In recent years, a growing number of Singaporeans have expressed interest in diversifying their investment portfolios through overseas property ownership. This trend can be attributed to several factors, including a limited domestic real estate market, the pursuit of potentially higher returns, and a desire for wider lifestyle options.

Let’s explore some of the primary potential benefits that drive Singaporeans to invest in properties abroad:

- Diversification: Overseas property investment offers an opportunity to expand beyond the Singapore market, potentially reducing overall portfolio risk and exposure to local market fluctuations. By investing in different real estate markets, investors can spread their risk and potentially benefit from varying economic cycles.

- Rental Income: Depending on location, overseas properties can generate a steady stream of rental income, either in the local currency or Singapore dollars. This rental income can provide a supplementary source of passive income or offset the holding costs of the property.

- Currency Appreciation: If the value of the foreign currency appreciates against the Singapore dollar, investors may realize additional gains upon converting their profits. This potential for currency appreciation adds another dimension of potential return to the investment.

It’s important to note that careful research and consideration are essential before venturing into overseas property investment. Investors should thoroughly assess the economic and political stability of the target country, understand the local property market dynamics, and be fully aware of the legal and tax implications involved in foreign property ownership.

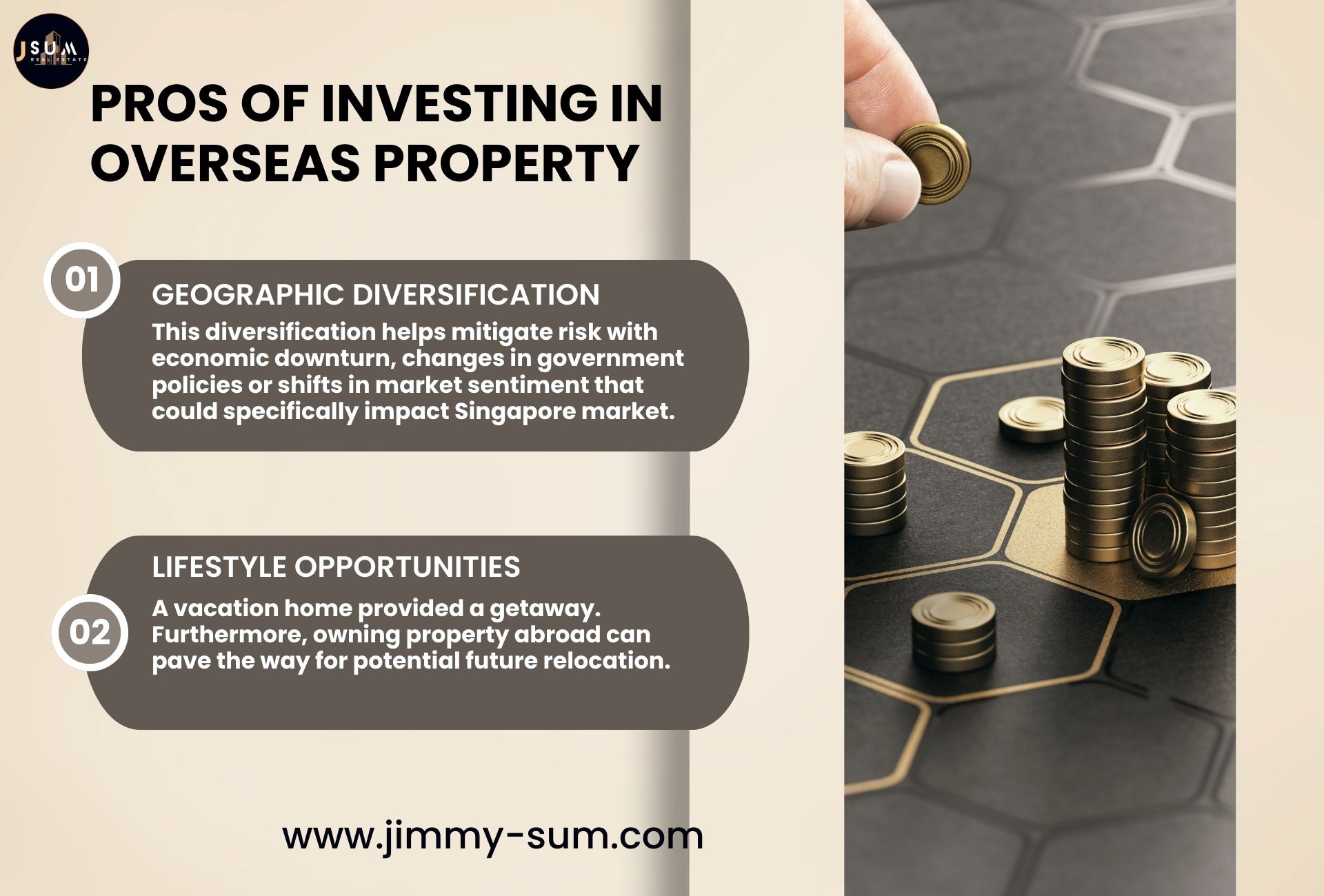

Pros of Investing in Overseas Property

-

Geographic diversification

It is a fundamental principle of sound investment strategy. By investing in overseas property, you reduce your reliance on the Singapore real estate market and its inherent fluctuations. This diversification helps mitigate risks associated with economic downturns, changes in government policies, or shifts in market sentiment that could specifically impact the Singapore market.

Additionally, by investing in multiple markets, you expose yourself to potentially different economic cycles, which could provide greater stability in your overall portfolio. Some markets may offer better yields or capital appreciation

Identifying overseas markets with favorable economic conditions is key to maximizing returns. Consider factors such as:

- Economic growth: Robust GDP growth rates often indicate a healthy and expanding economy, which can drive demand for property.

- Infrastructure development: Investments in infrastructure like transportation, utilities, and public services can improve the attractiveness of specific locations and boost property values.

