In line with the overarching themes of “Building a Stronger Singapore Together” and “Securing Our Retirement,” Budget 2024 introduces a series of measures aimed at bolstering financial security for Singaporeans. This blog post delves into the key updates impacting both homeownership and retirement planning, providing a detailed and informative summary of the changes.

Key Themes of Budget 2024:

- Strengthening Social Safety Nets: The budget prioritizes supporting vulnerable segments of society, such as low-income individuals and seniors, through enhanced financial assistance and targeted initiatives.

- Promoting Sustainability: Environmental considerations are woven into various budget measures, emphasizing responsible development and long-term resource management.

- Investing in Future Growth: Strategic investments in technology, innovation, and human capital development are prioritized to ensure Singapore’s continued competitiveness and economic resilience.

Navigating the Changes:

This post focuses on two crucial areas within the budget:

- Property Updates: We will explore changes impacting homeowners, including potential savings on property tax, new incentives for downsizing seniors, and adjustments to developer regulations.

- CPF Retirement Updates: We will examine how revisions to the Central Provident Fund (CPF) system, such as the removal of the Special Account and increased retirement sum ceiling, affect future retirees and overall retirement planning strategies.

By understanding these key updates, you can gain valuable insights into how Budget 2024 might impact your personal financial situation and make informed decisions regarding your homeownership and retirement goals.

Property Updates: Navigating Changes in Budget 2024

This section unpacks key property-related changes introduced in Budget 2024, aiming to empower you to understand their potential impact on your situation.

