Rental Yield: The Heartbeat of Real Estate Investment Returns

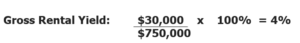

Rental yield, a pivotal metric in property investment, quantifies the income-generating capability of a property. It is calculated by dividing the property’s annual rental income by its purchase price and expressed as a percentage. A property purchased for $750,000 with an annual rental income of $30,000 would have a gross rental yield of 4%.

Rental yield holds immense significance for astute investors. it allows them to accurately assess the potential profitability of an investment, compare various properties, and make data-driven decisions to optimize their real estate portfolios.

The Singapore Real Estate Market: A Beacon of Stability and Growth

Singapore boasts a highly reputable real estate market renowned for its stability, robust regulatory framework, and long-term potential for appreciation. It presents a diverse spectrum of investment options, including the government-subsidized public housing sector (HDB flats) and the private property market consisting of condominiums, landed homes, and other property types. Singapore’s flourishing economy, strategic positioning as a global hub, and pro-business policies make it an exceptionally attractive destination for real estate investment, drawing both domestic and foreign capital.

Factors Affecting Rental Yield: A Comprehensive Analysis

1. Location: The Bedrock of Rental Demand

- Proximity to Amenities: Tenants prioritize properties that offer easy access to daily necessities and lifestyle options. Residences within walking distance of supermarkets, malls, hospitals, clinics, and recreational facilities command premium rents. Location greatly impacts a tenant’s quality of life and willingness to pay more for convenience.

- MRT Access: The MRT network is the backbone of Singapore’s public transportation system. Direct access or close proximity to an MRT station reduces commuting times and enhances connectivity to employment hubs, educational centers, and other parts of the city. This translates to robust tenant demand and the ability to secure higher rental incomes.

- Educational Institutions: The presence of well-regarded schools, from primary to tertiary levels, attracts a specific demographic. Families actively seek rental units in catchments of desired schools, while areas with universities and colleges draw a large student population. The consistent demand for housing in these locations supports healthy rental yields.

2. Property Type: Catering to Diverse Tenant Profiles

- Condominiums: Private condominiums often boast a range of facilities such as swimming pools, gyms, tennis courts, BBQ pits, and 24-hour security. These amenities cater to comfort, leisure, and security, appealing to professionals, expatriates, and families willing to pay for lifestyle benefits. Consequently, condominiums can have the potential for higher rental yields.

- HDB Flats: Public housing units offer a more standardized experience, yet their rental potential is highly location-dependent. HDB flats located near MRT stations, commercial centers, and with convenient amenities command greater interest. While individual units may have lower yields compared to condominiums, their relative attainability can still result in healthy overall returns. However, foreigners are not allowed to buy HDB in Singapore.

- Landed Properties: This category, including terrace houses, semi-detached, and bungalows, provides exclusivity, privacy, and more spacious living. However, their substantial upfront investment means rental yields must be carefully calculated. Landed properties may attract niche tenants like larger families or those desiring a specific lifestyle, impacting the yield potential.

3. Unit Size and Layout: Optimized Space, Optimized Returns

- Size: While larger units naturally demand higher absolute rents, investors must be mindful of the balance between purchase price and income to determine true yield. Smaller units, like studio or 1-bedroom apartments, might offer superior yields due to their lower entry point and appeal to young professionals or students.

- Layout: Efficient layouts maximize floor area and create well-defined, usable spaces. Tenants appreciate functional designs that avoid awkward configurations or wasted space. A well-optimized layout increases a unit’s appeal, potentially justifying higher rent and positively affecting yield.

4. Age and Condition of the Property: The Impact of Maintenance

- Age: Newly built properties with contemporary designs, fittings, and finishes such as The Arcady at Boon Keng garner higher rental interest compared to significantly older buildings. Modern aesthetics and amenities align with tenant preferences.

- Condition: Investors must prioritize regular maintenance. A well-kept unit in good repair commands premium rents. On the other hand, neglected properties with signs of wear and tear or requiring renovations may necessitate lower rental rates, impacting yield calculations.

5. Market Demand and Competition: The Dynamics of the Rental Landscape

- Economic Conditions: A robust economy with low unemployment supports housing demand, boosting rental yields. Conversely, economic downturns can weaken demand, potentially compelling landlords to reduce rents.

