will affect your decision of buying properties in Singapore, here is your comprehensive guide to ABSD for 2023.

To conclude, I guess that there is no perfect cooling measure that can help to cool the whole property market. When one segment has stabilized, other segments may get heated up.

As for now, we have no idea how effective is this set of new cooling measures. But in the short term, I believe that it will definitely help to calm down the resale HDB market, stabilizing the prices. Afterall, HDB is meant to be affordable for Singaporeans to stay and this will not change from the past and it will not be in the future as well.