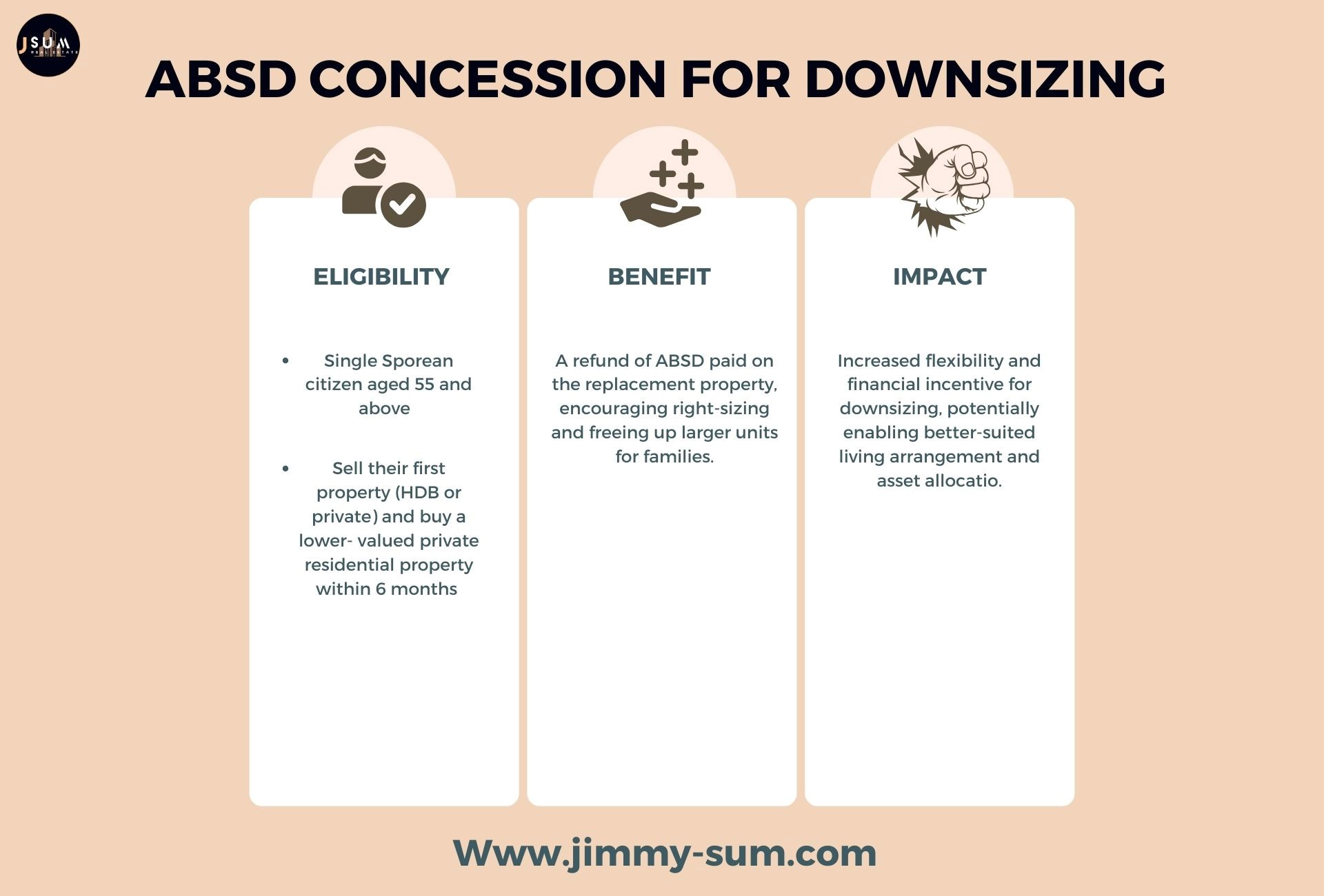

1. ABSD Concession for Downsizing:

- Eligibility: Single Singaporean citizens aged 55 and above who sell their first dwelling (HDB or private) and purchase a lower-valued private residential property within 6 months qualify.

- Benefit: A refund of the Additional Buyer’s Stamp Duty (ABSD) paid on the replacement property, encouraging right-sizing and freeing up larger units for families.

Potential Impact:

- Seniors: Increased flexibility and financial incentive for downsizing, potentially enabling better-suited living arrangements and asset allocation.

- Property Market: May influence demand dynamics, potentially increasing interest in smaller units and impacting certain segments of the market.

- Right-sizing Trends: Likely to accelerate, impacting both supply and demand in specific segments, potentially prompting adjustments in development strategies.

2. Revised ABSD Clawback for Developers:

- Current Policy: Developers pay ABSD on the land price, with a portion clawed back if they fail to sell a certain percentage of units within a five-years timeframe.

- Change: Reduced clawback rate for projects achieving at least 90% sales within five years of land acquisition.

Potential Benefits:

- Developers: Improved cash flow and reduced financial burden, incentivizing faster project completion and potentially lower launch prices.

- Market Liquidity: Encourages faster unit absorption, potentially leading to a more balanced market with less overhang.

- Project Completion Times: May lead to quicker project turnaround, potentially increasing market agility and responsiveness.

