With its strong economy, political stability, and vibrant culture, Singapore has become an attractive destination for foreigners looking to invest in the property market. The increasing interest of foreigners in Singapore’s real estate sector is driven by the city-state’s reputation as a global financial hub and its high standard of living.

However, purchasing property in Singapore as a foreigner can be a complex and unfamiliar process. It is crucial to have a comprehensive understanding of the property purchase process to navigate it successfully. This blog post aims to provide a step-by-step guide that will equip you with the knowledge and confidence to make informed decisions when investing in Singapore’s property market.

By following this guide, you will gain insights into the legal framework, financing options, property selection, negotiation strategies, and post-purchase considerations. Whether you are a first-time buyer or an experienced investor, this guide will serve as a valuable resource to help you navigate the Singapore property purchase process with ease.

Investing in Singapore’s property market as a foreigner can be a rewarding endeavor. By understanding the intricacies of the process, you can make informed decisions and capitalize on the opportunities available. So, let’s dive into the step-by-step guide and embark on your journey to owning a property in Singapore.

Researching the Singapore Property Market

Before starting the purchase process, it is essential to conduct thorough research. This research will provide you with a solid understanding of the Singapore property market, enabling you to make informed decisions.

It helps you grasp the current market conditions, trends, and potential risks and rewards associated with investing in different areas. By gaining a comprehensive understanding of the market, you can maximize your investment potential and minimize potential pitfalls.

To ensure that you have accurate and reliable information, it is important to rely on trustworthy sources. Here are some tips for finding reliable sources:

- Government Websites: Government websites, such as the Urban Redevelopment Authority (URA) and the Housing and Development Board (HDB), offer valuable data on property prices, regulations, upcoming developments, and government policies. These websites are excellent starting points for gathering reliable information.

- Reputable Real Estate Agents: Established real estate agents such as Jimmy Sum has access to a wealth of market information and can provide expert guidance on property investment in Singapore. Look for agents with a strong track record and positive reviews from clients. They can offer insights into market trends, property listings, and expert advice.

When conducting research on the Singapore property market, there are several key factors to consider:

Location

The location of a property is a critical factor in determining its potential for growth and rental yield. Consider factors such as proximity to amenities, transportation links, schools, and employment hubs. Research the neighborhood’s reputation, safety, and potential for future development.

Property Types

Understand the different property types available in Singapore, such as condominiums, landed houses, and HDB flats. Each type has its own set of regulations, financing options, and considerations. Determine which property type aligns with your goals, preferences, and budget. Take note that foreigners are not allowed to purchase HDB flats. As for landed houses, special approval is needed from our government – Singapore Land Authority.

Market Trends

Stay updated on the latest market trends, including property prices, rental yields, and supply and demand dynamics. This information will help you gauge the market’s stability and identify potential investment opportunities. Look for patterns and trends that can guide your decision-making process.

By conducting thorough research and considering these key factors, you will be well-equipped to navigate the Singapore property market with confidence. Remember, knowledge is power, and the more you understand the market, the better positioned you will be to make informed and successful property investments.

Understanding the Legal Framework

When it comes to purchasing property in Singapore as a foreigner, it is important to understand the legal requirements and restrictions that apply.

Foreigners are generally allowed to purchase property in Singapore, but there are certain restrictions and requirements to be aware of. These include:

- Approval from the Singapore Land Authority (SLA): Before purchasing restricted properties such as vacant land, landed properties, or properties in certain areas, foreigners need to seek approval from the SLA.

- Non-restricted properties: Foreigners can freely purchase non-restricted properties such as condominiums and apartments without the need for approval.

- Public housing: Foreigners are not allowed to purchase HDB in Singapore unless you have become a Singapore Permanent Resident (SPR) or married to a Singapore Citizen or a SPR.

Freehold versus Leasehold Properties

In Singapore, properties can be categorized as freehold or leasehold. Understanding the difference between these two types is important:

- Freehold properties: Freehold properties grant the owner full ownership rights indefinitely. The owner has the right to occupy, rent out, or sell the property without any time restrictions.

