En bloc sales in Singapore real estate market has always been a trend, with older condominiums being out for sale, hoping that developers will accept the sale price collectively agreed by the existing owners. Redeveloping old condominiums through en-bloc will somehow create some degree of transformation and potential for rejuvenation within mature estates. Despite their age, older condominiums possess a unique set of characteristics that make them surprisingly attractive for en bloc redevelopment.

Key factors include:

- Prime Locations: Situated in desirable, central locations with excellent accessibility and proximity to amenities.

- Underutilized Land & Plot Ratio: Potential to increase density and build more units, maximizing the site’s profitability.

- Large Land Parcels: Offer developers flexibility for modern designs and comprehensive amenities.

- Lower Acquisition Costs: Can be more financially viable for developers than newer developments.

- Rejuvenation Potential: Enable the revitalization of established neighborhoods with updated designs and amenities.

Prime Location and Redevelopment Potential

- Central and Desirable Locations

Older condominiums boast an invaluable asset because of their strategic positioning within mature, often centrally located neighborhoods. Decades of development have established these areas with robust transportation infrastructure, including proximity to MRT lines and bus interchanges. Additionally, residents enjoy easy access to a wide range of amenities such as esteemed educational institutions, diverse shopping and dining options, healthcare facilities, and recreational spaces.

This unparalleled convenience and connectivity remain a key driver of real estate desirability, positioning older condos favorably for redevelopment.

- Transformation Possibilities

Established neighborhoods reimagined through the rise of urban hubs such as mixed-use development or even transit-oriented development. The redevelopment of older condos provides a unique canvas for the creation of integrated mixed-use developments. These projects transcend traditional residential boundaries by incorporating retail outlets, office spaces, and sometimes even light industrial components. This approach fosters walkable urban environments, reduces reliance on long-distance commuting, and creates a thriving sense of community within the revamped neighborhood.

- Higher-Density Projects

Maximizing land use on existing older condominiums often have significant potential for higher density development due to underutilized plot ratios. Developers can strategically leverage this by constructing taller, more space-efficient buildings. This optimizes land use, accommodating Singapore’s growing population while addressing the demand for modern housing. These new projects often boast cutting-edge architectural designs and enhanced amenities such as expansive pools, fully-equipped gyms, and versatile communal spaces that cater to contemporary lifestyles.

Underutilized Development Potential (Plot Ratio)

In urban planning, the plot ratio, or Gross Plot Ratio (GPR), is a vital tool for controlling building density and land use. It represents the ratio of a building’s total Gross Floor Area (GFA) to the size of its land plot. The GFA encompasses all enclosed areas within a building, including residential units, commercial spaces, lobbies, and other common areas.

Many older condominiums were constructed during eras when zoning regulations allowed for lower plot ratios compared to current standards. This means that the existing buildings on these sites may not have fully maximized their permitted floor area.

As a result, these condos offer developers the potential to unlock additional development capacity. Through redevelopment, they can increase the number of units, potentially add lifestyle amenities, and optimize the overall value of the land.

Zoning regulations, including allowable plot ratios, are not static. They evolve over time to address changing urban needs, population growth, and housing demands. Singapore has witnessed strategic revisions to its Master Plans over the years, often increasing plot ratios in certain areas to promote redevelopment and intensification. This trend makes older condos, whose plot ratios lag behind the revised zoning, increasingly attractive targets for en bloc sales.

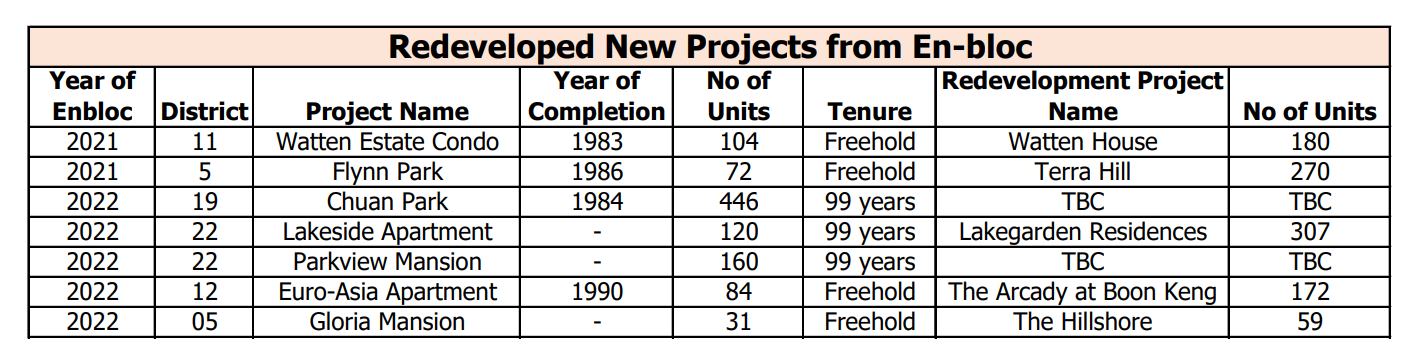

Below table shows some of the en-bloc sales that take place between 2021 and 2022 and redeveloped into new condo projects. From what you can see, the land size that those older condos sit on allows for more units to be built in the redevelopment.

