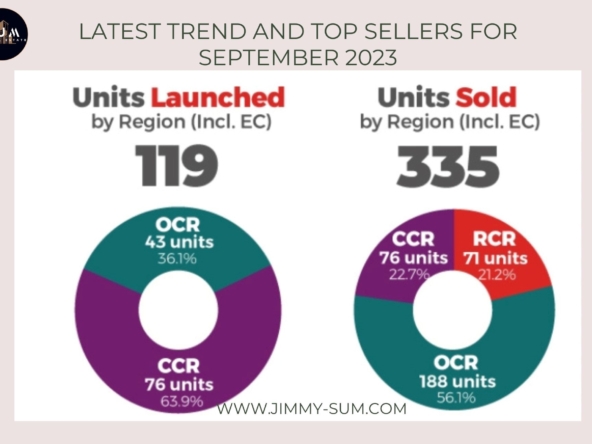

In a surprising turn of events, Singapore new home market witnessed a staggering 87% drop in sales in September 2023 compared to the same period last year. With only 217 units finding buyers, this significant decline comes in stark contrast to the robust figures of September 2022, when 913 units were sold. The primary culprit behind this downturn lies in the muted launch of new projects, with a mere 119 units hitting the market, a notable decrease from the previous year’s figures.

The industry’s spotlight in September was primarily held by a solitary venture: The Shorefront (OCR), a project comprising just 23 units. This scarcity of new offerings undoubtedly played a pivotal role in shaping the subdued sales landscape, underscoring the need for a revitalized market approach in the months ahead.

Also, a beacon of hope emerged when Altura, an Executive Condominium (EC), saw unprecedented demand. As we delve deeper, we unravel the intricate tapestry of Singapore’s real estate market, from the surge in new unit launches to the nuanced dynamics in luxury properties and the ever-persistent demand from Singaporean buyers. This tale of highs and lows paints a vivid picture of a market poised for transformation in the months ahead.