- Supply and Competition: An influx of new rental units into a specific area intensifies landlord competition. Oversupply can put downward pressure on rents, requiring investors to carefully assess market dynamics.

Rental yields are not fixed. It’s a constantly shifting metric influenced by the confluence of the factors described above. Savvy investors must stay informed about market trends, conduct due diligence, and strategically position their properties to maximize rental returns.

Top Neighborhoods for Rental Yield – Central Region

Singapore’s Central Region, which also known as Core Central Region of Singapore (CCR) offers unparalleled investment opportunities with its combination of prestige, convenience, and high tenant demand.

Here’s a deeper look at the top neighborhoods:

Tanglin/Holland/Bukit Timah

- Prestigious Address: This district exudes exclusivity, boasting spacious landed properties, high-end condominiums, and proximity to international schools like Hollandse School and Swiss School.

- Amenities & Lifestyle: Residents enjoy world-class shopping along Orchard Road, dining options, and the tranquility of the Singapore Botanic Gardens.

- Accessibility: Well-connected by MRT (Circle Line, Downtown Line) and major expressways for easy commutes.

- Tenant Profile: Ideal for expatriate families, high-net-worth individuals, and those seeking a premium lifestyle.

Orchard/River Valley

- Heart of Luxury: The pinnacle of city living, with iconic shopping malls like ION Orchard and proximity to five-star hotels.

- Unbeatable Convenience: Premium residences integrated with high-end retail, offering residents unparalleled convenience.

- Connectivity: Superb accessibility via MRT stations (Orchard, Somerset) and major roads.

- Tenant Profile: Attracts affluent expatriates, business executives, and individuals desiring the ultimate in cosmopolitan lifestyles.

Newton/Novena

- Prime Location: Strategically positioned with convenient access to the CBD, Orchard Road, and other districts.

- Healthcare Hub: Home to Tan Tock Seng Hospital, Novena Medical Center, and numerous specialized clinics.

- Amenities & Education: Offers good schools (Anglo-Chinese School), shopping malls (United Square, Velocity), and diverse food options.

- Tenant Profile: Appeals strongly to healthcare professionals, families, and those prioritizing convenience and accessibility.

Areas commanding high rental yields might have slower long-term capital appreciation compared to developing districts with growth potential.

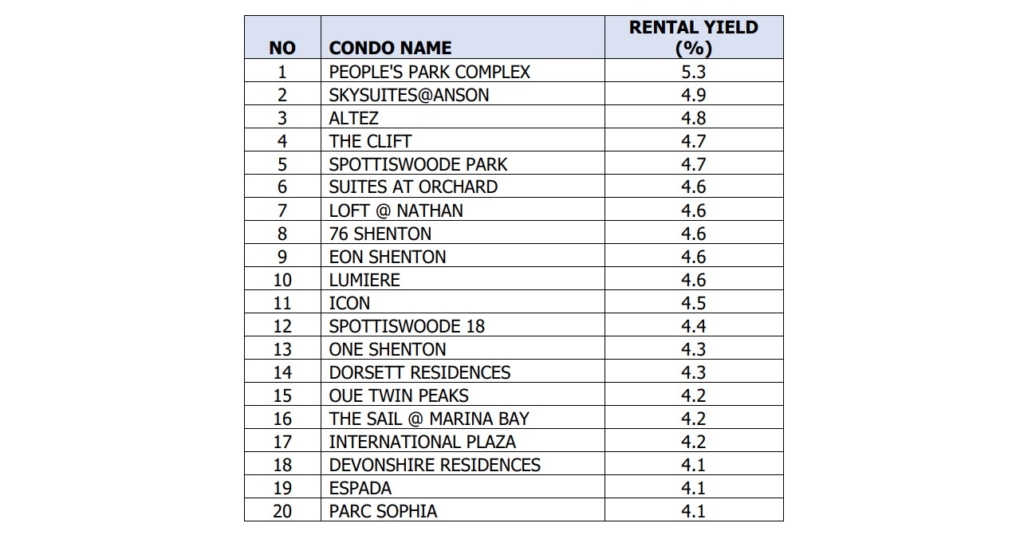

Below is the list of Top 20 High Rental Yield Condo in CCR

City Fringe: High Rental Demand & Growth Potential

The City Fringe in Singapore, also known as the Rest of Central Region (RCR), presents a compelling mix of accessibility, lifestyle choices, and future development such as Greater Southern Waterfront, making it an attractive location for rental investment. Let’s delve deeper into its key neighborhoods:

Alexandra/Commonwealth

- Transformation in Progress: This area is experiencing a wave of redevelopment, with aging housing stock making way for modern mixed-use projects, commercial spaces, and improved public amenities.

