Highlights

- The condo downpayment required in Singapore is 25% of the total purchase price. The remaining 75% of the total purchase price can be covered by your bank loan if it is eligible.

- Additional Buyer’s Stamp Duty (ABSD) is a tax imposed on certain buyers, ranging from 5% to 60% of the purchase price, depending on the buyer’s profile and the number of properties owned.

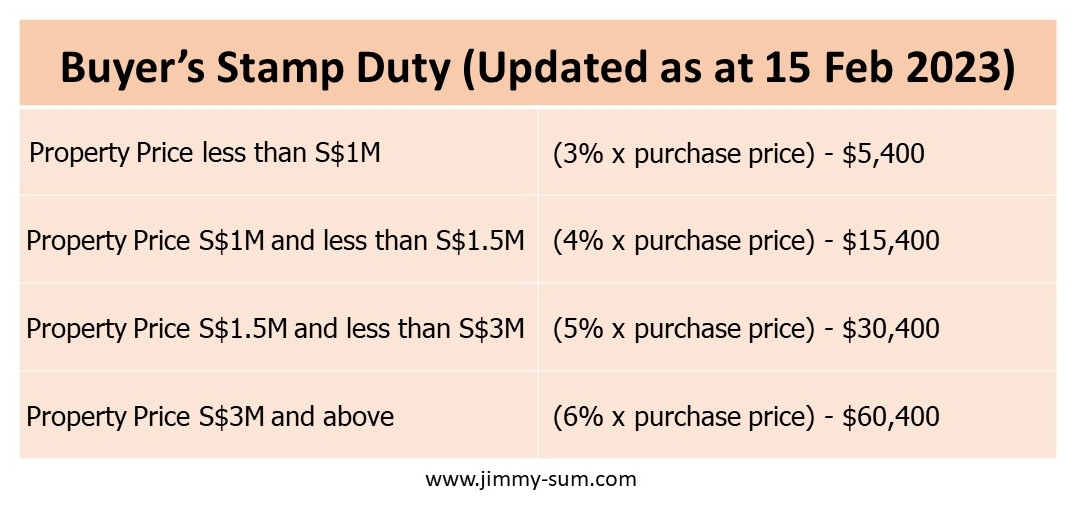

- Buyer’s Stamp Duty (BSD) is a cost based on the condo’s purchase price with rates ranging from 3% to 6%.

- Total Debt Servicing Ratio (TDSR) determines the maximum loan amount and impacts the minimum cash downpayment required, depending on the number of outstanding mortgages.

- You should consider legal fee when purchasing a condo. A reasonable price range for legal fees is S$2,500 to S$3,200.

- Additional costs besides the condo downpayment in Singapore include home insurance, furnishing and renovation expenses, maintenance fees, and property tax.

- Monthly repayment costs for a home loan depend on the loan amount, interest rate, and loan tenure.

- CPF can finance up to 95% of the downpayment of condos if there is enough. The remaining 5% of downpayment must be paid in cash.

- Owners of HDB flats can buy a condo after fulfilling the 5-year Minimum Occupation Period (MOP) requirement.

Factors Affecting the Cost of Condos in Singapore

1. Additional Buyer’s Stamp Duty

ABSD is a tax imposed for buying second property onwards for locals. The ABSD rate will be different for Singapore Permanent Residents as well as for foreigners and entities. The rate ranges from 5% to 60% of the purchase price, depending on the number of properties owned.

The exempt countries from paying ABSD under Free Trade Agreements include Iceland, Norway, Switzerland, Liechtenstein, and the United States. Couples purchasing a second home often choose decoupling, where each spouse owns one property instead of both jointly. Another option is to purchase the property under a child’s name if the child is at least 21 years old to avoid ABSD and potentially use it as a future investment. Alternatively, you can buy property under trust as well even though there is an ABSD of 65% payable. However, this can be claimed back from IRAS if you meet its eligibility conditions. ABSD is only payable in cash or from CPF.

2. Buyer’s Stamp Duty (BSD)

When purchasing a condo, the buyer’s stamp duty (BSD) is a standard cost to consider alongside the downpayment. BSD is calculated based on the purchase price of the condo.

The current BSD rates are as follows:

Including the BSD in your budget when planning for the downpayment of a condo is crucial, as it contributes to the overall cost of the property acquisition.

