The new private home sales market in Singapore has entered a period of notable turbulence, with October 2023 marking a sharp decline in sales activity.

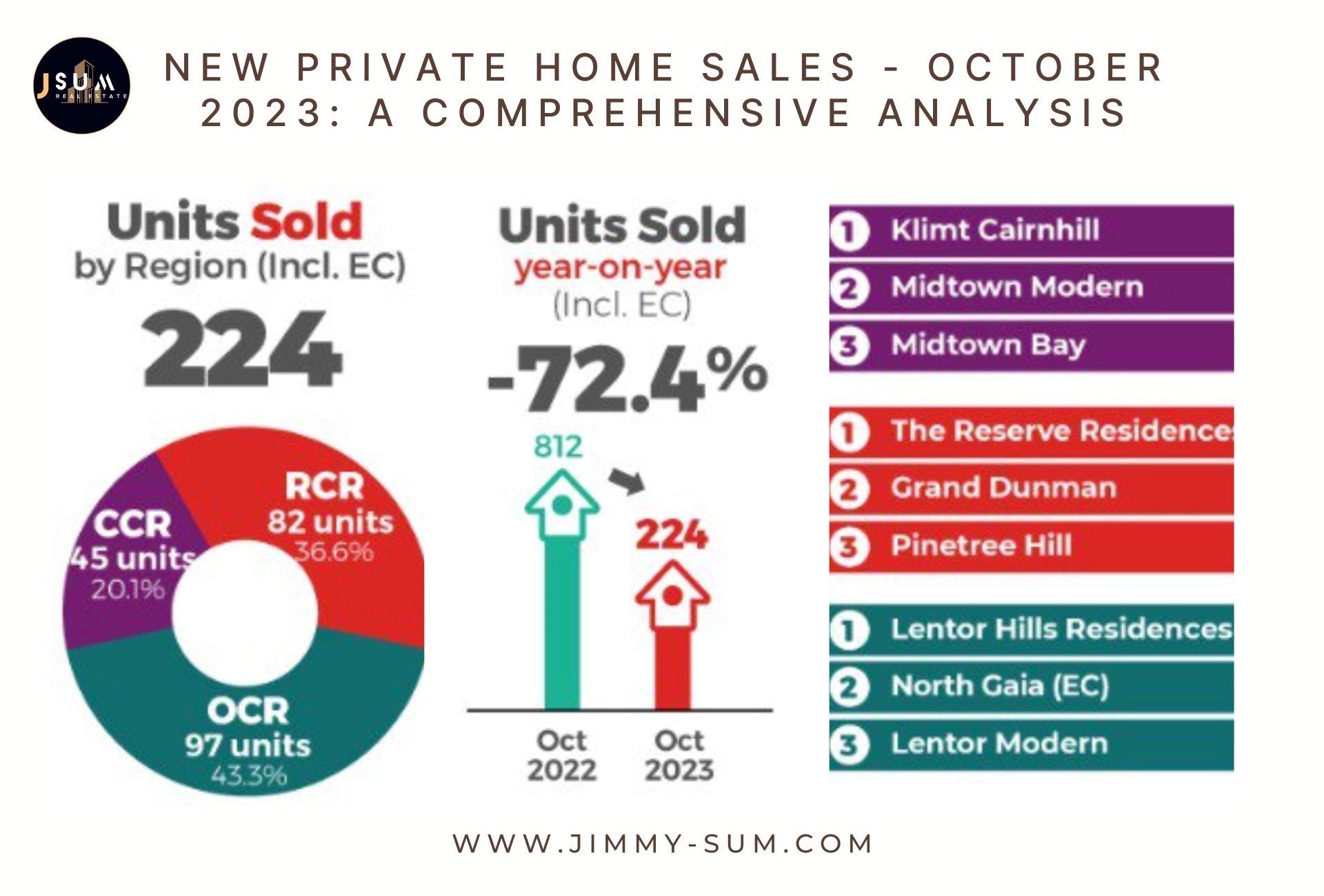

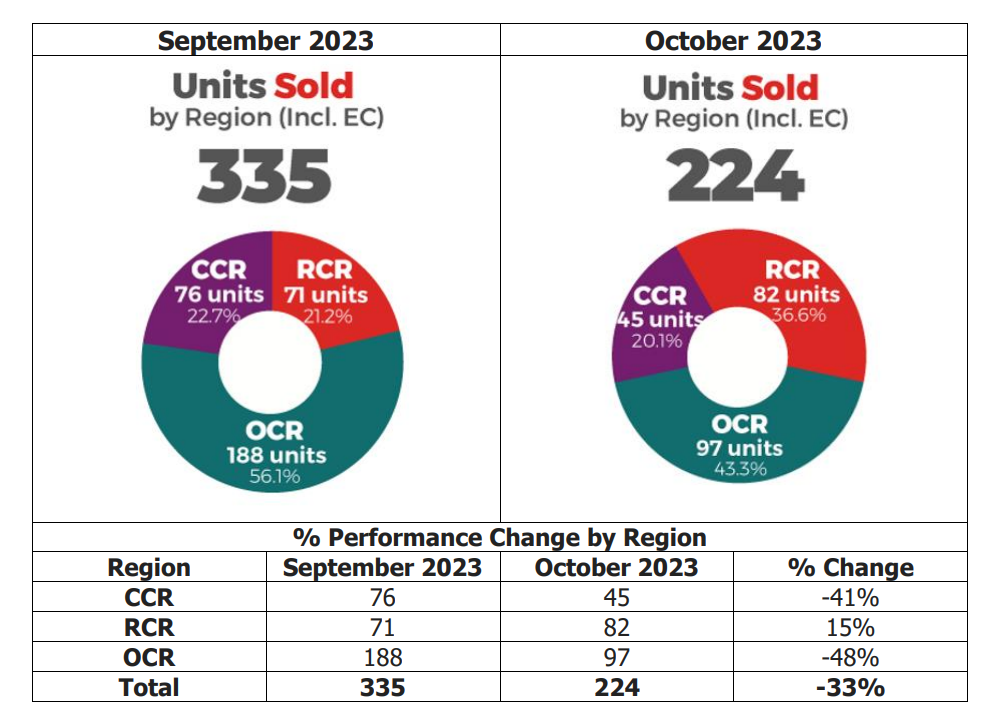

This slowdown, characterized by a 33.1% month-on-month and 72.4% year-on-year drop in sales, represents the lowest monthly sales volume since December 2022. This downturn has permeated all regions and price segments, reflecting the impact of a confluence of challenging factors that are shaping the market landscape.

Navigating the Sales Performance by Regions

The Core Central Region (CCR), Singapore’s most prestigious and expensive property zone, experiences a slowdown of 41% month-on-month in sales. Despite this overall trend, Klimt Cairnhill emerged as the top seller in the CCR, successfully moving 11 units at an average price of $3,509 per square foot.

The Rest of Central Region (RCR), encompassing the remaining central areas of Singapore, sees a slight increase with sales improving by 15% month-on-month. The Reserve Residences emerged as the top performer in the RCR, selling 23 units at an average price of $2,361 per square foot.

The Outside Central Region (OCR), representing the more suburban and affordable housing areas, was not immune to the slowdown, with sales declining by 48% month-on-month. Lentor Hills Residences is the project in OCR that has better than the rest of the new launches with 24 units sold at an average price of $2,116 per square foot.

Factors Driving the Slowdown

From the above, you can see that the sales for new homes has been on the decline since July 2023 with October 71.5% lower than the previous six months average.

A combination of factors is likely contributing to the slowdown in new private home sales, including:

- Rising Interest Rates:The Monetary Authority of Singapore (MAS) has implemented a tightening of monetary policy in recent months to combat rising inflation. This has resulted in higher interest rates for mortgages, making it more expensive for buyers to purchase private property.