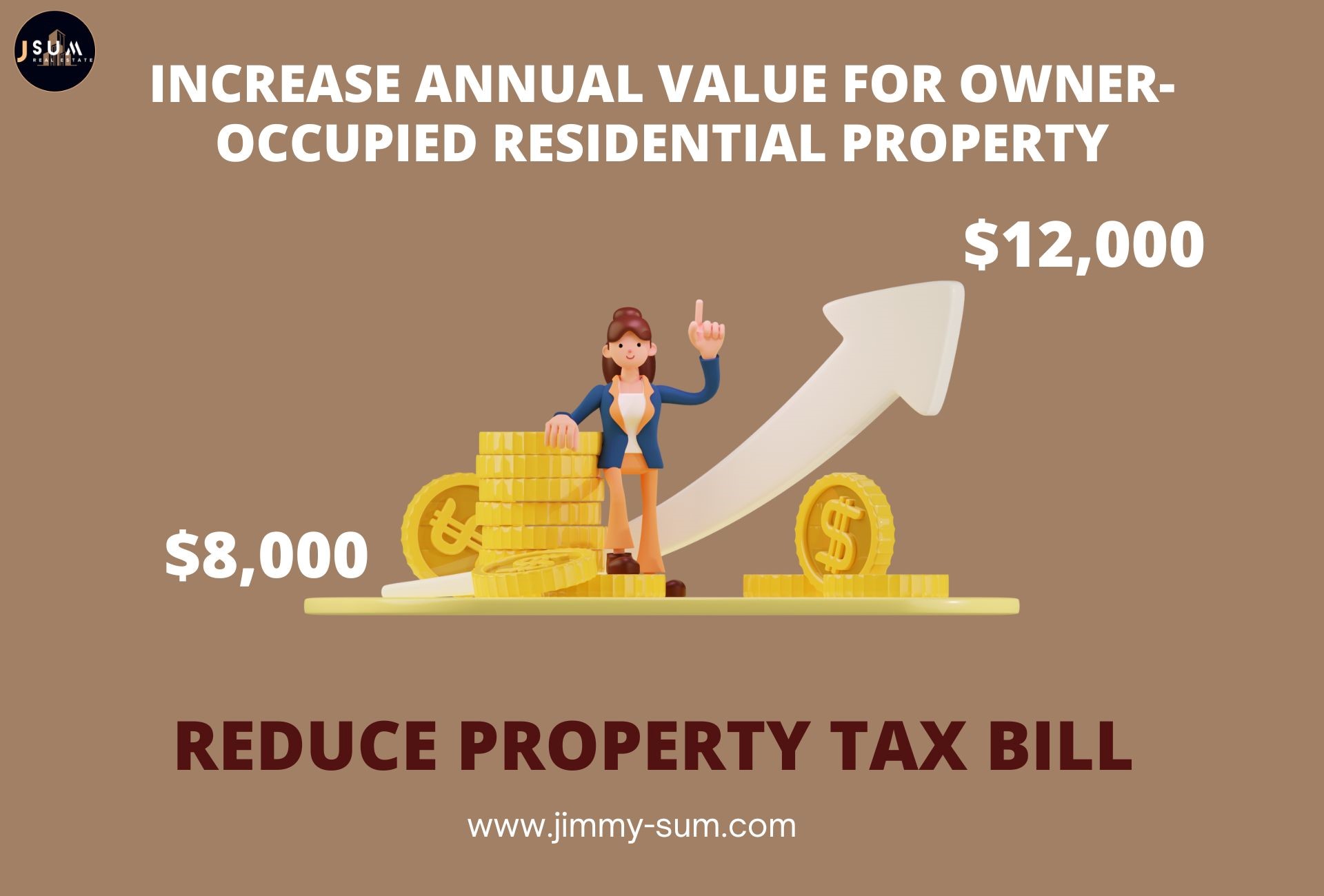

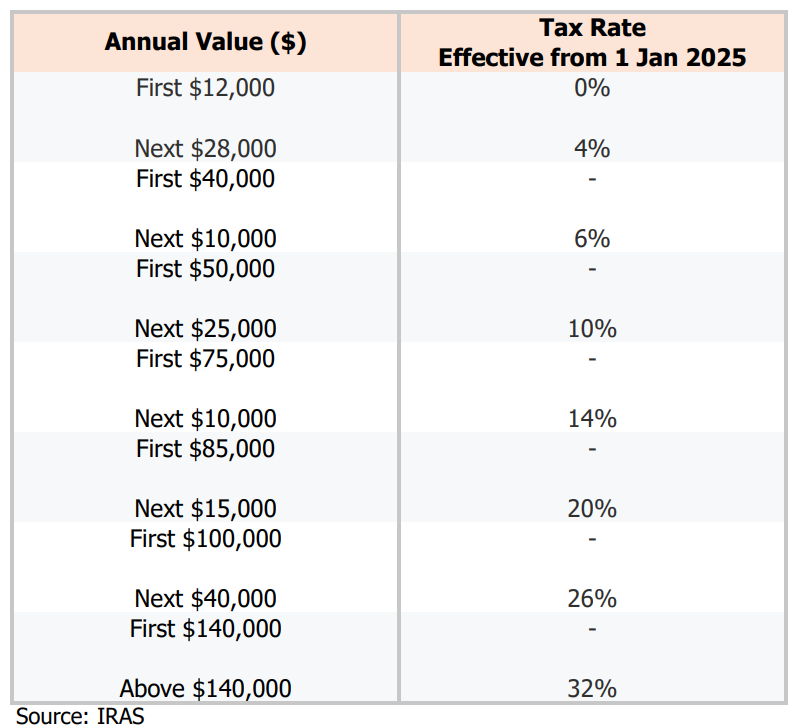

3. Lower Property Tax Bills:

- Change: Increased annual value (AV) bands from S$8,000 to S$12,000 for owner-occupied residential properties (applicable from Jan 2025).

