Qn 1: I’m a single local Singaporean with a loan of $1M. I’m torn between buying a resale HDB flat in a mature estate with potential for upgrading later, or a resale private condo in a developing area with potential for higher capital appreciation. Which will be a better investment for me?

Hi there,

Thank you for writing in via Whatsapp and allowing me to shed some insights into your dilemma that you are facing now.

Before we proceed, we are making some assumptions here:

- You are able to take a bank loan of $1M based on your income.

- You have some CPF saving in your Ordinary Account which can be used for your property purchase.

- You are at least 35 years old in order to buy a resale HDB if you decide to go for this option.

- You are open to 3 or 4 room HDB in those matured estate

- For private condo, you are open to 1 or 2 bedrooms.

Both options have their merits, but the best choice for you will depend on your individual priorities, lifestyle preferences, and long-term financial goals. Let’s break down the key considerations:

Resale HDB Flat in a Mature Estate: The Comfort of Convenience

Pros:

- Established Amenities: Mature estates offer a wide range of amenities at your doorstep, including supermarkets, hawker centers, schools, and public transport. This translates to a more convenient lifestyle, especially if you value easy access to daily necessities.

- Potential for En Bloc Sales: Older HDB flats have the potential for en bloc sales, where the entire estate is sold for redevelopment.

- Lower Initial Investment: Resale HDB flats are generally more affordable than private property due to their purchase price. However, given that you are able to get a $1M loan based in your income, you are not eligible for the CPF grant for Single. Only CPF proximity grant if you stay near your parents.

Cons:

- Lease Decay: HDB flats have a 99-year lease, and older flats will have a shorter remaining lease. This can affect the flat’s resale value in the long run.

- Maintenance and Renovation Costs: Older flats may require more extensive renovations and maintenance, adding to your overall expenses.

- Limited Appreciation Potential: While mature estates offer stability, the potential for significant capital appreciation might be lower compared to developing areas.

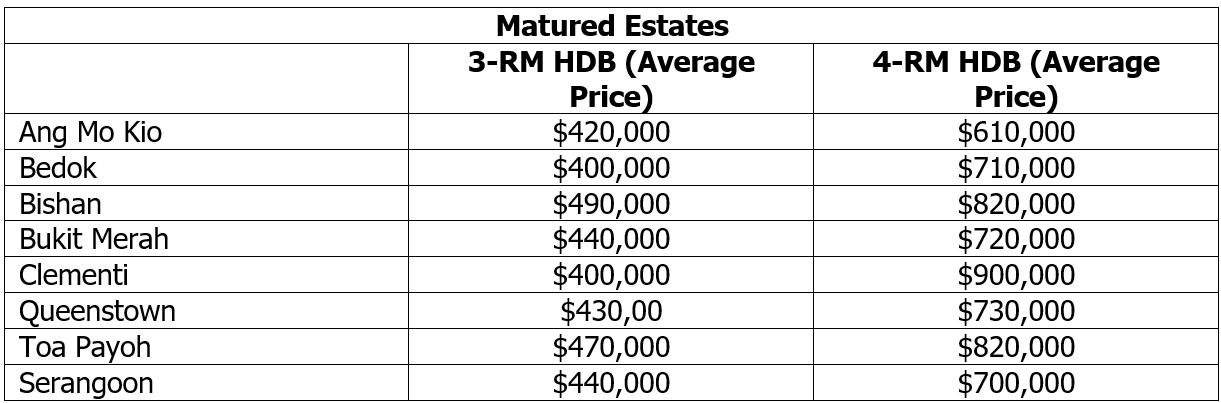

Let’s take a look at the average prices for the 3-rm and 4-rm HDB resale HDB in those matured market:

On average, HDB resale prices have gone up quite significantly over the last couple of years after Covid. 5-rm HDB can transact above $1M. Just MOPed 4-rm HDB can go as high as in the range of $800K in some of the estates like Punggol or Queenstown.

On average, HDB resale prices have gone up quite significantly over the last couple of years after Covid. 5-rm HDB can transact above $1M. Just MOPed 4-rm HDB can go as high as in the range of $800K in some of the estates like Punggol or Queenstown.

Although older HDB command a lower price but you will need to spend a considerable amount to renovate the place. If the remaining lease of the HDB that you have decided to buy does not cover up to 95 years of your age, you are not allowed to use 100% of your CPF but on a pro-rated amount.

