Now that we have walked through how to properly conduct a property search in Singapore, it’s time to understand the buying process in a bit more detail. There are a variety of different approaches a buyer can take and depending on the type of property – it can greatly influence this process.

We’ll be taking a look at the most common payment schemes to provide a generalized understanding of what it takes to become the title owner of a property in Singapore.

Let’s talk a bit about “Progressive Payment Schemes”

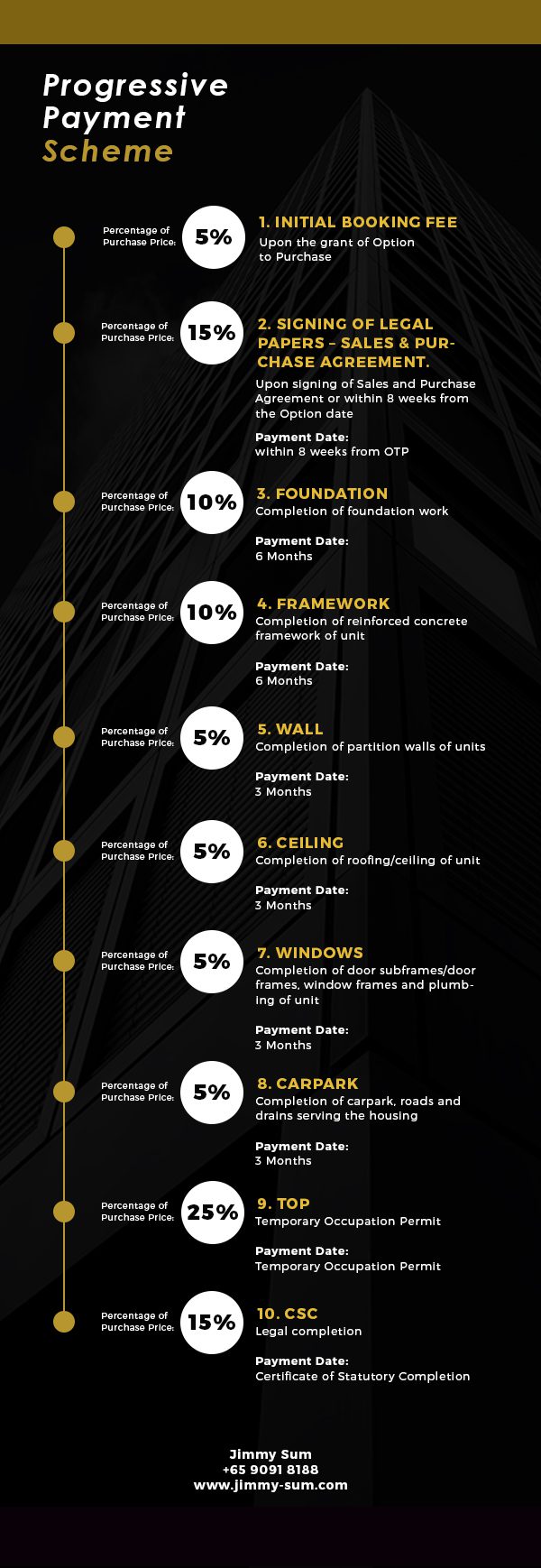

“Progressive Payment Schemes” are considered your standard or “normal” payment plan. Essentially – this is an installment plan where you don’t have to pay the lump sum of the property at once but rather pay as the project progresses. This is typically offered for BUCs or “Buildings under construction”. Essentially the buyer will have a schedule to pay certain amounts as the construction advances.

Here’s a sample of what that would look like:

As you can see – this payment scheme continues in progressive payments until the condo or flat has been completed. This could take anywhere between 3-5 years when we’re talking about BUCs depending on their estimated legal completion.

Another approach you could take is a DPS or a Deferred Payment Scheme.

What is a Deferred Payment Scheme?

A Deferred Payment Scheme – unlike the Progressive Payment Scheme requires the buyer to pay up 20% as an initial down payment. Then for the next 12 or 24 months (differs between projects), they don’t have to pay anything. However, once the 12 or 24-months expire – all subsequent fees and outstanding payments must be liquidated. The entire 80% must be paid in full either by cash and/or CPF and/or through bank loan.

An illustration of a Deferred Payment Scheme offered by one Developer of its project:

There are obvious benefits from DPS, which include;

- Smaller initial payment required – While it’s true that you’d be paying 20%, the actual sum is lower than with a Personal Property Tax for some of you.

- More time to raise capital – In most cases, people would have the money worked out by now, however, the 12 or 24-months does provide extra time to get creative with where you source your investment from.

- Avoiding Interests – With this scheme you don’t have to pay interest on the property until the whole sales completion is done, which is a bonus.

Conversely, when we’re talking about already completed property in the resale private property market the process will be different.

Buying in the Resale Private Property Market

Now that we have spoken about the payment schemes for new project launch, it is important to mention how buying in the resale market works as well.