- Strategic Location: Its proximity to major business hubs like Mapletree Business City, one-north, and the CBD translates to strong demand from young professionals and executives.

- Transportation: The Queenstown MRT station (East-West Line) and easy access to major expressways ensure convenient commutes for residents.

- Evolving Amenities: Expect a boost in shopping options (like Alexandra Central), dining, and recreational offerings as the area revitalizes.

- Tenant Profile: Appeals to young professionals, couples, and small families drawn to the work-life balance offered by a short commute and emerging lifestyle amenities.

East Coast/Marine Parade

- Seafront Appeal: A strong draw for those desiring a less hectic pace alongside beach access, parks (East Coast Park), and a vibrant community atmosphere.

- Family-Oriented: Well-established neighborhood with a reputation for good schools (Tao Nan School, CHIJ Katong), making it desirable for families.

- Mix of Housing: Offers both private condominiums and landed properties, catering to different budgets and preferences.

- Improved Connectivity: The upcoming Thomson-East Coast MRT Line will significantly enhance connectivity to the CBD and other key areas, adding value for tenants and investors.

- Tenant Profile: Popular with expatriates seeking coastal living with city access, families seeking a spacious environment, and those prioritizing a strong sense of community.

- Timing Matters: Early investments in the City Fringe may offer the best potential upside as redevelopment projects mature.

- Lifestyle vs. Investment: Tenants prioritize different factors; some may favor newer developments with upscale amenities, while others are price-sensitive.

- Micro-Locations: Rental yields can vary between specific developments even within the same neighborhood based on proximity to MRT, amenities, and unit type.

Below is the list of Top 20 High Rental Yield Condo in RCR

Outside Central Region (OCR): Affordability & Growth Potential

The OCR presents investors with compelling opportunities, particularly those prioritizing long-term appreciation or seeking higher rental yields because of lower entry point as compared to those typically found in the more expensive Central Region. Here’s a deeper dive into these areas:

Hougang/Punggol/Sengkang

- Suburban Transformation: These formerly less-developed areas now boast comprehensive town planning, providing residents with modern conveniences and a balanced lifestyle.

- Focus on Family Living: Emphasis on more spacious HDB flats and condominiums with family-friendly layouts, attracting a specific tenant demographic seeking affordability and larger homes.

- Infrastructure Upgrades: Continuous improvements in transportation networks, including LRT systems, expressways, and new MRT lines under development, bolster connectivity and unlock future value.

- Evolving Amenities: Expect a steady increase in shopping malls, recreational facilities (e.g., Punggol Safra), and educational options that enhance resident lifestyles.

- Tenant Profile: Primary appeal to HDB upgraders, local families, working professionals on a budget, and a smaller segment of expatriates willing to trade location for affordability.

Jurong East

- Strategic Growth Area: Positioned as Singapore’s second CBD, with a long-term vision for commercial, residential, and recreational development in the Jurong Lake District.

- Employment Hub: Home to major companies, International Business Park, and tertiary institutions (like Ngee Ann Polytechnic) creating strong rental demand near workplaces.

- Diverse Property Options: Offers the most varied housing choices in the OCR, from affordable HDB units to condominiums and landed homes, allowing investors to target specific tenant segments.

- Excellent Connectivity: Boasts the Jurong East MRT interchange and direct access to major expressways, appealing to commuters across the island.

- Tenant Profile: Attracts a mix of professionals drawn to the area’s employment opportunities, families, and forward-thinking investors betting on the district’s long-term transformation.

What does Investment in OCR offer?

- Affordability Advantage: The OCR’s biggest draw is a lower investment barrier, potentially translating to higher rental yields.