3. Loan to Value (LTV)

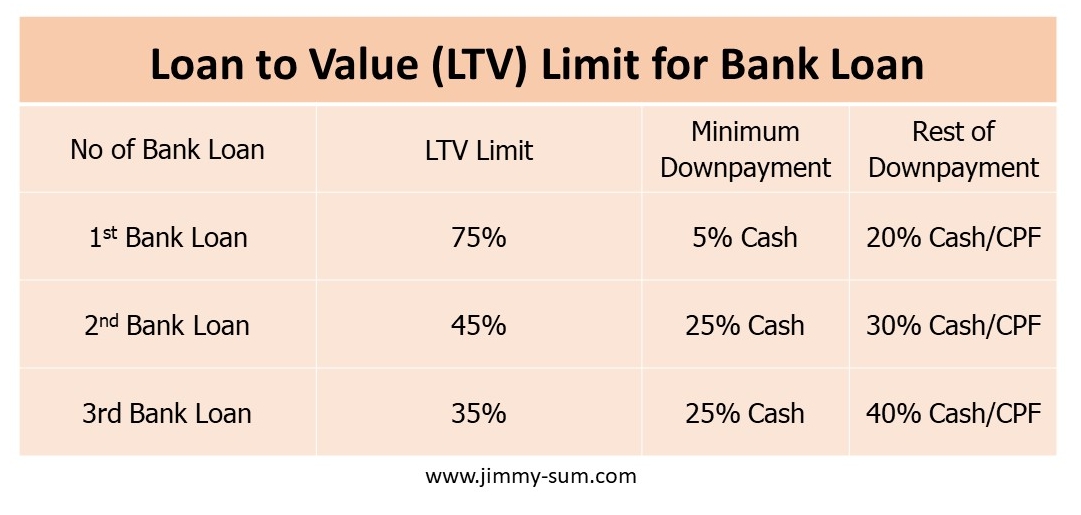

LTV refers to the maximum amount of loan that can be taken for a property purchase. It determines the maximum amount the bank will lend and impacts the minimum cash downpayment required for a property purchase, alongside loan tenure and interest rates.

Although the LTV for bank loan has remained at 75% when a round of cooling measures is introduced in September 2022, however, the LTV for HDB loan has tightened from 85% to 80%.

The LTV and the number of outstanding mortgages influence the minimum cash downpayment. If there are no outstanding mortgages, the LTV limit is 75%, and the minimum downpayment is 25% of the property’s value, with 5% paid in cash.

With one outstanding mortgage, the LTV limit decreases to 45%, and the minimum downpayment increases to 55%, with 25% paid in cash. For two or more outstanding mortgages, the LTV limit further decreases to 35%, requiring a minimum downpayment of 65%, with 25% paid in cash.

4. Legal Costs

When purchasing a condo, it’s important to consider the legal fees charged by conveyancing lawyers. Seek out lawyers who provide efficient or excellent services at a fair cost.

There are lawyers available who offer their services at lower prices, aiming to attract clients. Conversely, some may demand excessively high fees. A reasonable price range to keep in mind is between S$2,500 and S$3,200.