- Impact: Potentially lower property tax bills for many homeowners, particularly those with lower-value properties.

- Estimation: For example, a three-bedroom apartment in the Outside Central Region with an AV of S$40,000 could see a property tax reduction of S$360 (24%) compared to 2024.

CPF Retirement Updates: Charting Your Course with Budget 2024

Budget 2024 introduces significant changes to the Central Provident Fund (CPF) system, potentially affecting your retirement planning and future financial security. Let’s explore these key updates to empower you to navigate your retirement journey.

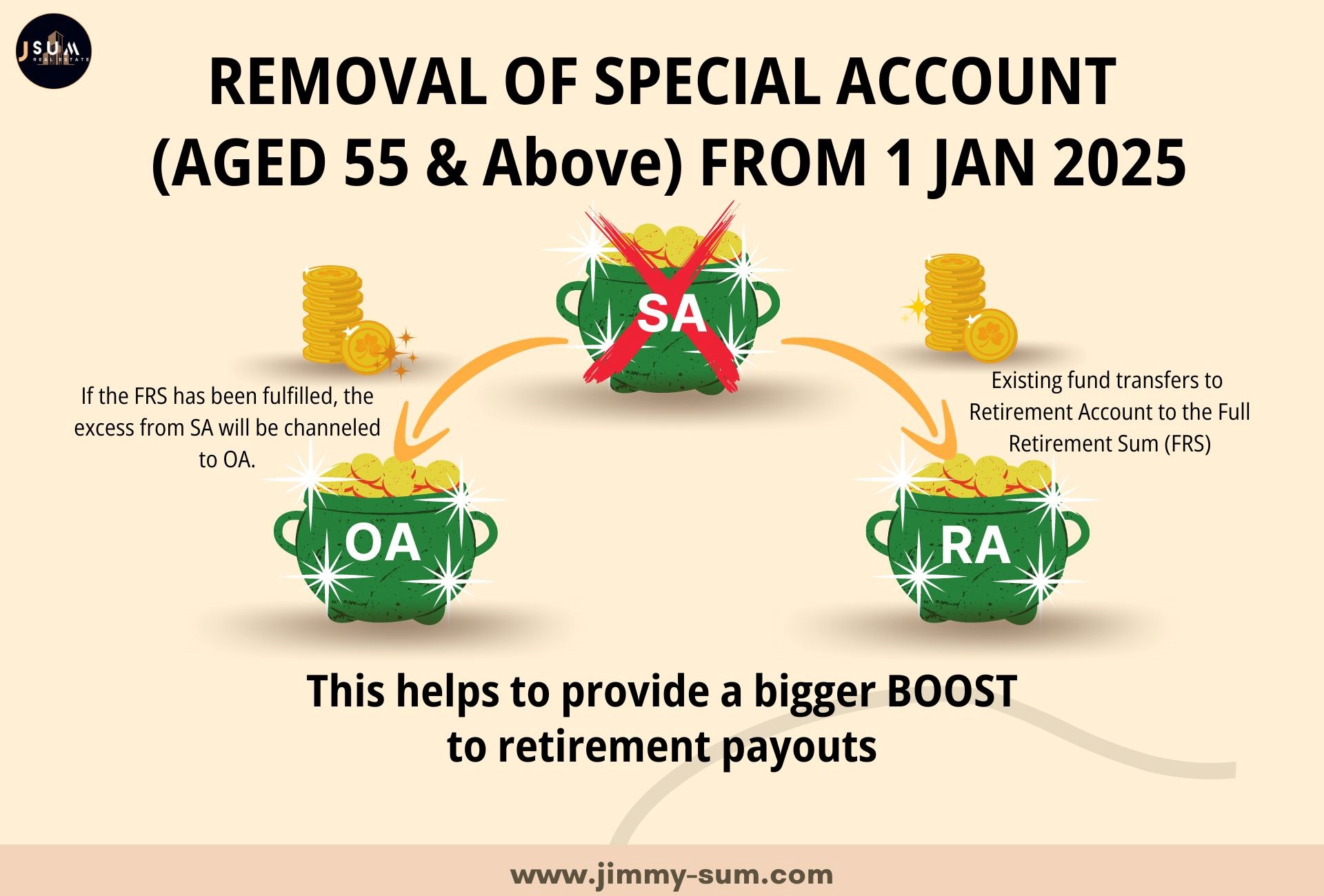

1. Removal of Special Account for Age 55 and Above:

- Current System: Individuals aged 55 and above have a separate Special Account, holding a portion of their CPF savings earmarked for specific uses like housing and healthcare.