- Leasehold properties: Leasehold properties, on the other hand, are owned for a specific lease period, typically 99 years or 999 years. Once the lease expires, ownership reverts to the landowner unless a lease extension is granted.

Additional Buyer’s Stamp Duty (ABSD) and Seller’s Stamp Duty (SSD) Regulations

The Singapore government has implemented stamp duties to regulate property transactions. Two key stamp duties to be aware of are:

- Additional Buyer’s Stamp Duty (ABSD): ABSD is a tax imposed on property buyers, including foreigners and entities. The rate varies depending on the buyer’s residency status and the number of properties owned. It is important to factor in ABSD when budgeting for a property purchase.

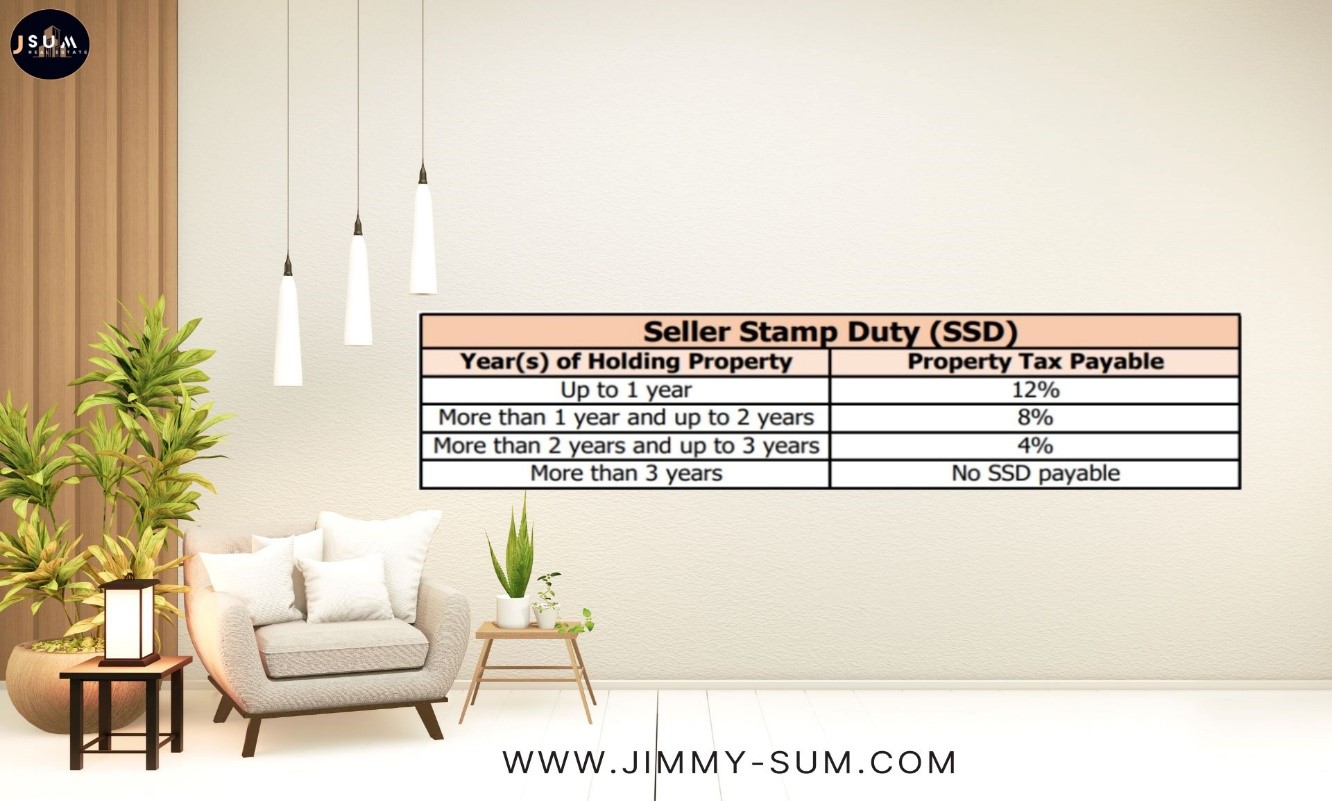

- Seller’s Stamp Duty (SSD): SSD is a tax imposed on properties that are sold within a holding period of 3 years. The holding period and the rate of SSD depend on the date of purchase and the number of years the property has been held. It is designed to discourage property speculation.