- Demographics: Areas with a growing population, especially a young and working-age population, tend to experience steady demand for housing.

- Currency appreciation: Benefit from favorable exchange rates

Investing in a country with a strengthening currency can enhance your returns significantly. Consider countries with stable economic policies, trade surpluses, and low debt levels, as these factors can contribute to a strong currency. When converting your rental income or capital gains back to Singapore dollars, a favorable exchange rate acts as a multiplier for your profits.

-

Lifestyle opportunities

Overseas property ownership can offer unique lifestyle benefits. A vacation home provides a getaway in a location of your choosing, offering you the chance to experience different cultures and environments. Furthermore, owning property abroad can pave the way for potential future relocation. Should you choose to pursue work opportunities, retirement, or simply a change of scenery, your overseas property provides a foundation for a smooth transition.

Cons of Investing in Overseas Property

Higher risks

Unfamiliarity with foreign markets, regulations, and taxes. Investing in a foreign country carries inherent risks stemming from a lack of familiarity with various aspects of the market. It’s critical to consider:

- Economic and political instability: Sudden shifts in political leadership, policy changes, or economic downturns within the foreign country could directly impact the value of your property, your ability to rent it, and your capacity to repatriate profits. It’s vital to invest in markets with a track record of stability and favorable economic policies.

- Market dynamics: Limited understanding of factors like supply and demand within the local market, neighborhood-specific trends, and valuation methods could lead to overpaying for a property or misjudging its potential for growth. Thorough research, including consulting local real estate experts, should be done beforehand.

- Tax implications: Navigating foreign tax systems can be a major challenge. Income derived from rental activities, capital gains upon selling, property taxes levied locally, and potential withholding taxes all introduce complexity. Inadequate tax planning could erode your returns substantially.

- Management challenges: Finding reliable property managers and dealing with maintenance from afar.

Managing a property remotely involves a number of obstacles

- Finding trustworthy management: Locating a competent property management company or rental agency in a foreign country with limited personal connections can be time-consuming. Due diligence, including obtaining references and seeking recommendations is crucial.

- Maintenance and repairs: Promptly addressing issues like repairs or breakdowns can be complicated from Singapore. Inefficient handling can leave a property vacant, deteriorate its condition, and damage your reputation as a landlord.

