What Is Asset Progression?

The term “asset progression” describes the process of selling one type of asset and moving on to the next that is a more profitable one. Some people consider it like ascending a ladder but there is a much more essential reason behind it. Asset accumulation provides you with a variety of financial possibilities later in life. The term “progression” refers to the process of gradually evolving or progressing to a more advanced condition.

Depending on your life stage and circumstances, there are various approaches and strategies to approaching property asset progression. These options are not available if you do not plan for asset progression. That’s just how it is.

Assets Progression Journey:

The chart above shows the journey of a person from his early intention of seeking independence from family and slowly leaning towards asset progression with small steps through wealth acquisition and accumulation and finally towards retirement age. Each step symbolizes a different stage of life. Understanding wealth in your 20s, the beginning of wealth acquisition in your 30s, progressing into wealth accumulation in your 40s & ultimately enjoying your retirement in your 50s or 60.

The majority of our working life takes place between the ages of 21 and 65. Many people buy their first home during this period, which could be a small investment or a House Development Board (HDB) flat (the most affordable) or private property (with some support from family).

Some people reach the stage of Wealth Accumulation after several years of Wealth Acquisition, allowing them to either enhance their assets or purchase a second property.

Those who learn the Asset Progression Theory have the higher possibilities to enhance their properties on a proactive basis than those who don’t.

Property values, like people, have life cycles in which their value reaches a peak at least once in its life cycle.

Upgrading does not always imply spending all of your savings on a larger (and more expensive) home. It entails unlocking the cash locked up in a property by selling it and investing the proceeds in a high-performing property with better capital gains or rent.

When their children have left the nest, some people may decide to downgrade and sell one or two assets to free up funds for their elderly years.

Unfortunately, we have encountered individuals who have only recently realized that selling their homes will result in a loss. The 2.5 percent CPF accumulated interest that must be repaid to accounts means that many HDB and condo owners will have insufficient funds following the sale.

Why Progression through Property Investment?

As of December 2018, Singapore had a relatively high property ownership rate of 91 percent (based on statistics from the Department of Statistics Singapore).

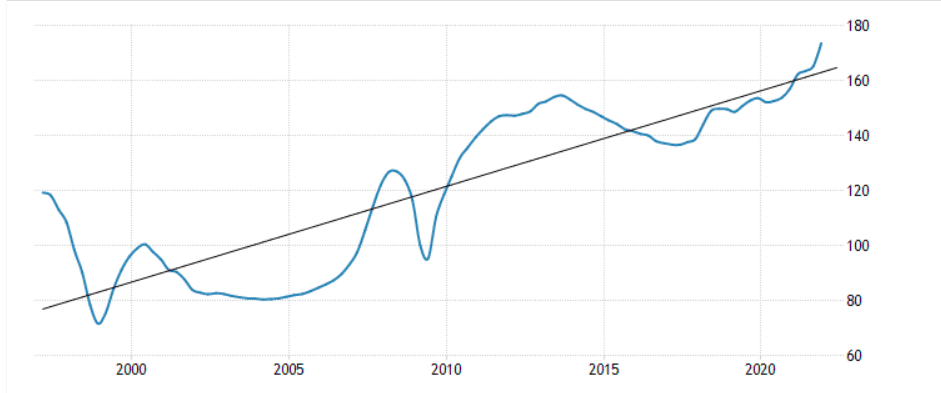

The high percentage of home ownership does not come merely from a hobby or a status-symbol. Rather, Singapore’s real estate market is one of the most lucrative and the most stable one. The below chart can be seen as the property price index has an upward trend and it grew almost by 100% in the past 20 years. So, if a person invested $1 million in the year 2000 now worth about $2 million in 2020-21. It’s more than many of the investments plans in the country including that fixed bank deposits. One of the safest ways to achieve financial independence is through real estate. This is why many Singaporeans (as well as foreigners) are always interested in Singapore real estate.

