Qn 2: Our 3rm HDB can fetch in the range of $700K to $800K. If we cash out, what can we buy as private properties are very expensive now. Perhaps please share your insights. Thanks.

Hi there,

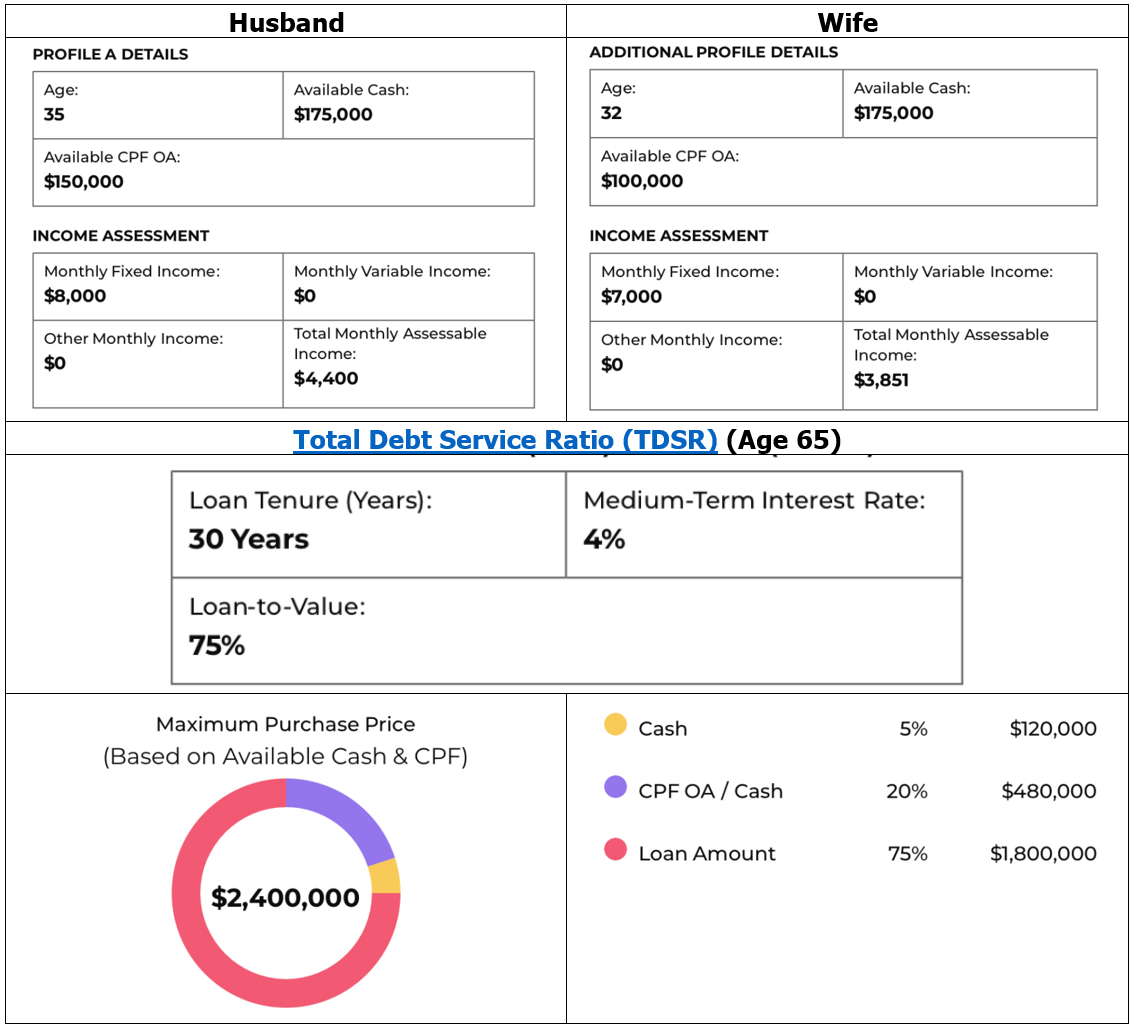

Thank you for writing in to us via WhatsApp. Before we proceed to share our opinions, we will need to make some assumptions. Below are the assumptions that we have made:

Assumptions:

• Both of you and your wife are still in your 30s and loan tenure is able to stretch in the range of 25 years to 30 years.

• Sale proceeds after paying back HDB loan and CPF returns will be around $300K – $350K.

• Combined CPF to be used in the next property purchase will be around $250K.

• Combined income is around $15K monthly.