- Change: Effective January 2025, the Special Account will be closed for those aged 55 and above, with existing funds transferred to the Retirement Account (RA).

Impact:

- Simplified Management: Merging accounts may ease CPF management and financial planning.

- Payout Strategy: Individuals need to review their overall CPF savings and adjust payout plans as funds previously in the Special Account become available for monthly payouts.

- Retirement Planning: This change necessitates revisiting and potentially revising retirement income strategies.

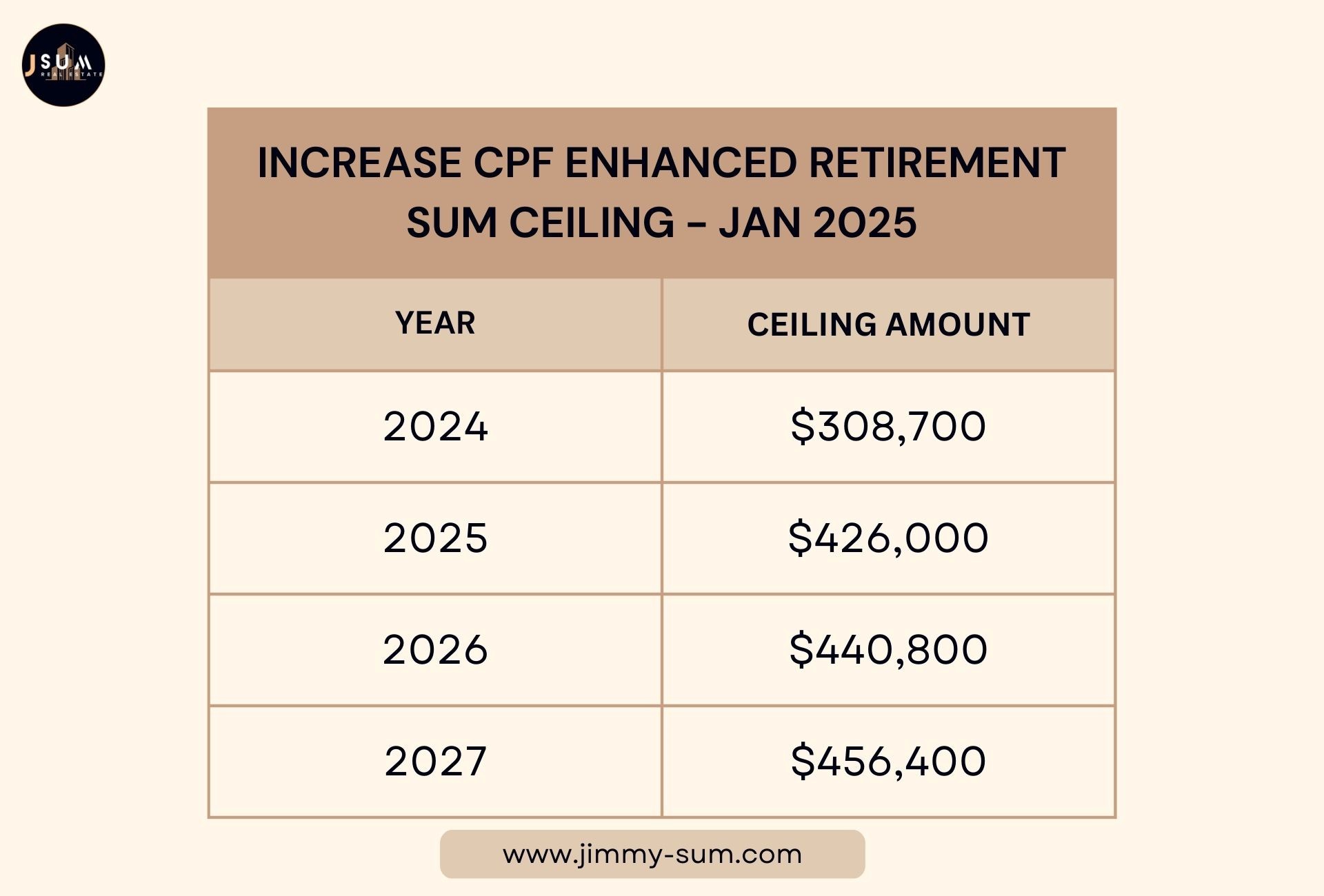

2. Increased CPF Retirement Sum Ceiling:

- Current Limit: The Enhanced Retirement Sum (ERS) ceiling, allowing higher monthly CPF LIFE payouts, is currently 3 times the Basic Retirement Sum (BRS).

- Change: From January 2025, the ERS ceiling will be raised to 4 times the BRS to $426,000.

Benefits:

- Higher Payouts: Individuals near retirement can top up their RA, potentially leading to significantly higher monthly income from CPF LIFE, the national annuity scheme.

- Enhanced Security: This measure supports a more secure retirement by encouraging savings and potentially increasing payouts.

4. Changes to the Matched Retirement Savings Scheme (MRSS)

The Matched Retirement Savings Scheme (MRSS) has undergone some significant changes recently. Here’s a breakdown of the key alterations:

1. Removal of Tax Relief for Cash Top-ups with Matching Grant:

- Previously, individuals receiving the MRSS matching grant (dollar-for-dollar up to $600 annually) also enjoyed tax relief on their cash top-ups.

- Change: Starting January 1, 2025, tax relief will no longer be available for cash top-ups that qualify for the MRSS matching grant.

- Reasoning: The government considers the matching grant itself a substantial benefit, therefore removing tax relief reduces potential double benefits.

2. Increased Annual Matching Grant Limit:

- Previously, the maximum annual matching grant was capped at $600.

- Change: Starting January 1, 2025, the annual matching grant limit has been increased to $2,000 per year.

3. Lifetime Cap on Matching Grant:

- Previously, there was no limit on the total amount of matching grant an individual could receive throughout their lifetime.