Understanding the legal framework surrounding property ownership in Singapore is crucial for foreigners. By familiarizing yourself with the legal requirements and restrictions, as well as concepts like freehold and leasehold properties, and stamp duty regulations such as ABSD and SSD, you can navigate the property market more effectively and make informed decisions. It is advisable to seek professional advice from lawyers or professional real estate agent to ensure compliance with all legal obligations.

Engaging the Services of a Real Estate Agent

When it comes to purchasing property in a foreign country like Singapore, hiring a professional real estate agent with experience in dealing with foreign buyers can provide numerous benefits. Here are some key points to consider:

Benefits of Hiring a Professional Real Estate Agent:

- Expertise and Local Knowledge: A professional real estate agent who specializes in working with foreign buyers will have a deep understanding of the local market, regulations, and legal requirements. They can provide valuable insights and guidance throughout the entire buying process.

- Access to Exclusive Listings: Experienced agents often have access to a wide range of properties, including off-market listings and exclusive deals that may not be readily available to the general public. This can give foreign buyers an advantage in finding the right property.

- Negotiation Skills: Real estate agents are skilled negotiators who can help buyers secure the best possible deal. They have the knowledge and experience to navigate negotiations effectively, ensuring that buyers get the most favorable terms and conditions.

Tips for Selecting a Reliable and Trustworthy Agent:

- Research and Referrals: Conduct thorough research and seek recommendations from trusted sources, such as friends, family, or colleagues who have worked with real estate agents in Singapore. Look for agents with a proven track record of working with foreign buyers.

- Credentials and Experience: Check the agent’s credentials, certifications, and experience in dealing with foreign buyers. Look for agents who are members of professional real estate organizations and have a solid understanding of the local property market.

- Communication and Rapport: It is important to choose an agent with whom you have good communication and rapport. A reliable agent should be responsive, attentive, and able to understand your specific needs and preferences.

The Role of the Agent in Guiding the Buyer:

A professional real estate agent plays a crucial role in guiding foreign buyers through the entire purchase process. Their responsibilities include:

- Property Search: Agents help buyers identify suitable properties based on their preferences, budget, and requirements. They can provide comprehensive property information, arrange viewings, and answer any questions or concerns.

- Due Diligence: Agents assist buyers in conducting thorough due diligence on potential properties, including verifying legal documents, assessing property value, and identifying any potential issues or risks.

- Negotiation and Documentation: Real estate agents handle negotiations on behalf of the buyer, aiming to secure the best possible price and terms. They also assist with the preparation and review of legal documents, ensuring that all necessary paperwork is in order.

- Closing the Deal: Agents guide buyers through the final stages of the purchase process, coordinating with lawyers, financial institutions, and other parties involved. They ensure a smooth closing and help facilitate the transfer of ownership.

Engaging the services of a professional real estate agent with experience in dealing with foreign buyers can greatly simplify the property buying process in Singapore. Their expertise, local knowledge, and guidance can help foreign buyers make informed decisions, navigate legal requirements, and secure the best possible property investment.

Financing Options for Foreign Buyers

When it comes to financing a property purchase in Singapore as a foreign buyer, there are several options available. Understanding these financing options, eligibility criteria, and how to compare loan packages can help you make an informed decision. Here are some key points to consider:

Financing Options Available for Foreign Buyers:

- Bank Loans: Foreign buyers can apply for bank loans from local banks in Singapore. These loans typically have competitive interest rates and flexible repayment terms.