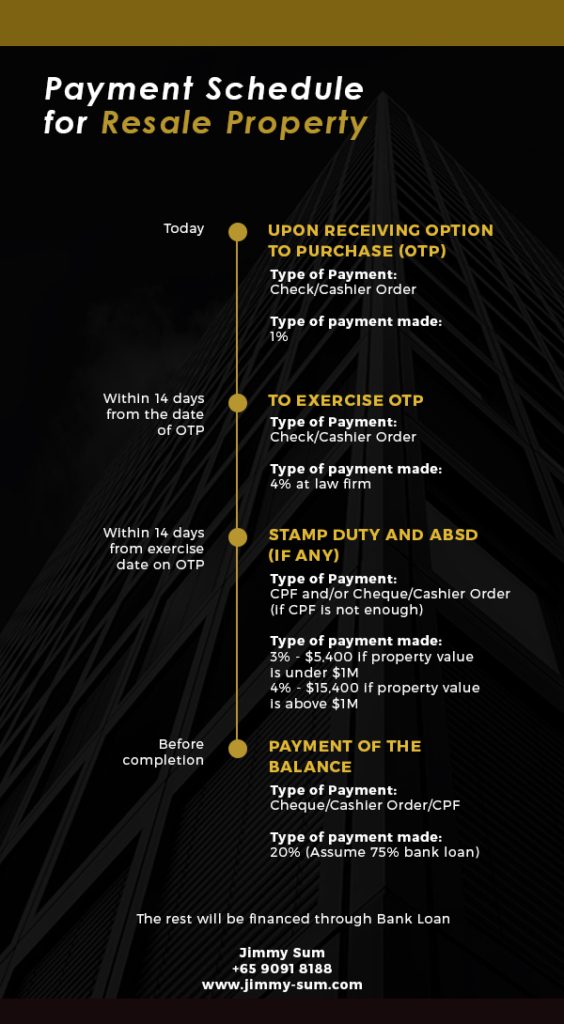

Typically, in the resale market, you need to pay 1% of the purchase price in exchange for the Option to Purchase (OTP) that will be issued by the seller(s).

When the Option to Purchase agreement is received by you (as the buyer), you have 14 days to exercise the OTP by paying 4% of the purchase price in your appointed law firm. By doing so, you are entering into a legal agreement with the seller to purchase the property. Once OTP has been exercised, you are required to pay for stamp duty and Additional Buyer Stamp Duty (if any) on the property.

Before the legal completion of your property purchase, you will be advised by your law firm when you need to pay for the balance of 20% either through CPF or cash or a combination of both with the assumption that you are eligible to secure a 75% bank loan. The whole process will take around 12 weeks to complete.

Payment Schedule for Resale Property

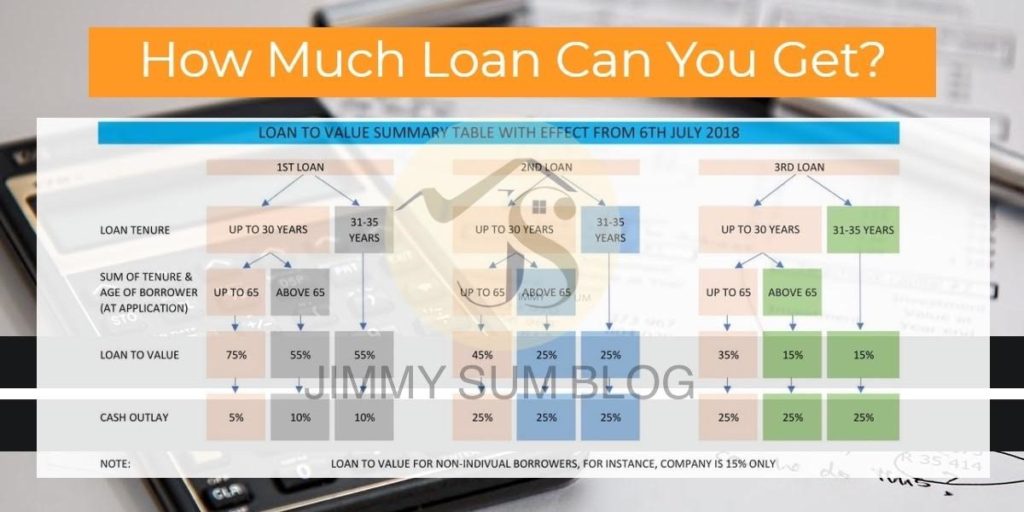

Depending on how many property you own, the table below shows the loan type that you can get.

Next Steps – How to Make your Decision

Once you have completed all of the steps within the document and considered all of your options – you should have a clear idea about the type of property you’d like as well as different ways to source the money to get it – as well as what would be expected of you when purchasing a property.

Even though we have given you a completely robust and helpful guide – there are still so many elements that without the help of a professional real estate agent in Singapore –would still prove challenging to go about it on your own.

Nonetheless –we are confident that by now you would have a firm understanding of the general process of buying a property in Singapore. Armed with this knowledge – you would now be able to assist your real estate broker in Singapore in finding you your ideal property.

By now – if you have been on the hunt – you should have a few properties shortlisted. We recommend reaching out to a professional to help guide you through the process and to help remove the stress from buying a property.

Before we wrap this up here’s a few more crucial tips when buying a property in Singapore.

- Don’t be emotional – There is a difference between investing in a property and staying in a property to live. It’s important to separate these two concepts. If you’re going to invest – think cold and clinically.

- Don’t overextend – Many property owners will push their limits when purchasing. This isn’t always good since we can’t calculate what is going to happen. This is especially true for first-time buyers. Stay within your budget and “splurge” only when it’s worth “splurging.”

- This is not your last property – Think of this as a stepping-stone. The next property will be bigger, better and this first property will fuel your next investment. Keep this as a mindset when investing.

- Get Help – If this is your first time investing in a property, don’t do it alone. Get help from a professional real estate agent in Singapore. Jimmy Sum can help you not only find the property of your dreams – but also will help you get it at the most cost-efficient price point.

Don’t wait too long…

The final piece of advice that we can give you in the search for property in Singapore is – don’t wait too long. Singapore is a fast-moving real estate marketplace. This means that if you’re looking at the property – odds are that at least 2-3 other people are looking at the same property.

This is why having an experienced real estate agent in Singapore is a good thing. Their experience can tell you when to act and when to hold. It’s probably the biggest asset you have in your favor when searching for your ideal place.

If you need any assistance or have found a place and need to buy it – reach out to Jimmy Sum and let’s see how we can help.