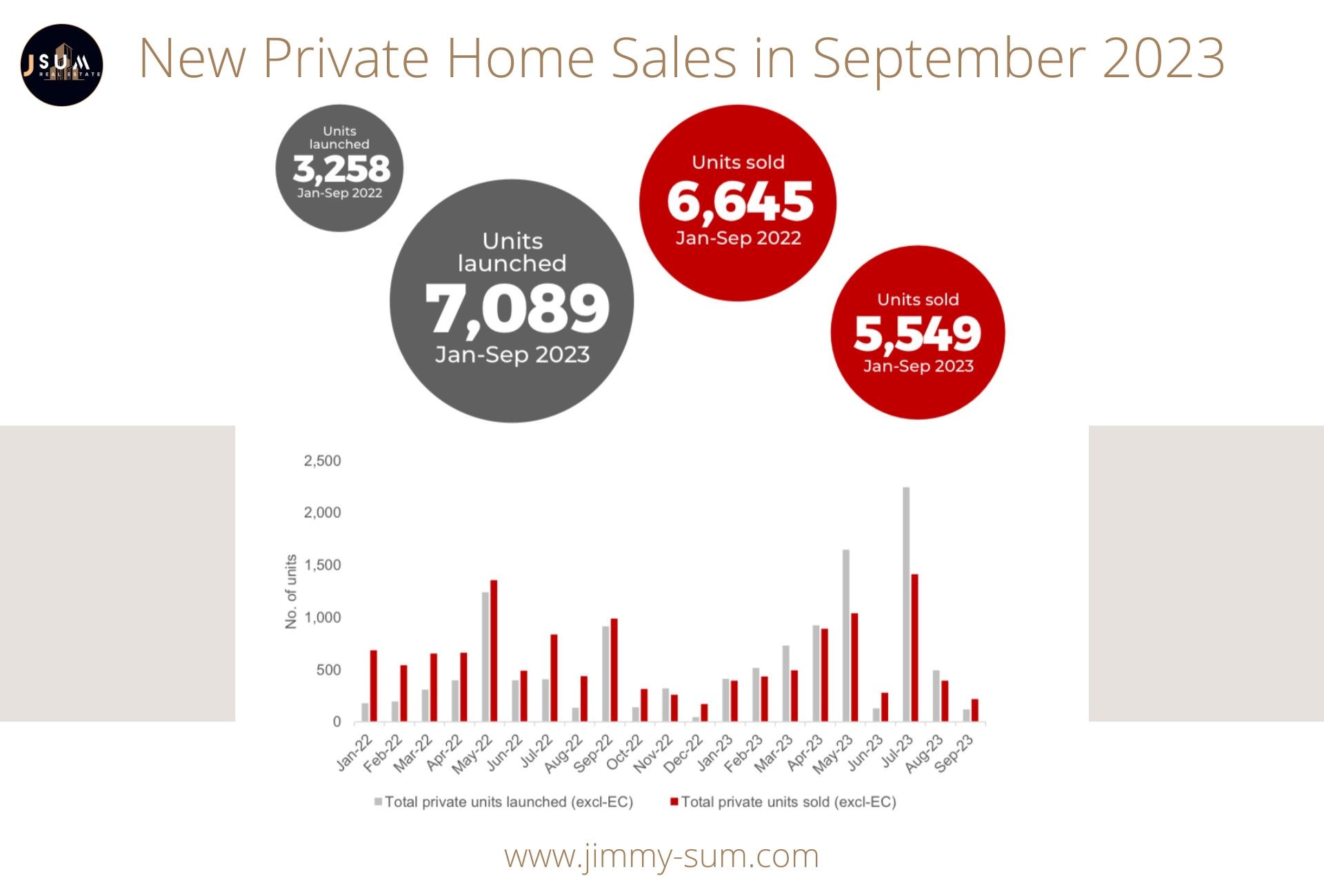

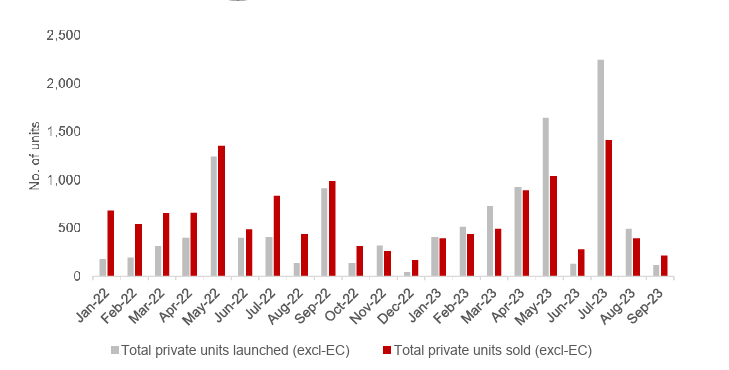

Market Performance: Jan-Sep 2022 vs. Jan-Sep 2023

a. A Surge in New Home Unit Launches

- Jan-Sep 2022: In the corresponding period of 2022, a total of 3,258 new home units were launched in Singapore’s real estate market.

- Jan-Sep 2023: Fast forward to 2023, and the market experienced a significant boost in new unit launches, with a staggering 7,089 units introduced to prospective buyers. This represents more than double the number launched in 2022, signifying a remarkable increase in real estate activity.

b. Sales Decline Despite Increased Launches

- Jan-Sep 2022: During the first three quarters of 2022, a total of 6,645 new home units were successfully sold, indicating robust market activity.

- Jan-Sep 2023: However, in stark contrast, during the same period in 2023, only 5,549 units found buyers. This represents a 16.5% drop in sales compared to the previous year despite the substantial increase in units launched.

c. Excluding Executive Condominiums (ECs)

The data presented here excludes Executive Condominiums (ECs) to provide a clearer picture of the market dynamics for private non-landed residential units.

Analyzing the Surge in Launches

- The surge in new home launches from Jan-Sep 2023 indicates an increased supply in the market. This could potentially lead to a more competitive environment, offering buyers a broader range of options.

- Developers might have been spurred by favorable market conditions or policy changes, leading to this substantial increase in project launches.