It is important to note that the loan amount may be subject to certain limits and restrictions based on factors such as the buyer’s income, loan-to-value ratio, and the property type.

- Financing from Foreign Banks: Another option is to explore financing options from foreign banks. Some international banks may offer loans to foreign buyers purchasing property in Singapore. These loans may have different eligibility criteria and terms compared to local bank loans.

Eligibility Criteria and Required Documents for Obtaining a Loan:

- Income and Employment: To be eligible for a loan, foreign buyers are generally required to have a stable source of income. This can include employment in Singapore or overseas or self-employment. Lenders typically assess the buyer’s ability to repay the loan based on their income and employment history.

- Loan-to-Value Ratio (LTV): The loan amount that can be obtained is often subject to a loan-to-value ratio, which is the percentage of the property value that can be financed, which is capped at 75% of the purchase price. LTV ratios may vary depending on factors such as the buyer’s residency status, property type, and loan amount.

- Required Documents: Common documents required for loan applications include proof of identity, proof of income, bank statements, employment or business documents, and property-related documents such as the Option to Purchase (OTP) or Sales and Purchase Agreement (SPA).

Tips on Comparing Loan Packages and Finding the Best Interest Rates:

- Shop Around: It is advisable to approach multiple lenders and compare loan packages to find the best terms and interest rates. Different lenders may offer varying loan amounts, interest rates, repayment periods, and fees. Consider consulting with a mortgage broker who can help you navigate the options and negotiate on your behalf.

- Interest Rates: Pay close attention to the interest rates offered by different lenders. Fixed-rate loans provide stability, while floating-rate loans may offer flexibility but are subject to market fluctuations. Consider your financial goals, risk tolerance, and the current interest rate environment when choosing between fixed and variable rates.

- Additional Fees and Charges: In addition to interest rates, consider other fees and charges associated with the loan, such as processing fees, legal fees, and valuation fees. These can vary between lenders and may impact the overall cost of the loan.

- Loan Tenure and Repayment Options: Evaluate the repayment options available, such as the loan tenure and the flexibility to make additional repayments or early loan settlements. Longer loan tenures may result in lower monthly repayments but higher overall interest costs.

- Seek Professional Advice: It is advisable to consult with financial advisors or mortgage brokers who can provide personalized advice based on your specific circumstances and financial goals. They can help you navigate the complexities of loan packages, eligibility criteria, and the overall financing process.

With careful consideration and professional guidance, you can find a loan package that suits your needs and helps you achieve your property ownership goals.

Property Viewing and Selection

Finding the perfect property involves careful consideration and thorough research. Here are some key points to guide you in shortlisting properties based on your preferences and budget, as well as tips on what to look for during property viewings and the importance of conducting due diligence:

Shortlisting Properties Based on Preferences and Budget:

- Determine Your Needs: Start by identifying your priorities and requirements. Consider factors such as location such as core central regions vs rest of central region, property type, size, amenities, proximity to schools or workplaces, and transportation options. This will help you narrow down your search and focus on properties that align with your preferences.

- Set a Realistic Budget: Assess your financial situation and set a budget that you are comfortable with. Take into account not just the purchase price, but also additional costs such as stamp duty, legal fees, and renovation expenses. This will help you shortlist properties that fall within your budget range.

- Utilize Online Platforms: Take advantage of online property portals and real estate websites to search for properties that match your criteria. These platforms allow you to filter properties based on location, price range, and other specifications, making it easier to find suitable options.

Tips for Property Viewings:

- Location: Consider the location’s proximity to amenities such as schools, hospitals, shopping centers, and public transportation. Evaluate the neighborhood’s safety, accessibility, and potential for future development. A convenient and desirable location can enhance the property’s value and rental potential.

- Property Condition: Pay attention to the overall condition of the property during viewings. Look for signs of wear and tear, structural issues, or any potential maintenance or renovation needs. Assess the quality of construction, fixtures, and fittings. This will help you estimate any additional costs that may arise after the purchase.

