How can you make your hard-earned salary go a little bit further? Have you given much thought to investing it? Perhaps you have but are unsure what type of investment to choose. Real estate investment is one of the most popular and successful forms of investment in Singapore, thanks to the fact there’s a strong property market on the island, and it continues to experience growth.

If you’re new to real estate investment, you may not know where to start. In this post we want to discuss the basics, for you have a good understanding on the different types of property that are available for investment in Singapore market.

What Are Your Singapore Real Estate Investment Options?

Real estate investment involves buying property with a view to making money from it. Generally, investment properties are those you have no intention of living in or using it yourself.

You may decide to buy a property and then rent it out to tenants and make money that way. The three different types of investment property available in Singapore are industrial, commercial, and residential.

Industrial Real Estate

Industrial real estate investment properties include warehouse units, heavy industrial units and light industrial units. This form of investment provides a stream of income as you rent the units out to companies and organizations on a long- or short-term basis. The yield you could get from an industrial investment is like what you would get from commercial properties, and more than what you’re likely to get from residential properties. This is down to the fact industrial properties are more flexible and used in a variety of different ways.

Commercial Real Estate

Commercial real estate includes cafes, restaurants, shopping malls, office buildings, hotels and other properties where a business can be run. This is an ideal option if you’re interested in making better profits and want a stable cash flow. For instance, you could invest in an office unit and then divide the space into smaller, separate units. You could then very easily rent out the separate rooms to different clients at a much higher rental rate.

Residential Real Estate

Residential real estate is perhaps the most obvious choice for trying to make money from purchasing property. You need to understand there are several different types of residential properties.

Housing Development Board (HDB)

Housing Development Board (HDB) flats or public housing are government-built and owned property. This type of housing is built with the intention for its citizens to use it as a home for a long term and hardly be used as an investment vehicle.

Executive Condominium (EC)

Executive condominium (EC) is very similar to private condominium in terms of the facilities and design but they are developed by HDB. Similar to HDB, you will need to stay in the property for minimum occupation period of 5 years. After which, if you have the intention to sell, this property can only be sold to Singapore Citizen and Singapore Permanent Resident. After 10 years, you are allowed to sell to anyone, including foreigners.

Private Condominium/ Apartments

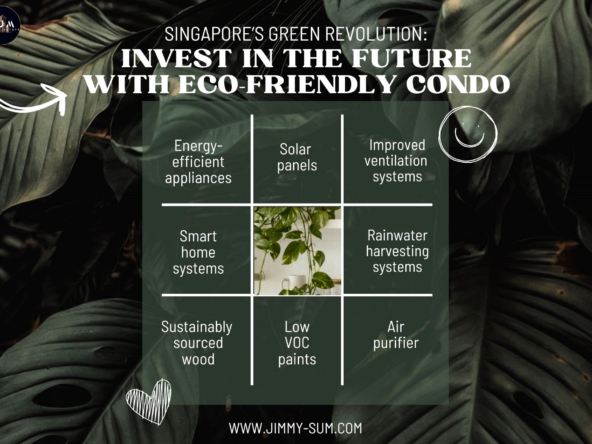

This type of residential property is developed by private developers. This is the most common type of residential property bought in Singapore as an investment vehicle. Before buying a private condominium or apartment for investment, there are certain rules and regulations that you need to be aware of such as Seller Stamp Duty (SSD), Buyer Stamp Duty (BSD) or Additional Buyer Stamp Duty (ABSD) for local citizens, Singapore Permanent Residents, and foreigners.

Landed Property

Landed property includes terrace houses, cluster houses, houses and bungalows. Although they need more in terms of maintenance, they are better properties when it comes to the level of privacy and living space they offer. For buying of landed houses in Singapore, you need to be local Singaporean before you are allowed to purchase one. If you are a Singapore Permanent Resident for at least 5 years and will like to purchase a landed property, it will be subjected to approval by our local authority, Singapore Land Authority (SLA)

Nice! I am so glad that you have come so far. I believe that right now, you have a much better understanding of the different types of properties that can be used as an investment vehicle in Singapore.

If you need further assistance regarding property investment in Singapore, you can reach me, Jimmy Sum at 65 9091 8188