- Change: As of January 1, 2025, a lifetime cap of $20,000 has been implemented for the matching grant.

Overall Impact:

The changes aim to target the MRSS toward lower-income seniors and ensure its sustainability. While some individuals may lose the tax benefit, the higher matching grant limit compensates for it.

Conclusion: Navigating Your Future with Confidence

Budget 2024 unveils a series of changes impacting both homeownership and retirement planning in Singapore. While navigating these updates may seem complex, understanding their potential implications empowers you to make informed decisions for your future.

For Homeowners:

- Potential Property Tax Savings: Increased annual value bands offer opportunities for reduced tax burdens, particularly for lower-value properties.

- Downsizing Incentives: The ABSD concession encourages seniors to right-size, potentially freeing up larger units and influencing market dynamics.

- Market Awareness: Stay informed about evolving market trends to make informed buying, selling, or holding decisions.

For Future Retirees:

- Enhanced Savings: The increased ERS ceiling allows for higher CPF top-ups, potentially leading to significantly higher CPF LIFE payouts.

- Matching Grant Advantage: Seniors aged 55 to 70 can leverage the matching grant on RA top-ups to boost their retirement income.

- Proactive Replanning: Review your existing retirement plan, factoring in these changes and adjusting your savings and payout strategies as needed.

For Families Waiting for BTO:

- Rental Voucher Scheme: Consider this temporary financial assistance while acknowledging limitations and exploring alternative housing solutions.

Singapore’s commitment to supporting its citizens is evident in these initiatives. By understanding and adapting to these changes, you can actively shape your future while contributing to the collective progress and prosperity of Singapore.

Budget 2024 presents both challenges and opportunities. Embrace the journey, seek expert advice, and make informed decisions to navigate your path towards a secure and fulfilling future. Remember, these are general insights. Consulting property professionals like Jimmy Sum can provide personalized guidance tailored to your specific circumstances and goals.