- Amenities and Facilities: Evaluate the available amenities and facilities within the property or its vicinity. This can include features like swimming pools, gyms, playgrounds, or communal spaces. These amenities can enhance your living experience and potentially attract tenants if you plan to rent out the property.

- Potential Rental Yields: If you are considering the property as an investment, analyze the potential rental yields. Research the rental market in the area to determine the average rental rates for similar properties. This will help you gauge the property’s income-generating potential and its suitability as an investment.

Making an Offer and Negotiating

When it comes to making an offer and negotiating the purchase price of a property, it’s important to approach the process strategically and with careful consideration. Here are some key points to guide you through this stage, including tips on determining a reasonable offer and negotiating effectively, as well as the importance of engaging a lawyer to review the Option to Purchase or Sale & Purchase Agreement.

Process of Making an Offer and Negotiating:

- Research the Market: Before making an offer, conduct thorough research on the current market conditions and recent sales of similar properties in the area. This will give you an idea of the property’s fair market value and help you determine a reasonable offer. As for new condo launches, the purchase price is fixed by developers.

Submitting the Offer: Once you have determined the offer price, communicate it to the seller or their agent through an Offer to Purchase for resale properties. This document outlines the proposed purchase price, any conditions or contingencies, and the desired timeline for the transaction. It’s important to clearly state your intentions and any terms you wish to negotiate.

As for new condo under construction, the developer will provide you with the option to purchase once you have given them the booking fee of 5% of the purchase price.

- Negotiating the Purchase Price: Negotiations typically involve a back-and-forth process between the buyer and the seller. Be prepared for counteroffers and be open to compromises. Consider factors such as the property’s condition, market demand, and the seller’s motivation. Maintain clear communication and be respectful throughout the negotiation process. The negotiation portion can be done on your behalf by your representing real estate agent if you have one.

Tips for Determining a Reasonable Offer and Negotiating Effectively:

- Set a Maximum Budget: Determine the maximum amount you are willing to pay for the property, taking into account your financial situation and the property’s value. This will help you stay within your limits and avoid overpaying.

- Consider Market Factors: Assess the current market conditions, including supply and demand, interest rates, and economic trends. This will help you gauge the seller’s position and negotiate accordingly.

- Be Prepared to Walk Away: While it’s important to negotiate, it’s equally important to know your limits. If the seller’s counteroffer exceeds your budget or if the terms are not favorable, be prepared to walk away and explore other options. There are always more properties available in the market.

Importance of Engaging a Lawyer:

- Reviewing Legal Documents: Engaging a conveyancing lawyer is essential to handle the legal part of the transaction They can review the Option to Purchase and the Sale & Purchase Agreement to ensure that your interests are protected and that the terms and conditions are fair and favorable.

- Understanding Legal Implications: A lawyer can explain the legal implications of the contract and advise you on any potential risks or issues. They can also help you navigate any contingencies or special conditions that may arise during the negotiation process.

- Ensuring Compliance: A lawyer will ensure that the transaction complies with all legal requirements and regulations. They can handle the necessary paperwork, facilitate the transfer of ownership, and protect your rights as a buyer.

By following these guidelines, you can approach the process of making an offer and negotiating the purchase price with confidence.

Completing the Purchase

Completing the purchase of a property involves several important steps that need to be followed to ensure a smooth and successful transaction. Here are the key steps involved in completing the purchase, the role of a lawyer in the process, and the importance of obtaining an Approval-in-Principle (AIP) from the bank.

Importance of Obtaining an Approval-in-Principle (AIP) from the Bank:

- Financial Assessment: Obtaining an AIP from the bank involves a preliminary assessment of your financial situation, including your income, credit history, and existing financial commitments. This helps you determine your borrowing capacity and ensures that you are financially capable of completing the purchase.

- Smooth Completion Process: Obtaining an AIP, which will eventually move on to getting your Letter of Offer from the bank, before completing the purchase allows you to finalize the financing arrangements quickly and smoothly. It reduces the risk of delays or complications during the completion process.

