The Prime Location Public Housing (PLH) model was declared by the Ministry of National Development (MND) on October 27, 2021. Starting with the November 2021 Built-to-Order (BTO) launch, this new model will apply a set of requirements to new Housing & Development Board (HDB) BTO units to be built in privileged areas. Developed in central areas such as the city center and the Greater Southern Waterfront, the flats will fall within the concept of “Prime Location” under the PLH model.

Before diving into the specifics of the Prime Location Public Housing (PLH) plan, it’s imperative to understand the problems it aims to solve. As many Singaporeans are aware, existing HDB laws allow for a “lottery effect,” in which buyers who are fortunate enough to get a BTO unit in a desirable location (e.g. Greater Southern Waterfront) stand to profit handsomely when they sell their flat after MOP. As a result of this circumstance, potential house buyers are more likely to apply for HDB flats in desirable locations, based on the rationale that these flats are excellent investments if you are well-off enough to obtain them.

The reality, on the other hand, is difficult to ignore. Developing flats at Tanjong Pagar, Rochor, City Hall, and the Greater Southern Waterfront will undoubtedly be more expensive than building flats in Tengah. Even if the cost of building flats in various places is similar, we can’t overlook the reality that these flats will be built on premium land with a significantly higher value.

The Prime Location Public Housing (PLH) concept has been established to address these concerns for new flats being built in prime locations. Here are eight main things you should know if you plan to apply for an apartment in a future BTO launch that follows the PLH concept.

Things to Know About the Regulations for the PLH Flats:

Application of Subsidy Recovery:

New flats in prime locations, according to MND and as mentioned above in this article, naturally have high prices and, as a result, would receive further subsidies on top of the already significant subsidies offered for BTO flats today. This is necessary to keep such low pricing accessible to a broad variety of Singaporeans.

A subsidy recovery will be applied to Prime Location Public Housing (PLH) apartments upon the first sale of the property to level the playing field with other BTO flats in non-prime locations. This means that the buyer who purchased it from HDB will have to pay HDB a percentage of the sale price.

This percentage has not yet been revealed and will be revealed in the Rochor estate’s next BTO launch. But consider the following scenario. Assuming a 6% subsidy recovery for the PLH (this is just an example; we don’t know the actual proportion), a $1 million sale of an HDB unit in the future will require $60,000 in subsidy recovery payments to HDB.

It’s also important to keep in mind that this isn’t a capital gains tax. The Subsidy Recovery is intended to recoup the additional subsidies that these flats received when they were first introduced, and it will be paid on the flat’s sale price, not on the capital gain. It’s also only charged on the first sale of the unit, not on subsequent transactions.

The Subsidy Recovery is not a Fixed Percentage:

Subsidy Recovery is not a set percentage and will vary between Prime Location Public Housing (PLH) developments. This subsidy percentage would be disclosed before the start of the PLH projects and would remain constant throughout the project.

As a result, potential homeowners for these PLH flats should evaluate the development’s Subsidy Recovery before deciding whether or not to apply for any PLH projects.

Extended Minimum Occupation Period (MOP):

Unlike standard HDB flats, which have a five-year MOP, Prime Location Public Housing (PLH) flats will have a ten-year MOP. This emphasizes the fact that HDB flats are intended for Singaporeans who have legitimate housing requirements and who intend to live in the flat as their primary residence. Before the owner can sell it on the secondary market, the 10-year MOP must be met. It’s also worth noting that the 10-year MOP applies to resale buyers of PLH flats as well.

Restriction on Renting out of The Whole Flat:

Even after the MOP, renting out the entire flat for Prime Location Public Housing (PLH) flats will be prohibited. This is in contrast to conventional HDB apartments, where after the 5-year MOP, you can rent out your full HDB unit for rental revenue.