Unfortunately, as asset progression or wealth creation is not taught in school, not everyone knows the market and how to profit from it. Those that have the benefit of advice get a head start in planning and executing the best real estate choices. Those in the opposing camp will have to put in the effort to determine whether or not you are in a position to do so and how to go about doing so.

Figure 2: Singapore Housing Price Index

Source: Www.tradingecnomics.com

Why Singapore is good for Property Investment?

Singapore has a distinct residential property market from the rest of the world. If you visit big cities throughout the world and look at their property prices, you will be surprised. In comparison to the suburbs, real estate prices in cities are always much greater. So, the question is that how can the government maintain housing inexpensive in Singapore, an island city-state?

The Housing Development Board (HDB) is the main reason why housing in Singapore is kept affordable. The Housing Development Board (HDB) was established in 1960 to achieve this goal. The goal was to give Singaporeans affordable low-cost housing. Around 80% of Singaporeans now live in HDBs, which are the cheapest and most economical type of residential housing available. The HDB is also the simplest “residential asset type” in which you can live. The property in Singapore can be classified as:

- HDB/DBSS

- Executive Condominiums

- Condominiums

- Landed Real Estate

For the following reasons, many overseas buyers are drawn to invest in Singapore properties or buy one to live in.

- Political Stability

- Education System

- It is good for families because of its low crime rate and safe atmosphere.

- Singapore’s position as one of the world’s most important financial centers

- The allure of Singapore for highly bright foreign nationals seeking to develop their careers.

- Singapore properties have a high value when compared to those in other major cities across the world.

Despite the ups and downs in property prices throughout time, these factors have positioned Singapore properties on a long-term price rise path. Singapore property purchasers and investors have been able to take advantage of these trends to lock in good profits from price growth, end-bloc sales, and passive rental income from their homes. Earnings from real estate investments are frequently factored into Singaporeans’ retirement plans.

When to Begin the Investment?

Stage 1 – Understanding Wealth: (Mid 20s to Early 30s)

There is a growing trend that this group of people are seeking independence and prefer to live on their own, rather than with their family or parents. Young people of this age group of mid 20s to early 30s, they will either rent a place with a group of friends or live by themselves. This is when they begin to understand cashflow as in how much of their income will go to paying for their monthly rental and their daily expenses Is it worth to rent for the long term?

However, at this point, they don’t prefer any form of financial commitment yet yearn to enjoy their freedom.

After a while, they may begin to realize that they are helping the landlord to pay for their monthly mortgage. Now, they will think, is it worth to do so?

Stage 2 – Wealth Acquisition: (Early 30s – Mid 30s)

At this stage, they have other plans like getting married and begin to explore the option of getting their first property. Normally, HDB is their option for their first property. Reason being is that the cost of purchase is much more affordable This could be a brand new HDB flat or an HDB resale property on the open market. It’s the most exciting stage as it’s one of their first and a big investment in life. But this may not be able to offer financial independence or a passive income due to personal use of property or its lower rental income.

Stage 3 – Wealth Accumulation: (Late 30s – Late 40s)

For some, as their careers progress, they try to sell their first property (HDB) and move into private property (either resale or new launch). Those with more disposable income may opt to keep both the HDB flat and the private property. However, with the latest property cooling measures that is announced on 16 December 2021, it may not be too worthwhile to keep their HDB and buying a second property. Ending up paying a hefty Additional Buyer Stamp Duty (ABSD).

Instead, it will be better if they can sell their HDB and if their finance permits, they can buy one property under each name. For instance, buying one for own stay and another one for investment.

For others who have already own multiple properties, they will need to do portfolio restructuring. Portfolio restructuring does not always imply purchasing a more expensive property. It entails taking money from a property that is no longer increasing in value (or, even worse, decreasing in value) and investing it in a property that has a much better chance of increasing in value. It can be considered a solid investment with good appreciation and a stable rental income. It paves the step stones towards retirement.

Stage 4 – Retirement/Legacy Planning: (Early 50s – Early 60s)

Reaching the retirement age, you should plan to sell your current home and downsize to a small HDB unit. The remaining money from the sales will be put into their retirement accounts.

