Navigating the rental market in Singapore can be a challenging task, especially when it comes to understanding rental costs and effectively managing your budget. By gaining a comprehensive understanding of rental costs and the factors that influence them, you can make more informed decisions and ensure that your housing expenses align with your financial capabilities. Let’s explore the key factors that shape rental costs in Singapore and delve into the importance of budgeting to rent real estate as a foreigner in Singapore

Factors Influencing Rental Costs in Singapore

- Supply and demand dynamics:

The rental market in Singapore is greatly influenced by supply and demand dynamics. During periods of high demand and limited supply, rental costs tend to rise. Economic factors, such as job opportunities and inflow of expatriates, play a significant role in driving demand for rental properties. Additionally, government policies regulating foreign labor can impact the rental market. Staying informed about market fluctuations and trends will provide insights into the state of supply and demand, helping you gauge the competitiveness of rental costs.

- Location and proximity to amenities:

One of the primary factors influencing rental costs is the location of a property. Prime residential neighborhoods, such as Orchard Road, Marina Bay, and Sentosa, command higher rental prices due to their desirability, convenient access to amenities, and proximity to business districts. On the other hand, properties in suburban areas or further away from central locations may have more affordable rental costs. Consider your personal preferences and lifestyle needs when evaluating locations and understanding the top neighborhoods that are popular among foreigners allow you to make a more informed decision that enables you to strike a balance between cost and convenience

- Property type and size:

Rental costs also vary based on the type and size of the property. Condominiums and apartments typically have higher rental prices compared to HDB flats or landed houses. The number of bedrooms, area and layout also play a role in determining rental costs. Larger units or those with additional features such as an extra study room may tend to be priced higher. Assess your space requirements and prioritize your needs when considering different property types to ensure that you are paying for what you truly need.

- Condition and age of the property:

The condition and age of a rental property can influence the rental price. Newer or recently renovated properties with modern facilities and finishes are generally priced higher due to their perceived value and desirability. Older properties or those in need of repairs may have lower rental costs but consider potential maintenance or renovation expenses that can arise in such cases. Look for a well-maintained property that meets your needs while staying within your budget.

Understanding these factors that influence rental costs in Singapore is crucial for effective budgeting and making informed decisions when looking for a rental property. By considering the location, property type, size, condition, and included facilities, you can better assess rental costs and find a property that meets your needs while remaining within your budget. In the next section, we will delve into the different types of rental costs you need to consider when budgeting for a rental property especially as a foreigner in Singapore.

Types of Rental Costs

Finding a rental property goes beyond just considering monthly rent. It’s important to understand the different types of rental costs involved to properly plan your budget. Here are the key types of rental costs to consider:

- Monthly rental fees:

The monthly rent is the most apparent cost associated with renting a property. It is the amount you pay each month to the landlord. This cost forms the foundation of your budget and should be carefully considered to ensure it fits within your financial means.

- Security deposit:

Landlords in Singapore require a security deposit before moving into a rental property. The security deposit serves as a form of protection for the landlord in case of any damages or unpaid rent. Typically, the security deposit is equivalent to one or two months’ rent, depending on the length of your lease and it is refunded at the end of your tenancy, provided there are no damages. Do take note that security deposit is not allowed to be used to offset the monthly rental.

- Advance one month rental:

Before you move into the rental property, you are required to pay one month of advance rental to the landlord regardless of the length of your lease. This is normally payable upon signing the Tenancy Agreement.

- Utility bills and service charges:

In addition to the monthly rental fee, you are responsible for paying for your utility bills, such as electricity, water, and gas. Additionally, internet subscription is under your own cost too. Therefore, it is essential to factor in these recurring costs when budgeting for your monthly expenses.