- Tenant screening: Verifying a tenant’s financial records, employment status, and background from a distance can be harder. A poor selection could result in payment defaults, property damage, and potential legal challenges.

- Currency fluctuations: Potential losses if the Singapore dollar strengthens.

The risk of currency fluctuations is ever-present. If the Singapore dollar appreciates significantly against the currency of your investment country, your rental income and any eventual capital gains will diminish in value when converted back to Singapore dollars. Hedging strategies may be necessary to mitigate this risk.

Complex legal and tax considerations

Different laws and regulations to navigate. Understanding the legal and tax landscape of the target country is paramount.

These considerations include:

- Foreign ownership restrictions: Countries may limit the rights of foreigners to own property, the types of properties they can acquire, or impose additional transaction costs for non-citizens.

- Inheritance laws: Ensure you understand how your property will be handled upon your death. Estate planning advice from legal professionals in both Singapore and the investment country may be required.

- Double taxation: Without careful structuring and consultation with tax advisors in both countries, you risk paying tax on your overseas investment income twice.

Thorough research, seeking expert advice from international tax advisors and lawyers, employing the services of reputable local property managers, and potentially utilizing currency hedging tools can help minimize the risks associated with overseas property investment.

Factors to Consider Before Investing

Market Research

Thoroughly research the target market’s economic outlook, property trends, and regulations. A deep understanding of the chosen market is critical for a successful investment. Research should encompass:

- Economic indicators: Analyze the country’s GDP growth, inflation, interest rates, unemployment levels, and overall economic health. Strong economic fundamentals usually translate to a favorable environment for real estate investment.

- Property market trends: Examine historical price trends, rental yields, vacancy rates, and the supply and demand dynamics in your target location. Look for areas with healthy demand and potential for appreciation.

- Regulations and restrictions: Thoroughly understand laws governing foreign ownership, property taxes, capital gains taxes, and any potential repatriation restrictions. These regulations can significantly impact your profitability.

- Financial Readiness: Account for additional costs like taxes, legal fees, and maintenance.

Overseas property investment goes beyond the purchase price. Factor in the following costs:

- Taxes: This includes property taxes, income taxes on rental earnings, capital gains taxes on sale, stamp duties, and potential withholding taxes.

- Legal fees: Costs associated with conveyancing, setting up ownership structures, and obtaining professional advice in both Singapore and the investment country.

- Maintenance and repairs: Budget for ongoing maintenance, unexpected repairs, and potential upgrades required to keep the property attractive to tenants.

- Property management fees: The costs of engaging property managers or rental agencies if you opt not to self-manage.

Risk Tolerance

Assess your comfort level with the added risks of overseas investment. Consider your individual risk appetite carefully. Overseas property carries higher risks compared to domestic investments. You must be comfortable with:

- Market volatility: Real estate markets can be cyclical, and overseas markets may experience greater volatility due to factors you are less familiar with.

- Currency risk: Fluctuations in exchange rates directly impact your returns. Be prepared for potential losses if the Singapore dollar strengthens.

- Management challenges: Dealing with the logistical complexities of remote property management and the potential for less control over the process.

Long-term Goals

Align the investment with your overall financial and lifestyle objectives. Defining your investment purpose is essential.

Consider these key questions:

Capital Growth

Are you prioritizing long-term appreciation? If maximizing the growth potential of your investment is the primary goal, focus on these aspects:

- Emerging markets with strong growth trajectories: Look for economies with expanding infrastructure, a growing middle class, and favorable demographics. These factors often drive future demand for housing.

- Specific locations within the country: Identify cities or neighborhoods experiencing rapid development or government-backed revitalization programs. These areas are likely to see rising property values in the long run.

Rental Income

Do you desire a consistent income stream? If your focus is on generating rental income, prioritize these factors:

- High rental demand: Research markets with low vacancy rates, a strong presence of multinational companies, universities, or a vibrant tourism industry. These factors ensure a steady supply of potential tenants.

- Favorable rental yields: Look at the historical average rental yields in different areas. Higher yields usually translate to a more substantial and reliable income stream.