- While an increase in supply can provide options for home buyers, it also poses challenges for developers to differentiate their offerings in a crowded market.

- The 16.5% decrease in units sold from Jan-Sep 2023 compared to the previous year may be attributed to various factors. Economic uncertainties, changing buyer preferences, or even external events could have influenced this trend.

- It’s important to note that despite the decline in sales, the market still saw a substantial number of units sold, indicating continued demand for new homes.

Strong Demand for Executive Condominiums (ECs)

- In September 2023, the demand for Executive Condominiums (ECs) remained robust, with a total of 118 transactions recorded.

- Notably, Altura stood out as the sole EC launch in 2023. Despite being the only new EC project, it managed to secure significant interest from buyers.

a. Altura’s Impressive Performance

- Altura’s launch in 2023 was met with enthusiasm, resulting in 100 units being sold in September alone, on top of the 118 units that have already been sold since its launch.

- Altura achieved a remarkable take-up rate of 88%, a clear testament to its appeal in the market.

- It is worth noting that Altura has also set a new benchmark for EC pricing, setting it at $1,585 per square foot (psf), potentially influencing future pricing strategies in the EC segment.

b. Continued Success of North Gaia

- North Gaia, which had its initial launch in April 2022, continued to demonstrate its popularity by selling an additional 16 units in September. This brings the total units sold to an impressive 270, reflecting a commendable 43.8% take-up rate.

Anticipated Demand for 4Q 2023 Launches

- The last quarter of 2023 holds promise for prospective homebuyers, as several highly-anticipated developments are slated for launch in popular locations.

- Noteworthy projects include J’den in Jurong East (OCR), Hillock Green (OCR) in Lentor, and Watten House in Bukit Timah (CCR). These launches are expected to provide buyers with a wider array of choices, potentially influencing their final decisions.

- Buyers may adopt a wait-and-see approach, keen on assessing all available options before making their investment decisions, given the attractive offerings on the horizon.

- The market’s response to these upcoming launches in the last 3 months of 2023 will be closely monitored as they are likely to have a significant impact on the dynamics of Singapore’s real estate landscape.

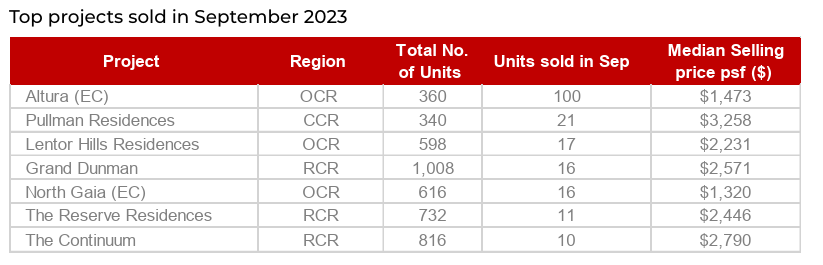

Top Selling Project in September 2023

Pullman Residences in District 11: Pullman Residences emerged as the top-selling project in September, accounting for an impressive 21 out of the 24 units sold in District 11.

Buyer Profile: Out of the 24 transactions, 18 were made by Singaporean buyers, 3 by Permanent Residents (PRs), and 3 by foreigners, indicating a diverse pool of interested parties.

Anticipated TOP: Pullman Residences is expected to receive its Temporary Occupation Permit (TOP) this year, making it an appealing choice for buyers seeking a new development without the typical 3–4-year construction waits.

a. Top Projects Sold in September 2023

These projects represented the top-performing developments in terms of units sold in September 2023, contributing significantly to the real estate landscape.