The Allure of Freehold Status

In Singapore’s real estate landscape, freehold land holds a distinct advantage over leasehold properties. Freehold status signifies perpetual ownership, granting landowners greater control over the property without the concern of a lease expiring. In contrast, leasehold properties typically have a 99-year term, after which ownership reverts to the state.

Key reasons for the desirability of freehold developments include:

- Legacy Planning: Freehold properties offer buyers a sense of permanence, knowing the asset can be passed down through generations without time constraints.

- Investment Potential: Freehold properties are traditionally believed to hold their value better in the long term and often have a greater potential for appreciation compared to leasehold properties, whose value may decline more sharply as their lease nears expiry.

- Fewer Redevelopment Restrictions: Freehold projects may offer developers more flexibility for future redevelopment compared to leasehold land, where lease-related considerations and potential government lease top-up fees add complexities.

Historically, Singapore granted more freehold land titles. Due to a shift in government policy prioritizing 99-year leaseholds for new residential projects, older condominiums have a higher likelihood of being freehold. This, combined with the other redevelopment advantages outlined earlier, makes them particularly attractive to developers seeking sites with long-term potential.

While leasehold properties can still be lucrative for redevelopment, they present additional complexities for developers:

- Lease Top-Ups: As the lease on a property decreases, developers may need to pay a substantial lease top-up fee to the government to extend the tenure to a fresh 99 years. This cost can significantly impact project feasibility and profitability.

- Uncertainty: The process of lease extensions and the associated costs can involve negotiation with the authorities, introducing a degree of uncertainty for developers.

Land Scarcity in Singapore

As a small island city-state, Singapore faces the inherent constraint of a limited land supply. This scarcity poses a significant challenge for urban planners and policymakers tasked with strategically managing land allocation for housing, economic development, infrastructure, and green spaces. The need to optimize existing land resources becomes paramount in a context where unchecked outward expansion is not a viable option.

En bloc sales, particularly targeting older condominiums, present a valuable tool for land use intensification in Singapore. Developers can demolish lower-density developments and replace them with modern high-rises that accommodate a greater number of housing units and potentially add mixed-use amenities. This approach provides several benefits:

- Addressing Housing Needs: Through redevelopment, more homes can be created on the same footprint of land, helping to meet the housing demands of Singapore’s growing population.

- Urban Renewal: En bloc sales enable the revitalization of aging neighborhoods, introducing contemporary designs and improved infrastructure.

- Land Preservation: By promoting intensification within existing urban areas, the need to encroach on undeveloped greenfield sites is reduced, helping to protect valuable land resources.

Singapore’s Urban Redevelopment Authority (URA) plays a pivotal role in addressing land scarcity challenges. Key strategies employed by the URA include:

- Master Planning: The URA’s Master Plan serves as a comprehensive blueprint for land use. It carefully zones areas for residential, commercial, and industrial purposes, ensuring balanced development while optimizing land usage.

- Transit-Oriented Development: The URA encourages high-density development around MRT stations and transport hubs. This maximizes the benefits of public transportation infrastructure and reduces reliance on private vehicles.

- Reclamation and Underground Development: Singapore has cautiously used land reclamation to expand its limited landmass. Additionally, the URA explores innovative use of underground space for infrastructure and various purposes.

Evolving Buyer Preferences

The Singapore property market is experiencing a notable evolution in what buyers desire. Traditionally, location was the most important factor, but now there’s a growing emphasis on the living space itself.

Buyers increasingly prioritize factors such as:

- Spacious and Functional Units: Larger floor plans, well-designed layouts that maximize usable space, and features like balconies and private enclosed spaces are increasingly valued. This reflects changing lifestyles and a need to accommodate work-from-home arrangements or multi-generational living.

- Comprehensive Amenities: Lifestyle-focused facilities like swimming pools, fully-equipped gyms, BBQ areas, function rooms, and beautifully landscaped spaces are in high demand. These amenities promote a sense of community and convenience within the development.

- Modern Aesthetics: Buyers are drawn to contemporary architectural styles, sleek designs, and high-quality finishes. This preference extends to interiors as well.

Realignment through Redevelopment

En bloc redevelopment provides developers with a unique opportunity to address these shifting buyer preferences and revitalize aging residential stock. By acquiring the sites of older condominiums, they can replace them with brand-new projects designed with modern buyers in mind.

Specific features influencing the success of redeveloped projects include:

- Smart Home Integration: Technology like smart lighting, climate control, and security systems appeal to tech-savvy buyers and those seeking convenience.

- Flexible Spaces: Open-concept layouts and rooms designed with adaptability in mind cater to a variety of needs.

- Biophilic Design: Incorporating natural elements, greenery, and maximizing natural light creates a healthier and more visually pleasing living environment.

- Sustainability Features: Energy-efficient appliances, water-saving systems, and sustainable building practices are attractive to environmentally conscious buyers.

Conclusion

While the en bloc market may experience fluctuations, the underlying reasons for redevelopment will likely remain strong. The combination of scarce land, shifting demographics, and changing buyer tastes suggests that Singapore’s en bloc market will continue to be active in the future.

Developers could focus on smaller, more affordable projects outside prime locations to cater to evolving market demands. Additionally, government policies regarding land use, development charges, and the potential revision of the 80% consensus rule for en bloc sales might have a significant impact on the trajectory of the market.

The future could see an increase in government-led redevelopment initiatives through the Government Land Sales (GLS) program, offering a balance between private-sector dynamism and public-sector control of urban renewal.