- Tenant-friendly laws: Ensure the legal framework in your chosen location protects landlord rights in cases of disputes, non-payment, or property damage.

Lifestyle

Is the investment for a potential vacation home or future relocation? If lifestyle considerations are paramount, balance them with sound investment principles:

- Desirable locations: Focus on regions that align with your personal preferences for climate, amenities, culture, and overall quality of life.

- Future potential: Consider not only your current needs but also the resale value or rental potential of the property should you decide to relocate or sell it in the future.

- Accessibility: If you plan on frequent visits to your overseas property, consider the ease of travel from Singapore and availability of direct flights.

- Other considerations:

- Retirement Planning: Explore whether overseas property fits into your long-term retirement strategy, either as a means of diversification or potential income source during retirement.

- Estate Planning: Understand the inheritance implications in both Singapore and the investment country to prepare adequately for your eventual beneficiaries.

It’s vital to find a balance between the potential returns, your risk tolerance, and any lifestyle aspirations that may be driving your investment decision.

Popular Overseas Markets for Singaporeans

Australia

- Strong, regulated economy

Australia offers investors a sense of security due to its robust economy, stable political landscape, and a property market governed by transparent laws and regulations. This stability and predictability are highly appealing for foreign investment.

- Proximity and cultural ties

The relative geographical proximity to Singapore and the shared historical links with the UK creates a sense of familiarity and ease of travel. Some Australian cities also have sizable Singaporean communities, adding to the comfort factor.

- Diverse property options

The Australian market caters to diverse investment goals. In major cities like Sydney and Melbourne, investors find modern high-rise apartments and condominiums with strong rental demand. Suburban areas offer more family-friendly housing options with potential for long-term capital appreciation.

- Education Hub

Australia’s well-regarded higher education institutions attract international students, creating a consistent rental market in university towns.

United Kingdom

- Global financial hub

London, as a major financial center, boasts a strong and consistent rental market, particularly in prime central locations. The city’s economic vibrancy offers potential for capital gains over time.

- Reputation for higher education

The UK is renowned for its prestigious universities, particularly Oxford and Cambridge. These university towns offer steady demand for student rentals and properties that can be geared toward the academic community.

- Historical charm

Investors seeking properties with architectural heritage, historical significance, or located in conservation areas often find the UK market appealing.

- Potential for diversification

UK property can offer a distinct asset class for diversification within a Singaporean-dominated portfolio.

Malaysia

- Familiarity and affordability

Malaysia’s close cultural connections to Singapore, geographical proximity, and relative affordability (compared to markets like Australia and the UK) make it a popular initial step into overseas property investment.

- Development corridors

Government-backed projects like Iskandar Malaysia present opportunities for investing in developing areas with new infrastructure and the potential for future growth.

- Retirement option

The “Malaysia My Second Home” (MM2H) program provides longer-term residency options. This attracts Singaporean investors seeking a future retirement location or a change in lifestyle.

Not forgetting emerging Southeast Asian markets like Thailand, Vietnam, and even Cambodia are gaining visibility among risk-tolerant Singaporean investors seeking higher potential returns. However, these come with greater research challenges and complexities.

Conclusion

Overseas property investment can present both attractive opportunities and significant challenges for Singaporean investors. The potential for portfolio diversification, higher returns in some markets, currency appreciation, and lifestyle benefits must be balanced against increased risks, management complexities, unfamiliar regulations, and the potential for currency losses.

Ultimately, overseas property investment is not a suitable strategy for everyone. It requires a higher risk tolerance, a long-term investment horizon, and a willingness to dedicate considerable time and resources toward in-depth research. Success depends on carefully identifying markets aligned with your financial objectives and risk profile.

Before proceeding with any investment, it’s strongly recommended to consult with an experienced financial advisor specializing in international property transactions and seek guidance from tax specialists in both Singapore and your chosen investment country. Their expertise is invaluable in navigating the complexities involved and developing a tailored investment strategy that maximizes your chances of success.

Lastly, I believe many of you still think Singapore property is still the safest asset to invest in as compared to overseas properties. Do let me know how I can assist you in your portfolio management.