Steps Involved in Completing the Purchase:

- Payment of the Option Fee: Once you have agreed on the purchase price and terms with the seller, you will typically be required to pay an option fee. This fee grants you the exclusive right to purchase the property within a specified period:

-

- Resale Property: Option fee of 1% of purchase price.

- New condo under construction: Option fee of 5% of purchase price. Option exercise fee of 15% within 3 weeks from the date of Sale and Purchase Agreement.

- Exercising the Option to Purchase: During the option period, you will need to exercise your option in order to purchase the property and paying the down payment. This agreement outlines the terms and conditions of the purchase, including the agreed-upon price, completion date, and any special conditions.

-

- Resale Property: Option exercise fee of 4% of purchase price within the usual 14 days from the date of Option to Purchase.

- New condo under construction: Option exercise fee of 15% of purchase price within 3 weeks from the date of Sale and Purchase Agreement.

- Engaging a Lawyer: It is essential to engage a lawyer who specializes in property law to assist you in completing the purchase. They will conduct property searches to ensure there are no encumbrances or legal issues associated with the property. They will also verify the legal documents, such as the title deed and land survey, to ensure their authenticity and accuracy.

- Facilitating the Completion Process: Your lawyer will guide you through the completion process, which involves transferring the ownership of the property from the seller to you. They will prepare the necessary legal documents, including the Transfer of Title, and facilitate the payment of the remaining purchase price.

Post-Purchase Considerations

After completing the purchase of a property, there are several important post-purchase responsibilities and considerations to keep in mind. These include property maintenance, property tax, insurance and renting out the property (if applicable). Let’s explore each of these aspects in detail.

Property Maintenance, Property Tax, and Insurance:

- Property Maintenance: As a property owner, it is your responsibility to ensure the maintenance and upkeep of the property. This includes regular cleaning, repairs, and addressing any issues that may arise. Proper maintenance not only preserves the value of your property but also ensures the safety and comfort of any occupants.