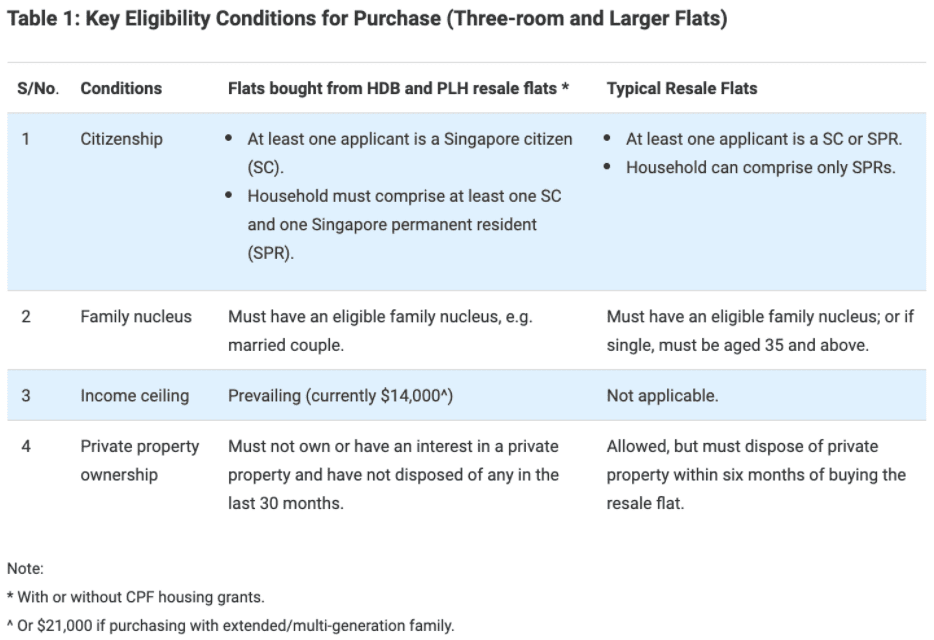

In other words, anyone purchasing a PLH flat to rent it out after the 10-year MOP (with intentions of earning high rentals in these regions) and living in a private property will be unable to do so. The below table will further clear the picture of conditions of ownership.

Figure 1: MND

Tight Regulations Future Resale Buyers:

As a departure from the norm, future resale buyers of these Prime Location Public Housing (PLH) flats will face stricter eligibility criteria. According to MND, this is to ensure that PLH flats remain inclusive and accessible to a diverse group of subsequent flat buyers, not just the initial buyers, over time.

Figure 2: Source: Ministry of National Development

These eligibility requirements are identical to the current BTO flat eligibility requirements. PRs and singles, for example, will not be allowed to own these flats in the future. Furthermore, whereas resale flats have no income ceiling, these PLH flats will have a $14,000 income ceiling, at least until HDB raises the income ceiling in the future.

In other words, future buyers of these PLH flats would be eligible to purchase a BTO property if they so desired, presuming they have not already used up their two chances.

This, combined with the fact that the first buyer would be responsible for Subsidy Recovery and the fact that the apartment cannot be fully rented out even after MOP, effectively limits the potential upside of these PLH flats. The fact that not all Singaporeans will be qualified to acquire the PLH flat in the resale market implies the pool of possible buyers will diminish.

Inclusion of Rental Flats in this Scheme:

MND also declared that, where possible, public rental flats will be developed on these PLH sites for lower-income people. This is to ensure that public housing in Singapore remains inclusive and diverse and that HDB towns continue to attract inhabitants from all walks of life.

The Model Will only Apply For New HDB Flats:

Existing owners of HDB flats in prime locations (e.g. Pinnacle@Duxton) will not be affected by the new PLH model, which will not be applied retroactively. Previous BTO launches in high-traffic areas that have yet to be finished will be unaffected.

Rochor, in the Central Area, will be the site of the first project under the PLH paradigm. At the approaching Nov 2021 BTO sales exercise, 960 units of 3-room and 4-room apartments will be offered for sale along Kelantan Road and Weld Road. A total of 40 two-room rental flats will be included in the trial project.

All Other HDB Regulation also Apply to Prime Location Public Housing (PLH) Flats:

While we consider the numerous restrictions in force for Prime Location Public Housing (PLH) flats, keep in mind that all other HDB policies apply to these PLH flats as well.

The HDB Resale Levy, for example, applies to these flats. This means that first-time PLH flat owners will have to pay the Subsidy Recovery and the HDB Resale Levy if they sell their flat on the open market after the 10-year MOP and acquire another BTO property from HDB as a second-timer.

Similarly, if purchasers qualify, grants such as the Enhanced Housing Grant will be allocated to these flats.

Implications/Impacts of the Model of the Real Estate Market:

The extended MOP period of 10 years in the PLH model flat could help temper demand and decrease the resale price in the future, making profiting from such excellent location houses more difficult.

Families are obviously emphasized for the new PLH model home, as seen by the restriction for the single individual to purchase the PLH model flat.

Due to the extended MOP period, the subsidy callback, and the restriction on renting out the entire unit after MOP, resale flats, new or resale private homes nearby PLH model flats may see a slight increase in demand as younger buyers with aspirations of upgrading to private homes may be deterred and turn to these alternatives.

The rental returns of surrounding properties may improve as a result of the whole unit rental restriction for PLH flats, as the number of full apartments for rent does not grow.