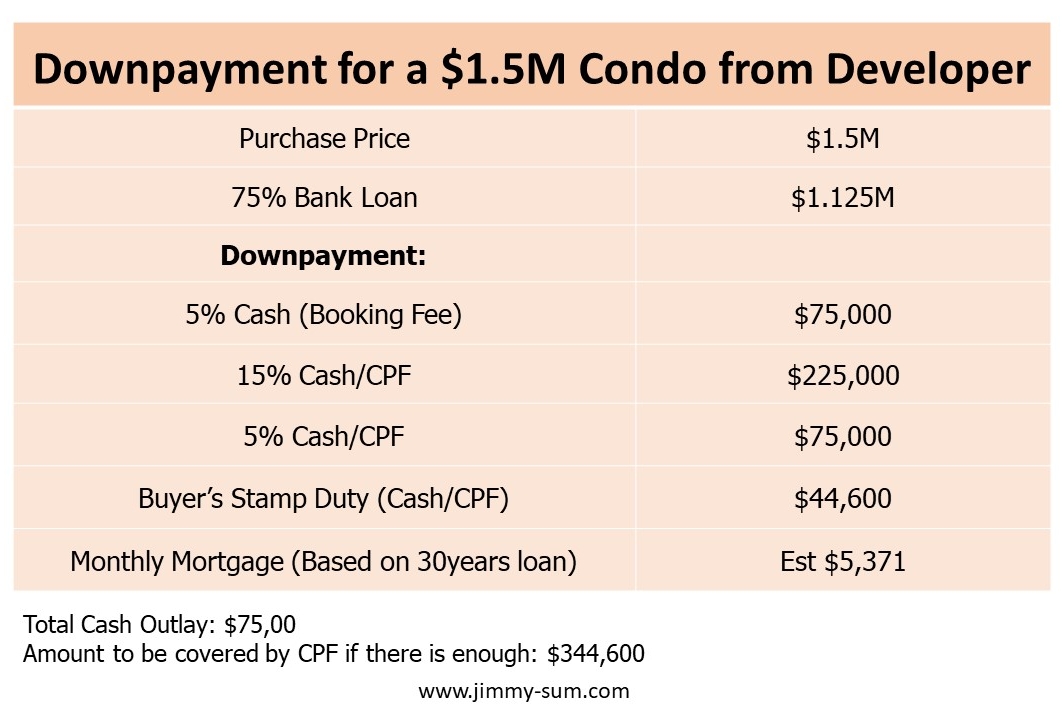

An Example: A New Condo Purchase with a Price of $1.5M

Assumption made:

- First property

- Bank loan: 75%

- Loan Tenure: 30 years

- Bank Interest Rate: 4%

5. Other Costs Besides Condo Downpayment

Apart from the above-mentioned factors that affect your condo downpayment, there are other costs that you will need to bear after you have purchased your condo:

Home Insurance: Home insurance is not mandatory but is highly recommended to protect your property against damage or loss. There are many types, such as fire insurance, theft insurance, and accidental damage insurance. The cost of home insurance varies depending on the coverage and property value.

Furnishing and Renovation: To make your condo livable, the cost of furnishing and renovation varies depending on your preferences and the size of the condo.

Maintenance Fees: The maintenance fee is payable quarterly and covers the cost of maintaining the common condo areas, such as the gym, pool, and garden. The fees range from a few hundred to a few thousand dollars per year, depending on the size and amenities of the condo.

Property Tax: Property tax is payable annually and is calculated based on the annual value of the property. The annual value is the estimated gross annual rent that your property can fetch if it were to be rented out. The tax rate is progressive, with lower rates for lower annual values and higher rates for higher annual values.

Typical Home Loan Monthly Repayment Costs

The monthly repayment costs depend on the loan amount, interest rate, and loan tenure. As of 2023, the average interest rate for home loans in Singapore is around 4%.

Example: A home loan of $1,125,000 with a 4% interest rate and a 30-year loan tenure will have a monthly repayment of around $5,371.

Can You Use CPF And Cash to Pay Condo Down Payment?

Except for the first 5% of the purchase price that needs to be paid in cash, the rest of the payment for your purchase can be paid through using CPF if there is enough. Otherwise, it can be financed using bank loan and CPF. By the way, Buyer’s Stamp Duty as well as Additional Buyer’s Stamp Duty can be paid using CPF as well.

FAQs

1. How Much Cash Loan Can You Get for Condo?

The loan amount depends on various factors, such as income, credit score, and property value. The maximum loan amount is 75% of the property’s value. While you must pay the remaining 25% as a downpayment. You may also be eligible for additional loans, such as a bridging loan, to cover the downpayment until you receive the funds from selling your existing property.

2. Can I Buy a Condo If I Hold An HDB?

If you own an HDB flat and wish to purchase a private condominium, you must adhere to the 5-year Minimum Occupation Period (MOP) requirement. This means you can only buy a condo at least 5 years after purchasing your HDB flat.

Once you have fulfilled the 5-year MOP, you can retain ownership of your HDB flat while purchasing a condo. You can continue residing in your HDB flat or move into your newly acquired condominium. However with the higher new ABSD rates for second property onwards even for locals, it may makes more sense to sell your current HDB before moving on to purchase a condo as part of your asset progression journey.

Conclusion

The total condo downpayment in Singapore requires careful consideration of the associated costs and a comprehensive understanding of the expenses involved. Owning a condo is a significant investment, and it is essential to plan and save accordingly to make this aspiration a reality.

By staying informed about the current market changes and diligently saving towards the downpayment, individuals can work towards purchasing a condo and enjoying the benefits of property ownership in Singapore’s thriving real estate market. Of course, you can seek the help of professional real estate agent to help assess on your current financial situation and how you can move on from there.