• Upgrade to private condo or executive condo

• You are not willing to wait for a couple of years to get your next property

Let’s dive in to your options after selling your current HDB. It is not advisable to hold your current HDB and buy another property as you need to pay for Additional Buyer’s Stamp Duty (ABSD) and since your HDB is able to provide you with a potentially high capital appreciation right now.

It makes all sense to cash it out and use the profit to buy another asset which enables you to have upgrade to your current lifestyle and potentially allowing you to earn some passive income at the same time.

Doing your Financial Calculation

As the information provided at this stage is pretty limited and we need to establish some fundamentals so that we can have some basis to work on our analysis. Accurate analysis can be done when we have the necessary information from you. Meanwhile, this is good enough to go 😊

Assumed Financial Calculation done for you and your wife:

TDSR calculation based on the below assumptions (based on combined income):

• Age of husband: 35 years old.

• Age of wife: 32 years old

• (Husband) Available CPF in OA after sale of HDB: $150,000

• (Wife) Available CPF in OA after sale of HDB: $100,000

• Husband’s income: $8,000

• Wife’s income: $7,000

• Available cash after sale of HDB: $175,000 each

Maximum loan amount based on combined income of $15,000 – $1.8M

Maximum purchase price that you can go – $2.4M

Property Options

Option 1 (Buy a 2/3-bedroom private condo based on combined income)

Based on a combined income, the max bank loan that you can get is $1.8M. So, what and where can you buy with that? Are you able to get 2 or even a 3-bedroom private property?

Let’s take a look now.