Unfortunately, some people only realize they can’t carry out their plan when they’re preparing to place their house on the market. That there isn’t enough after the CPF (Central Provident Fund) accrued interest is paid, or that the value of their property has decreased.

Why is it Important to Understand Asset Progression?

According to a recent OCBC study, one out of every three Singaporeans does not invest, and majority of them are financially unprepared for retirement. We’ve shown in this case that asset progression allows you to prepare for retirement while switching from one asset class to another. However, not all the investments appreciate consistently in value especially after completing their lifecycle of 20-25 years on average. Buying the wrong one can be incredibly costly and have a significant impact on your retirement goals.

Is the Property a Safe Investment for Retirement?

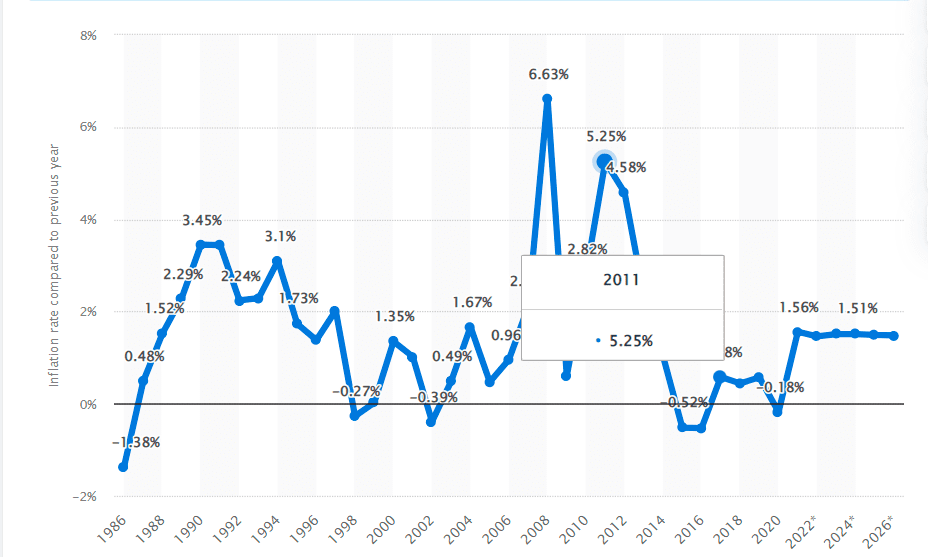

If we analyze and compare the past 20 years average inflation in Singapore, it turns out that it’s somewhere in between 1.5% to 2.5%. But the real estate sector has grown at 4 to 5% in this phase. It depicts that investment in a property protects you from the inflation by almost 100% Apart from it, if you have a stable job or business, it will further improve your purchasing power and will provide you a shield against the rising inflation. So, this way the property is considered among the most stable options.

Figure 3: Singapore Inflation Index

Source: Statista

The Importance of Retirement Planning:

Undoubtedly, you’ve worked hard to build your fortune, provided for your family, and lived the life you wanted, so it’s only natural that you’d want to safeguard it as you plan for your ideal retirement. This is why retirement planning which may eventually leads to legacy planning – a financial strategy that allows a person to leave assets such as money, real estate, and precious things to their loved ones after they die – is so crucial.

Not only will having a sound legacy plan provide you peace of mind in your golden years, but it will also ensure that you leave a lasting legacy for the people you care about, allowing them to live comfortably and happily. This will allow you to live the life you desire throughout your retirement without having to make compromises.

Property Asset Progression’s ultimate goal is to allow a person to develop a healthy retirement fund in his or her golden years by making wise property investments.

Conclusion:

Property is typically considered a highly desirable asset since it can offer a regular source of income through rental, be it a HDB, a private condominium, landed property that you own, or even property that you have invested in. It is the two-fold benefits of appreciation and passive rental income that make it the most sought-after investment plans for any of the investors irrespective of their age, trade and the capital they have for their future plans.