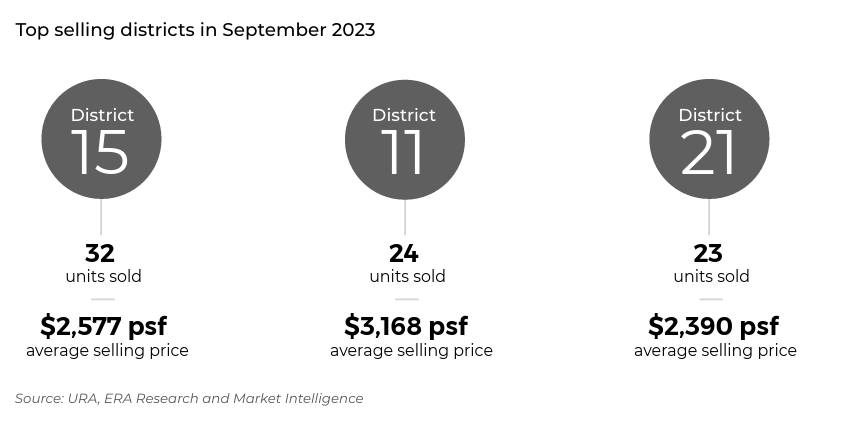

b. Districts with Highest Sales Activity in September 2023

- District 15: This district led the sales charts with an impressive 32 transactions. Of these, 84% were by Singaporean buyers and 16% by PRs. The district boasted an average selling price of $2,577 per square foot (psf), fueled by robust sales at Grand Dunman and The Continuum.

- District 11: Following closely, District 11 recorded 24 units sold, indicating a thriving market. The average selling price here was $3,168 psf, showcasing strong investor interest in this district.

- District 21: In this district, there were 23 units sold, with an average selling price of $2,390 psf.

- These districts emerged as the hotspots for real estate activity, attracting both local and international buyers.

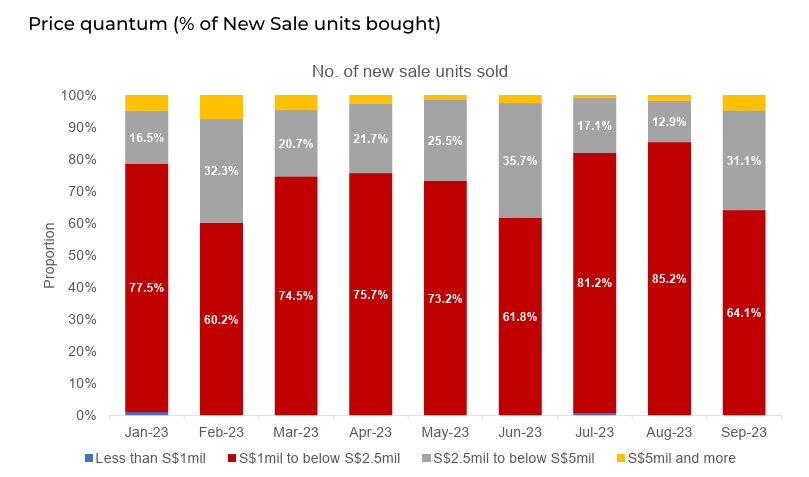

New Home Sales by Price Quantum

a. Dominance of Units Priced Between $1 to $2.5 Million

- In September 2023, new sale units priced between $1 to $2.5 million accounted for a substantial 64.1% of the total transactions.

b. Proportion of Units Sold Across Price Ranges

- $1 Mil to Below $2.5 Million Range: This price range witnessed a consistent proportion of units sold, ranging from 60.2% in February to 85.2% in August. However, in June, it saw a slight dip to 61.8%.

- $2.5 Mil to $5 Million Range: The percentage of units sold in this category fluctuated, with the lowest being 12.9% in August and the highest at 35.7% in June.

- Above $5 Million Range: This category consistently represented a smaller proportion of the market, never exceeding 2.5%.

c. Market Sentiment and Buyer Behavior

- The dominance of units priced between $1 to below $2.5 million suggests a strong preference among buyers for properties within this range, possibly indicating the affordability and attractiveness of these units.