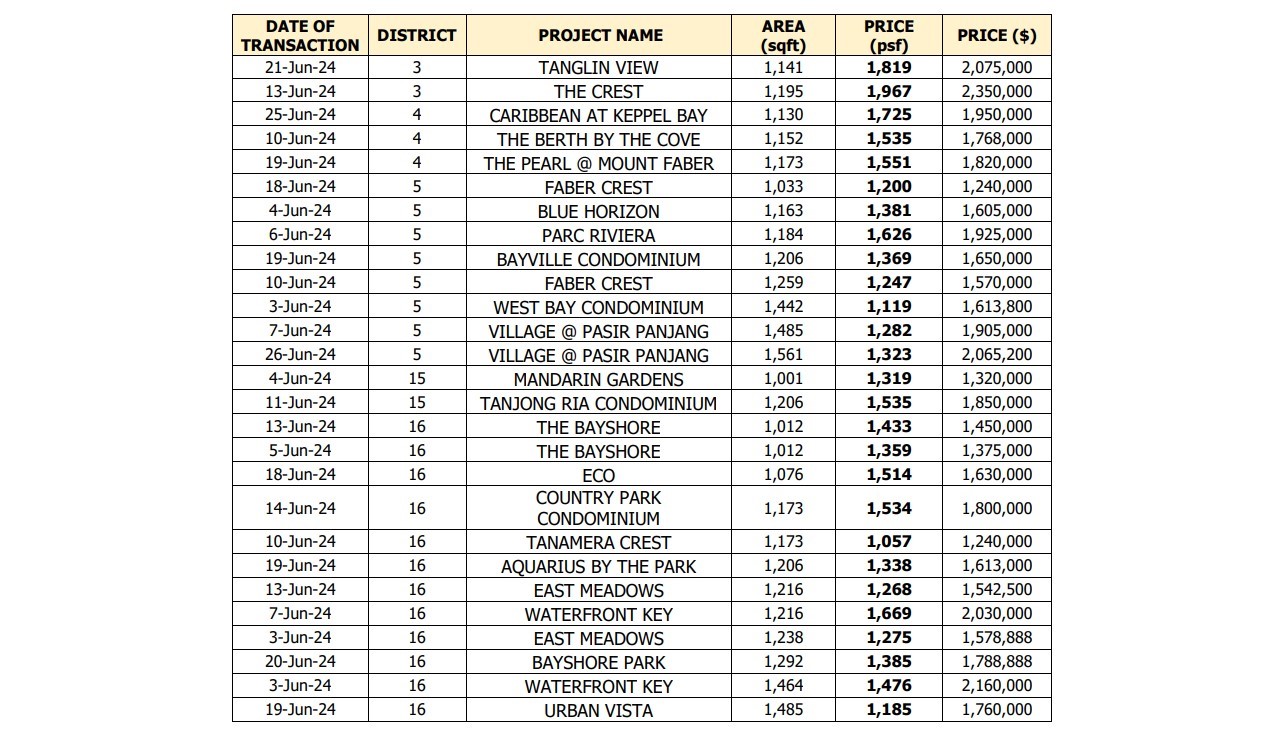

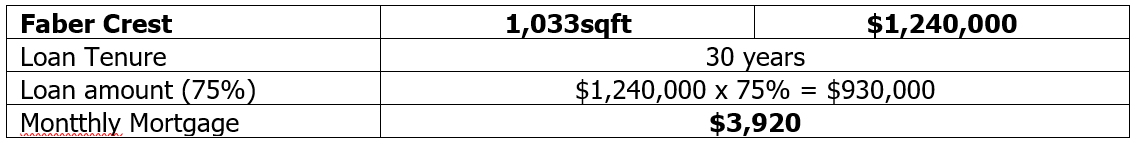

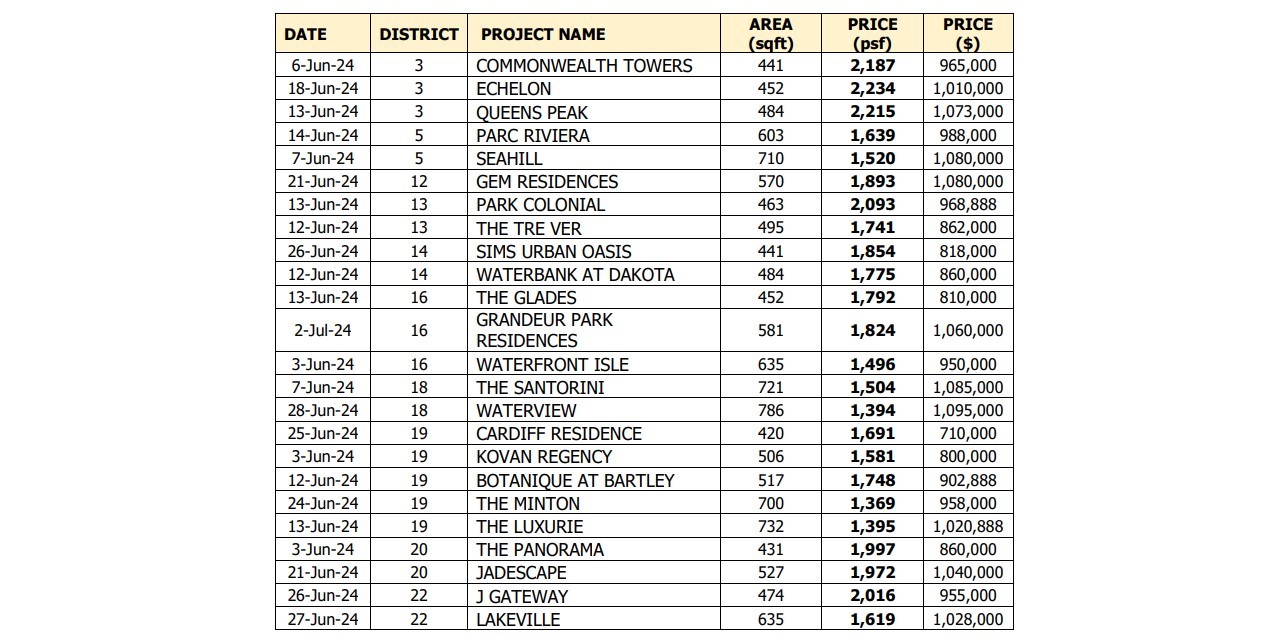

Below table shows the latest transactions in June 24 for resale condo in popular districts such as D3, D4, D5, D15 and D16 in Singapore. With your max purchase price of $2.4M, you are able to get a decent size of 3 bedroom above 1000sqft with a transacted price much lower than $2.4M.

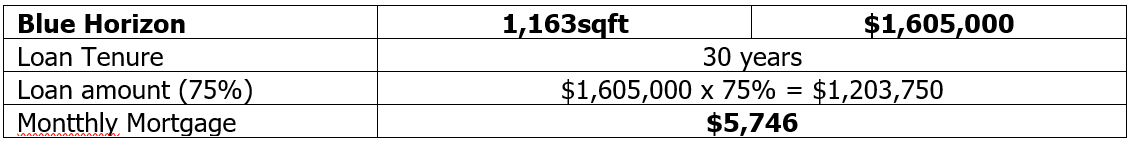

Monthly mortgage loan

Let’s take one property above for calculation purpose.

Option 2

Buy a 2-bedroom resale private condo for own stay and another 1 bedroom for investment purpose.