At the end of day, it really boils down to what you want. Since buying this HDB isn’t your last stop and you have the intention to sell and buy another property which is able to yield a higher capital appreciation, my suggestion is not to get too old HDB. Even though the price of older HDB with less than 60 years lease may seem attractive, its capital appreciation is pretty capped already. The only upside of it is its potential for en bloc.

Instead, you can consider to buy those HDB which are around 20 years old. Prices are more reasonable than those just MOP-ed HDB and more room for capital appreciation in years to come.

Between 3-rm and 4-rm HDB, what is your options?

Do you plan to stay single throughout? If so, 3-rm HDB seems to be better choice for you as less upkeep of the place is needed. Less burden on the monthly mortgage and focus more on your lifestyle. However, if you intend to get married or foresee bringing your aging parents to stay in the future, 4-rm is a more ideal choice for you. You have the space for family planning when you get married or having your aging parents to stay with you in time to come.

Right now, you may be thinking whether you should consider to buy BTO since the capital appreciation seems to be high. Unfortunately, you are not eligible to do so. Being single, you are only allowed to buy 2-rm flexi in non-matured estate. However, HDB mentions that from 2H2024, singles may allow to buy 2-rm flexi in matured estate too.

How about buying private condo in developing area? Let’s take a look.

You have not mentioned which developing areas are you looking at. So below are some of areas which bear locational transformation.

- Locational transformation – Jurong Lake District

- District 2. Locational transformation – Greater Southern Waterfront

- Tengah

Let’s take a look at the impact of Jurong Lake District.

The transformation of Jurong Lake District is huge. It has been termed as the second business district outside CBD. Properties around this transformation will see really good capital appreciation once this place is transformed due to increase in demand.

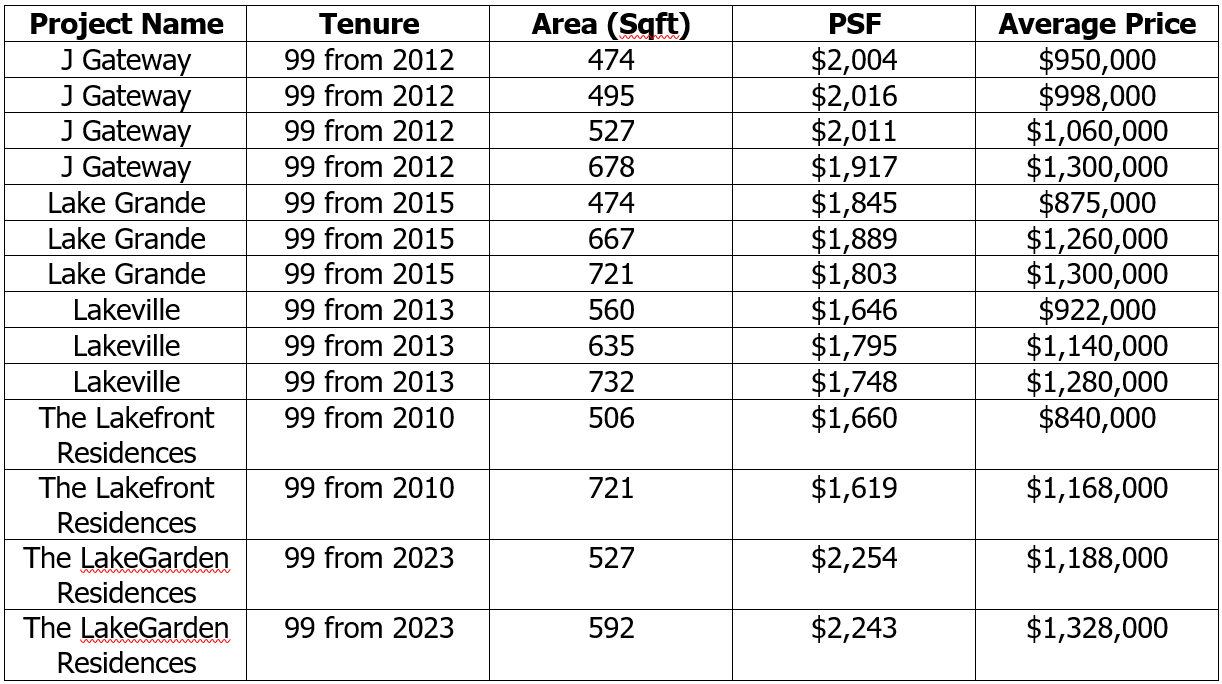

Let’s take look what you can buy with a budget of $1M.