- Agent fees:

If you engage a property agent to help you find a rental property, there will be agent fees involved. In Singapore, tenant agent fees are as followed:

One year lease: Agent fee is half month rental plus GST

Two years lease: Agent fee is one month rental plus GST

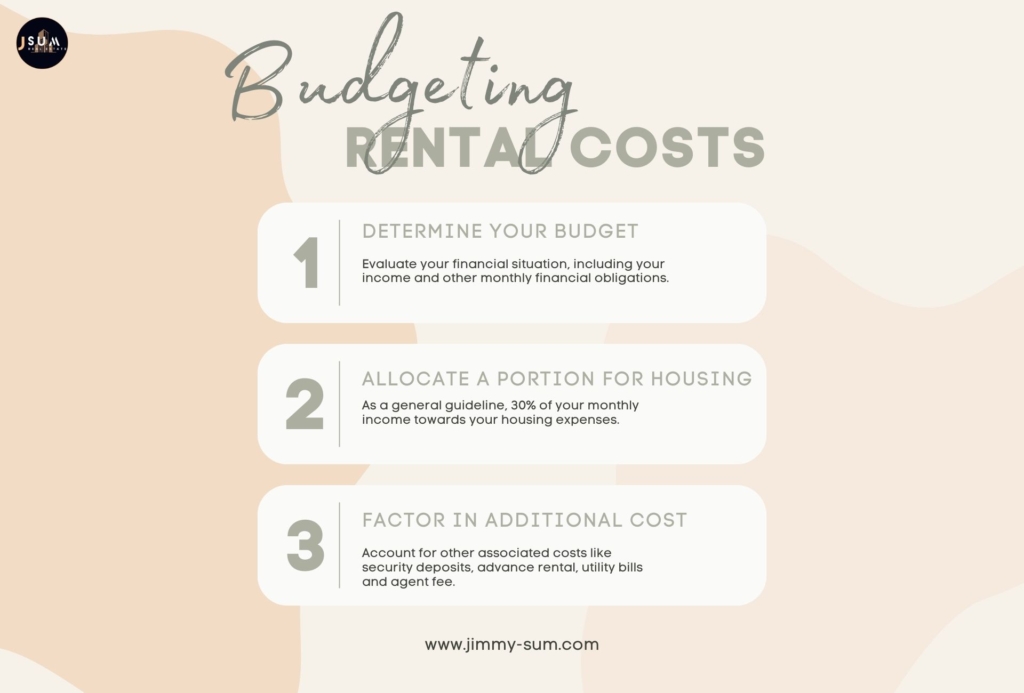

Budgeting for Rental Costs

Budgeting is a critical aspect of managing your rental expenses effectively. By creating a comprehensive budget, you can ensure that you allocate sufficient finances to cover all the rental costs. Here are some key steps to consider when budgeting for rental costs:

- Determining your budget:

Evaluate your financial situation, including your income and other monthly financial obligations. Consider your overall monthly expenditure, such as utilities, transportation, food, and savings. This will help you identify how much you can comfortably allocate towards rent without straining your finances.

- Allocating a portion of income for housing:

As a general guideline, financial experts suggest allocating around 30% of your monthly income towards housing expenses. However, depending on your financial situation and other financial commitments, this percentage can vary. Assess your income and expenses, and determine a reasonable percentage to allocate for rental costs.

- Factoring in additional costs:

Beyond the monthly rent, remember to account for other associated costs like security deposits, advance rental, utility bills, and agent fees. Be sure to set aside funds to cover these expenses along with your monthly rent. This ensures that you have a comprehensive and realistic budget.

By diligently budgeting and considering all the rental costs involved, you can make financially sound decisions and manage your rental expenses with ease. In the next section, we will explore the importance of thorough research and understanding the rental market before making any commitments.

Researching the Rental Market

Before committing to a rental property, it’s essential to conduct thorough research and gain a comprehensive understanding of the rental market in Singapore. This research helps you make informed decisions and ensures you find a rental property that meets your needs within your budget. Here are some key steps to consider when researching the rental market:

- Utilizing property listing websites and apps:

Property listing websites and mobile apps offer a wealth of information about available rental properties in Singapore. Websites like PropertyGuru, 99.co, and SRX provide detailed listings with photos, rental prices, property features, and contact information. Use these platforms to explore different options and narrow down your choices based on location, property type, and rental costs.

- Engaging with real estate agents:

Real estate agents have in-depth knowledge of the rental market and can provide valuable insights into rental trends, upcoming vacancies, and good deals. Just like Jimmy Sum who has years of experience working closely with tenants to help them secure their ideal homes in Singapore. Reach out to reputable agent who specialize in rental properties to guide you through the process and help you find properties that meet your requirements. They can also provide assistance in negotiating rental prices and navigating the paperwork associated with rental agreement. There are definitely numerous key benefits in engaging real estate agents to help you on sourcing for your ideal home, especially on your time and effort to understand this unfamiliar rental market.