- Cooling Measures:With the latest round of cooling measures introduced on 27 April 2023 to moderate demand for private property, its impact is becoming more evident in the recent months of new homes sold. These measures have made it more difficult for buyers to purchase multiple properties and have also increased the stamp duty payable on property transactions effective on 15 February 2023.

- Economic Uncertainty:The global economy is facing a multitude of challenges, including the war in Ukraine and Ganza. Not forgetting about surging inflation as well. All these have led to increased uncertainty among buyers, who are becoming more cautious about making large purchases.

Assessing the Outlook for the Market

The outlook for the new private home sales market in Singapore remains uncertain. The factors currently contributing to the slowdown are likely to continue to exert pressure on sales in the near term. However, the government may consider rolling back some of the cooling measures if the slowdown persists.

Delving into the Implications of the Slowdown

The slowdown in new private home sales is likely to have a ripple effect on the Singapore property market. Developers may delay or scale back new launches, and prices may soften in some areas.

The government is likely to continue monitoring the market closely and will take action if necessary to support the market.

Despite the slowdown, there is still some underlying demand for private property in Singapore. Buyers who are able to afford to purchase a home are still likely to do so.

Conclusion: Navigating the Market with Prudence and Patience

The new private home sales market in Singapore is navigating a challenging period marked by a confluence of factors. While the current slowdown may present opportunities for those with the financial means to secure attractive deals, it is crucial to conduct thorough research and exercise due diligence before making any decisions.