Assuming with a loan of $1M, you can go for properties with price tag of around $1.3M max.

Assumption made:

- You have at least $400,000 in your CPF OA plus cash to pay for the 20% of the purchase price and other miscellaneous cost such as buyer’s stamp duty if you plan to purchase up to $1.3M.

Below table shows the recent transacted average prices for properties which are located very close to the development of Jurong Lake District. As you can see, with your budget of $1M, you can only buy 1 bedroom with a price range as indicated below.

Of course, as the transformation is still in the midst of taking place, it will take time for the properties to fully absorb the impact and reflected in its pricing.

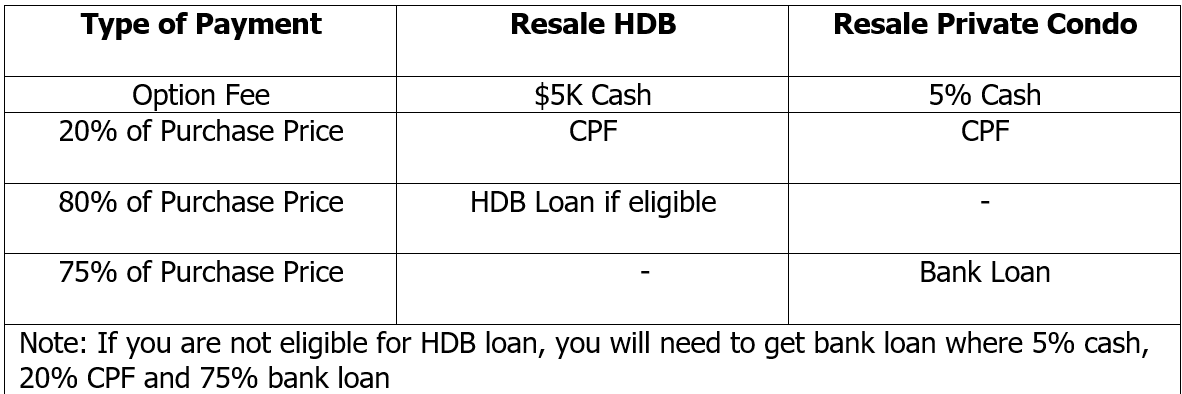

The difference between buying a resale HDB and a private condo is the initial cash outlay as well as the monthly mortgage.

Resale Private Property in Developing Area: The Lure of Appreciation

Pros:

- Higher Capital Appreciation Potential: Resale condos in developing areas often experience significant price increases as the area matures and new amenities are built. This can translate to higher returns on your investment in the long run.

- Modern Amenities and Facilities: Resale condos typically offer a wide range of amenities like swimming pools, gyms, and BBQ pits, adding to your lifestyle and potentially attracting tenants if you decide to rent out the property.

Cons:

- Lack of Amenities Initially: Developing areas might lack amenities like supermarkets or schools in the early stages, which could be inconvenient in the short term.

- Uncertainty of Development Timeline: The pace of development in the area can be unpredictable. It might take years for the full potential of the area to be realized.

- Higher Initial Investment: Resale condos are generally more expensive than resale HDB flats, requiring a larger upfront investment.

My Professional Advice

I would recommend the following:

- Analyze Your Priorities: Determine your priorities in terms of lifestyle, budget, and investment goals.

- Conduct Thorough Research: Research the specific areas and developments you’re interested in. Look into the master plans, upcoming infrastructure projects, and amenities in the vicinity.

- Work with a Trusted Agent: A knowledgeable real estate agent like Jimmy Sum can help you navigate the market, understand the intricacies of different property types, and find the best deals based on your specific requirements.

Ultimately, the best choice for you will depend on your unique circumstances and preferences. With careful consideration and professional guidance, you can make an informed decision that sets you on the path to achieving your real estate dreams.

Feel free to reach out to me at 65 90918188 if you have any further questions or would like to discuss your options in more detail. I’m here to help you make the right choice for your future.

Lastly, thank you for writing in to me to share your dilemma and I hope that my professional opinions help you to certain extent.

Disclaimer: This information is provided solely on a goodwill basis and does not relieve parties of their full responsibility to verify the information or seek advice from relevant professionals such as valuers, financial advisers and lawyers.

We are not responsible for any actions taken based on the information in this blog post. This post is for informational purposes only and should not be construed as financial or legal advice.