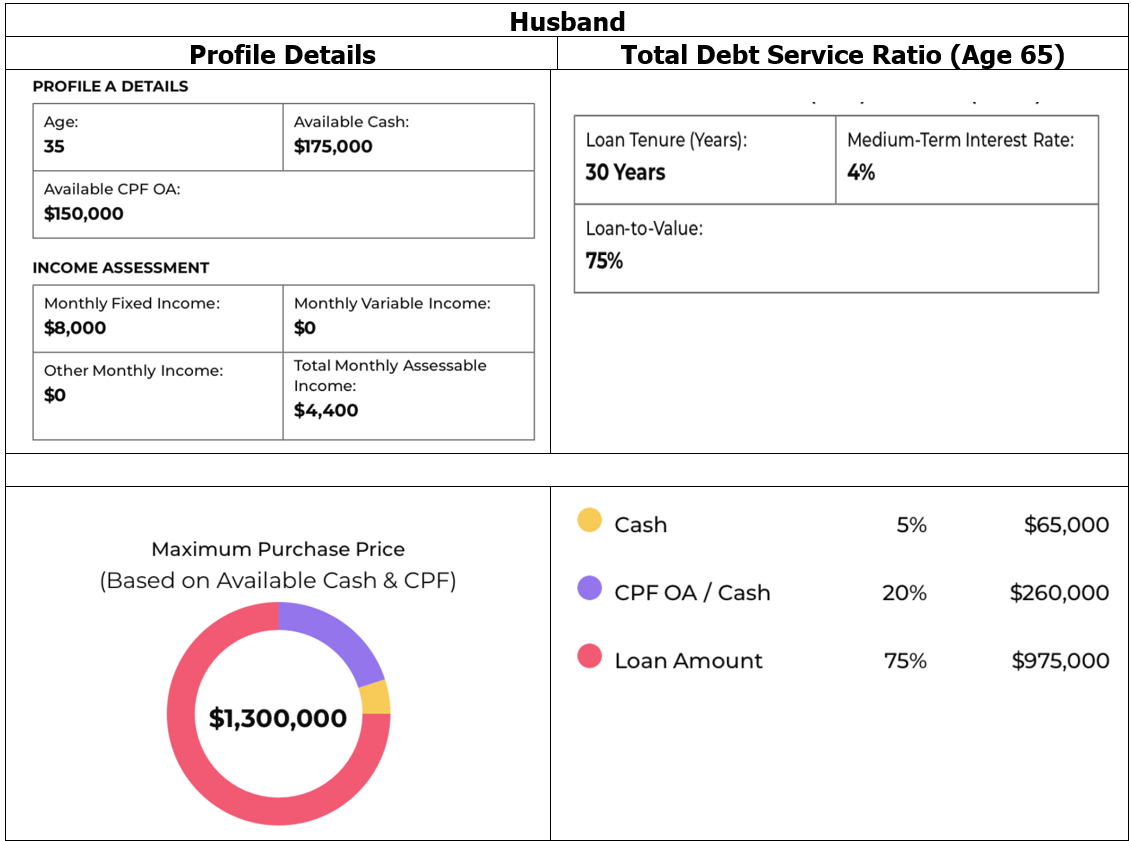

Based on husband income

TDSR calculation based on the below assumptions:

• Age of husband: 35 years old.