- Exploring different neighborhoods and comparing rental prices:

Familiarize yourself with different neighborhoods in Singapore and compare rental costs across various locations. Factors such as proximity to essential amenities and services, workplaces as well as schools can impact rental prices. Balance your budget considerations with factors like convenience, lifestyle, and any specific preferences you may have for certain neighborhoods.

Understanding Tenancy Agreements and Legal Aspects

As a prospective tenant, it’s important to have a solid understanding of tenancy agreements and the legal aspects associated with renting a property. Here are some key considerations:

- Key terms and clauses:

Familiarize yourself with the key terms and clauses typically included in a tenancy agreement. These may include the duration of the tenancy, renewal options, rent increase policies, access to facilities, maintenance responsibilities, and termination conditions. Review and understand these clauses to ensure you have a clear picture of your rights and obligations as a tenant.

- Tenancy duration and renewal options:

Understand the term of the tenancy and whether there are options for renewal. Some landlords may prefer shorter-term leases like a year lease, while others may be open to longer-term commitments which can be 2 years and beyond. Consider your plans and preferences to find a tenancy agreement that aligns with your needs.

- Rights and responsibilities of tenants and landlords:

Familiarize yourself with the rights and responsibilities of tenants and landlords as outlined by the Singapore Tenancy Act. This includes obligations related to rent payment, property maintenance, repairs, access to the property, and dispute resolution. Understanding these rights and responsibilities helps ensure a harmonious tenancy and protect your interests as a tenant.

- Legal recourse in case of disputes:

Understand the legal recourse available in case of any disputes with the landlord. While it is always preferable to resolve issues amicably, being aware of the legal options can provide you with peace of mind. If faced with any conflicts, consult legal professionals or seek advice from relevant authorities such as the Small Claims Tribunal or the Council for Estate Agencies.

Having a thorough understanding of tenancy agreements and legal aspects empowers you to navigate rental agreements confidently and protect your interests as a tenant. By researching the rental market and understanding the legalities, you can make informed decisions that align with your budget, preferences, and ensure a smooth rental experience.

Making an Informed Decision

After carefully considering rental costs, conducting thorough research, understanding legal aspects, and factoring in additional considerations, it’s time to make an informed decision. Here are some key steps to help you make the best choice:

- Compare and evaluate:

Compare different rental properties based on factors such as location, rental costs, amenities, and suitability to your needs. Evaluate the pros and cons of each option to determine which property aligns best with your budget and preferences.

- Visit the property:

Whenever possible, visit the rental property in person to assess its condition, layout, and surroundings. This allows you to have a firsthand experience and verify if it meets your expectations. Take note of any existing damages, proper functioning of utilities, and overall suitability for your needs.

- Seek advice and feedback:

Seek opinions from friends, family, or colleagues who have experience with renting in Singapore. Their insights and feedback can provide valuable perspectives and help validate your decision-making process.

- Trust your instincts:

Trust your instincts and listen to your gut feeling. If something doesn’t feel right or there are lingering doubts, it may be a sign to explore other options. Renting a property is a significant decision, and it’s crucial to feel confident and comfortable with your choice.

Conclusion:

Navigating the rental market in Singapore requires careful planning, research, and consideration of various factors. By understanding rental costs, conducting thorough market research, and seeking professional advice, you can make an informed decision and find a rental property that suits your budget, lifestyle, and preferences.

Remember to create a comprehensive budget that factors in all rental costs, including monthly rent, security deposit, utility bills, and agent fees. Research the rental market, compare different properties, and assess additional factors such as location, transportation, and safety. Understand the legal aspects and terms of the tenancy agreement to protect your rights as a tenant.

By carefully considering all these aspects, seeking professional guidance when needed, and trusting your instincts, you can navigate the rental market with confidence and find the perfect rental property that meets your needs and enhances your living experience in Singapore.

Start your rental journey in Singapore today. Contact us to find the ideal property that meets your needs and preferences.