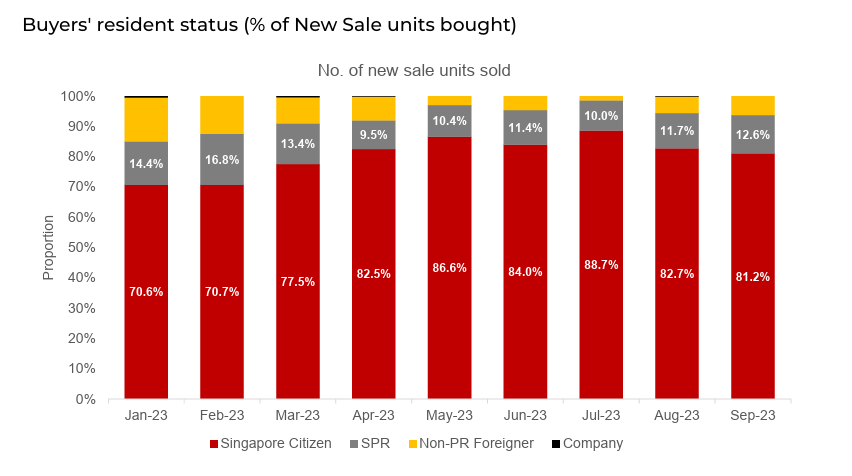

New Home Sales by Resident Status

a. Strong Dominance of Singaporean Buyers

- Singaporean buyers continue to exhibit robust demand in the real estate market, accounting for over 80% of transactions across the months.

b. Foreign Buyer Activity Despite ABSD

- Despite the higher Additional Buyers’ Stamp Duty (ABSD) rate imposed on foreigners, there were still 13 transactions made by non-resident buyers. This indicates a certain level of interest and investment from foreign individuals or entities.

- The proportion of foreign buyers in the market saw a slight increase of 1.3% in September 2023. This uptick suggests that despite regulatory measures, foreign interest in Singapore’s real estate market remains a factor to be considered.

c. Buyer Resident Status and New Sales Units

The data paints a vivid picture of the real estate landscape in Singapore, with Singaporean buyers playing a pivotal role in driving transactions across various price segments.

The Luxury Property Market

a. Transactions in the S$5 Million and Above Segment

- In the face of higher interest rates, the luxury property market recorded 10 transactions for new homes priced at S$5 million and above.

- Notably, one unit at Terra Hill (RCR) fetched S$5.34 million, equating to S$2,819 per square foot (psf). The remaining nine units, all located in the CCR, were priced at S$3,106 psf and higher.

- In the Rest of Central Region (RCR) segment, only one unit surpassed S$3,000 psf – a 678 sqft unit at The Landmark, which sold for S$2.11 million (S$3,108 psf).

b. Impact of Higher ABSD Rates on Foreign Buyer Activity

- The luxury property market has seen a decrease in foreign buyer activity, largely due to the higher Additional Buyers’ Stamp Duty (ABSD) rates, which have elevated the entry quantum for non-resident buyers.

- Notably, the highest transacted property by a foreign buyer was a 2,164 sqft unit at Dalvey Haus (CCR) for S$7 million. This development received its Temporary Occupation Permit (TOP) in December 2022.

c. Market Insights and Trends

- The luxury property market continues to exhibit resilience, with notable transactions in the high-end segment, particularly in the Core Central Region (CCR).

- The decrease in foreign buyer activity indicates that the higher ABSD rates have impacted their participation in this market segment.

- The data showcases that while Singaporean buyers dominate the luxury property market, there is still interest from non-resident buyers and companies.

Conclusion

Singapore’s real estate market in 2023 has been a tale of resilience, adaptation, and shifting dynamics. The significant surge in new home unit launches reflects a determined push by developers to meet growing demand and capitalize on favorable market conditions. However, the sharp decline in sales, particularly in the luxury segment, highlights the impact of various factors, such as economic uncertainties and regulatory changes.

The steadfast demand from Singaporean buyers remains a cornerstone of the market, providing stability amid fluctuations. As we move forward, the anticipation of new project launches in the last quarter of 2023 and the sustained interest in Executive Condominiums (ECs) offer promising indicators for market recovery. The intricate interplay of supply and demand will continue to shape the future of Singapore’s real estate landscape as stakeholders adapt to an evolving market terrain.