• Available CPF in OA after sale of HDB: $150,000

• Income: $8,000

• Available cash after sale of HDB: $175,000 each

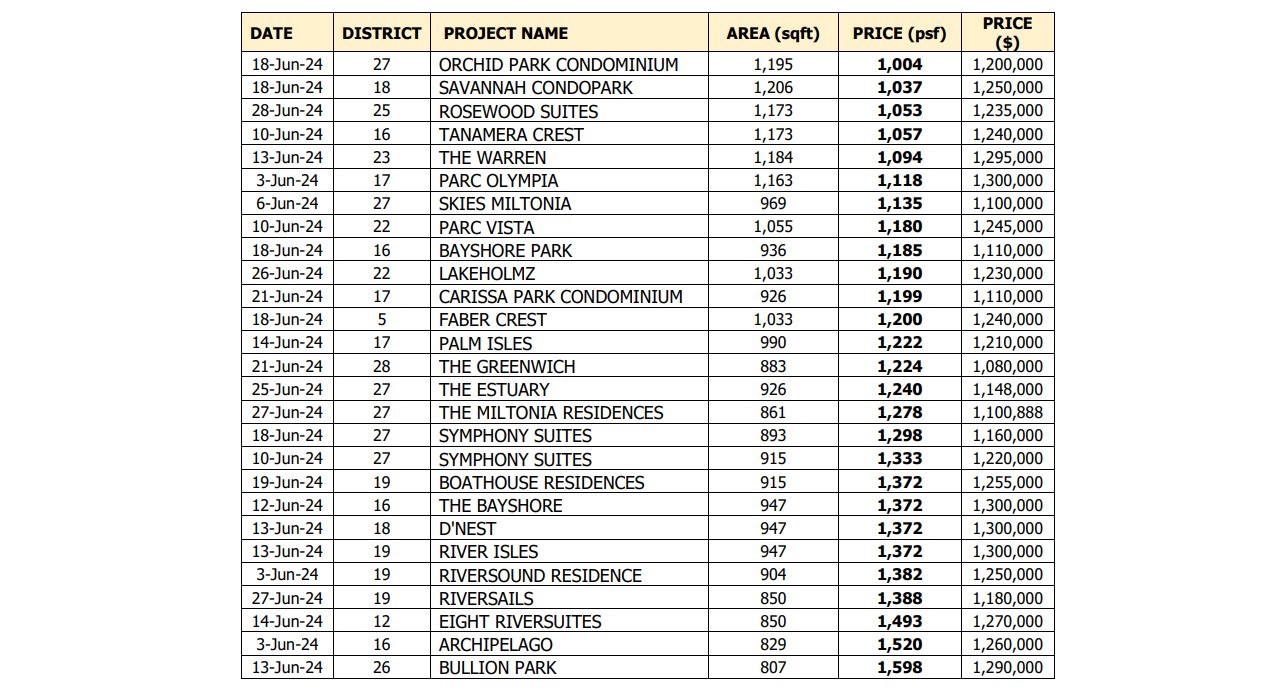

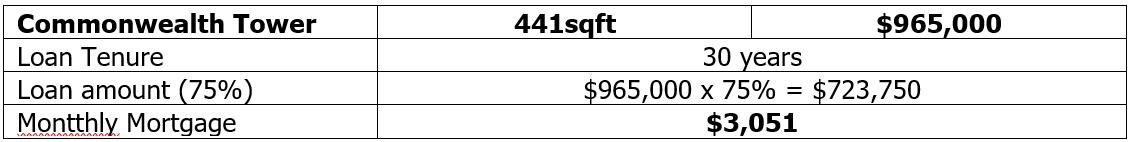

Below table shows the recent transactions for resale condo which is $1.3M and below. If location is not a major factor to consider, there are still numerous choices for you to ponder.

In fact, based on a budget of $1.3M, you can even have the option of going for a 3 bedroom. The only thing is that the location will be located outside of central region (OCR).

Monthly mortgage loan

Let’s take one property above for calculation purpose.

Based on wife income

TDSR calculation based on the below assumptions:

• Age of wife: 32 years old.

• Available CPF in OA after sale of HDB: $100,000

• Income: $7,000

• Available cash after sale of HDB: $175,000 each

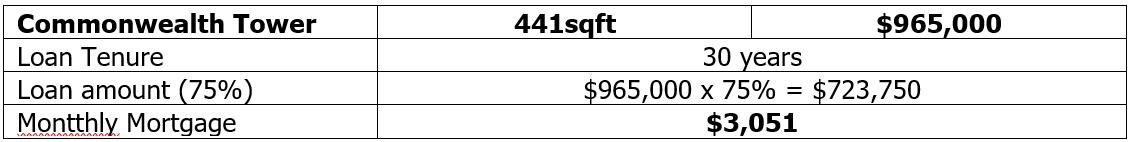

With a budget of $1.1M, you are able to buy a 1 bedroom in good developments such as Commonwealth Tower, Echelon or Gem Residence, and they are located at a very decent location in Singapore with good demand for rental from professionals.

Monthly mortgage loan

Let’s take one property above for calculation purpose.

Based on current rental market sentiment, it is possible to have the monthly rental to cover the mortgage. In other words, you are holding this property for free. At the end of day, when you decide to sell this property, you are the one who reap the potential capital appreciation of this property.

At this current market where the prices for new condo launches are on the high side where 1bedroom is priced between $1.25M to $1.6M on average. It is difficult to diversify your asset if you prefer to buy new condo launches. Furthermore, you need to wait for a couple of years before you can get the keys to your new home.

Right now, there is a pretty big gap between resale condo psf vs new launch psf. Resale psf is still within affordable range based on the recent transactions provided above.

So, it is still possible to sell one and buy 2 properties in current market.

Of course, the analysis provided in this context is based on a lot of assumptions and we believe that it will differ to certain extent based on your circumstance.

It is only after we have a full understanding on your current situation that we are able to provide you with an accurate analysis. But the analysis provided is good enough for you to have reference as to where you can go after you cash out on your current HDB.

Disclaimer: This information is provided solely on a goodwill basis and does not relieve parties of their full responsibility to verify the information or seek advice from relevant professionals such as valuers, financial advisers and lawyers.

We are not responsible for any actions taken based on the information in this blog post. This post is for informational purposes only and should not be construed as financial or legal advice.