- Appreciation Potential: While prices may rise slower than in prime central areas, strategic investments in well-connected locations aligned with development plans promise significant long-term capital gains.

- Localized Demand: Research specific micro-markets to identify high-occupancy projects near job centers, transport nodes, and emerging amenities.

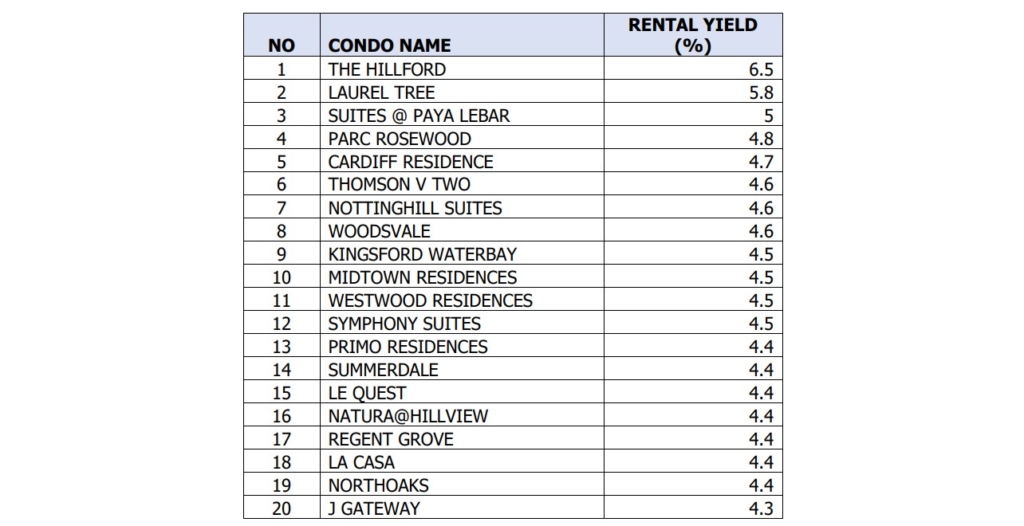

Below is the list of Top 20 High Rental Yield Condo in OCR

Important Considerations Before Investing

Successful rental property investment in Singapore requires careful planning and due diligence. Here are key areas investors should prioritize:

A. Thorough Area Research:

- Historical Rental Trends: Analyze rental performance for specific neighborhoods or property types to understand the area’s income potential.

- Future Developments: Investigate government development plans, new infrastructure projects, and changes in zoning regulations that may impact your chosen area’s desirability and long-term growth prospects.

B. Understanding Your Target Tenant:

- Neighborhood Demographics: Is the area attractive to expatriates, young professionals, or families? This will determine the type of property most in demand.

- Amenities & Lifestyle: Match potential properties to your target tenant’s needs. Are schools, proximity to transport, or a vibrant social scene more important?

Calculating Realistic Returns

- Gross Rental Yield: A simple calculation (annual rent / property price), but doesn’t factor in other costs.

- Net Rental Yield: A more accurate measure, subtracting maintenance, taxes, vacancy periods, and management fees (if applicable) from the expected rent.

- Capital Appreciation: Consider the area’s potential for long-term value growth alongside rental income.

Importance of Professional Advice:

- Real Estate Agents: Leverage their expertise in area analysis, current market conditions, and identifying properties that match your investment goals.

- Property Lawyers: Essential for understanding legal requirements, title searches, and thorough contract review.

- Financial Advisors: Can help structure a mortgage, optimize tax implications, and integrate rental property into your broader wealth management strategy.

Conclusion

Choosing the best neighborhood for rental yield in Singapore requires careful consideration. While the areas mentioned offer attractive returns, it’s vital to research thoroughly to beyond averages, delve into specific projects, unit types, and historical trends. Factoring in personal priorities to decide if you value proximity to the city, amenities, or tenant demographics more.

Lastly, it will be good to consult experienced real estate agent in Singapore who can provide valuable insights into localized market conditions. Jimmy is a very experienced real estate agent in Singapore property market for many years. His years of dedication and always putting his clients’ interest first has won him many awards over the years. If you need any advice, he is just a Whatsapp away.

Remember that investing wisely in Singapore’s dynamic property market can lead to significant rental income.