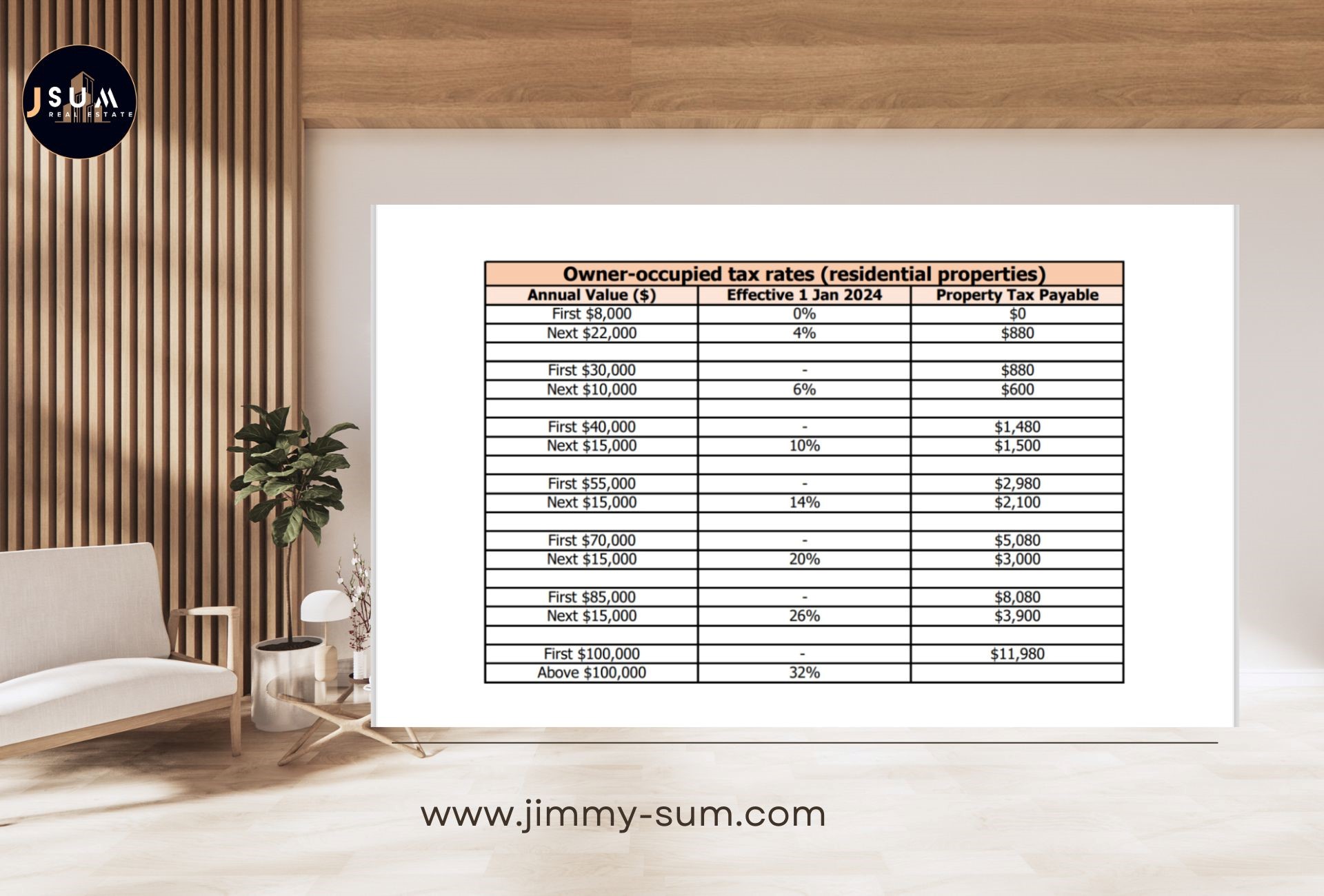

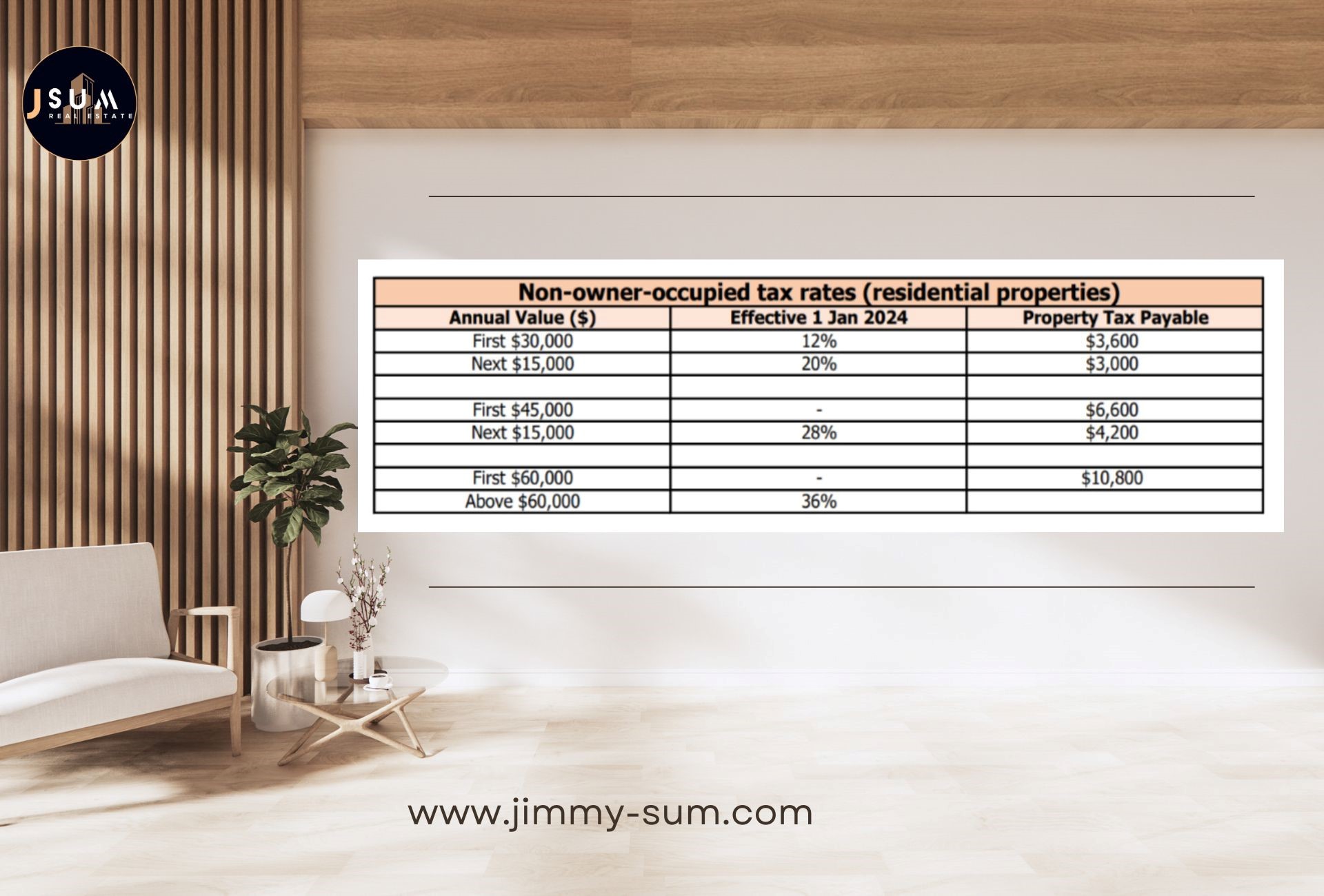

- Property Tax: Property tax is a recurring expense that property owners need to account for. The amount of property tax you owe will depend on the assessed value of the property and the local tax rates. It’s important to understand your tax obligations and make timely payments to avoid penalties. Below are the tax rates for owner-occupied and non-owner-occupied The annual value of your property can be on IRAS.

- Insurance: Property insurance is essential to protect your investment. It provides coverage for damages to the property caused by unforeseen events such as fire, natural disasters, or theft. Additionally, liability insurance protects you in case someone is injured on your property. Consult with an insurance professional to determine the appropriate coverage for your property.

Renting out the Property:

- Finding Tenants: If you decide to rent out your property, it’s important to find reliable and responsible tenants. You can engage the service of reliable real estate agent like Jimmy Sum to help you find a good tenant for your property.

- Understanding Rental Regulations: Familiarize yourself with local rental regulations and laws to ensure compliance. Understand your rights and responsibilities as a landlord, including tenant rights, lease agreements, security deposits, and eviction procedures

By understanding and fulfilling your post-purchase responsibilities, you can effectively manage your property and protect your investment. Whether it’s property maintenance, tax and insurance obligations or renting out the property, staying informed and proactive will contribute to a successful and rewarding property ownership experience.

Conclusion

In this blog post, we have covered the key steps and considerations involved in purchasing a property in Singapore. We discussed the importance of conducting thorough research, engaging a lawyer, obtaining an Approval-in-Principle (AIP) from the bank, and completing the purchase process.

It is crucial to seek professional advice and assistance when navigating the Singapore property purchase process, especially as a foreigner. Professionals such as lawyers and real estate agents like Jimmy Sum can provide valuable guidance and ensure a smooth and successful transaction.

While the process may seem complex, investing in the Singapore property market offers exciting opportunities and rewards. Singapore is known for its robust economy, stable property market, and attractive rental yields. By making informed decisions, staying proactive, and seeking professional support, you can tap into the potential of the Singapore property market and enjoy the benefits of property ownership.

Remember, each property purchase is unique, and it’s essential to tailor your approach based on your specific needs and circumstances. Stay informed about the latest market trends, regulations, and financing options to make well-informed decisions.

By staying positive throughout the process, you can embark on a successful property ownership journey in Singapore. Good luck!