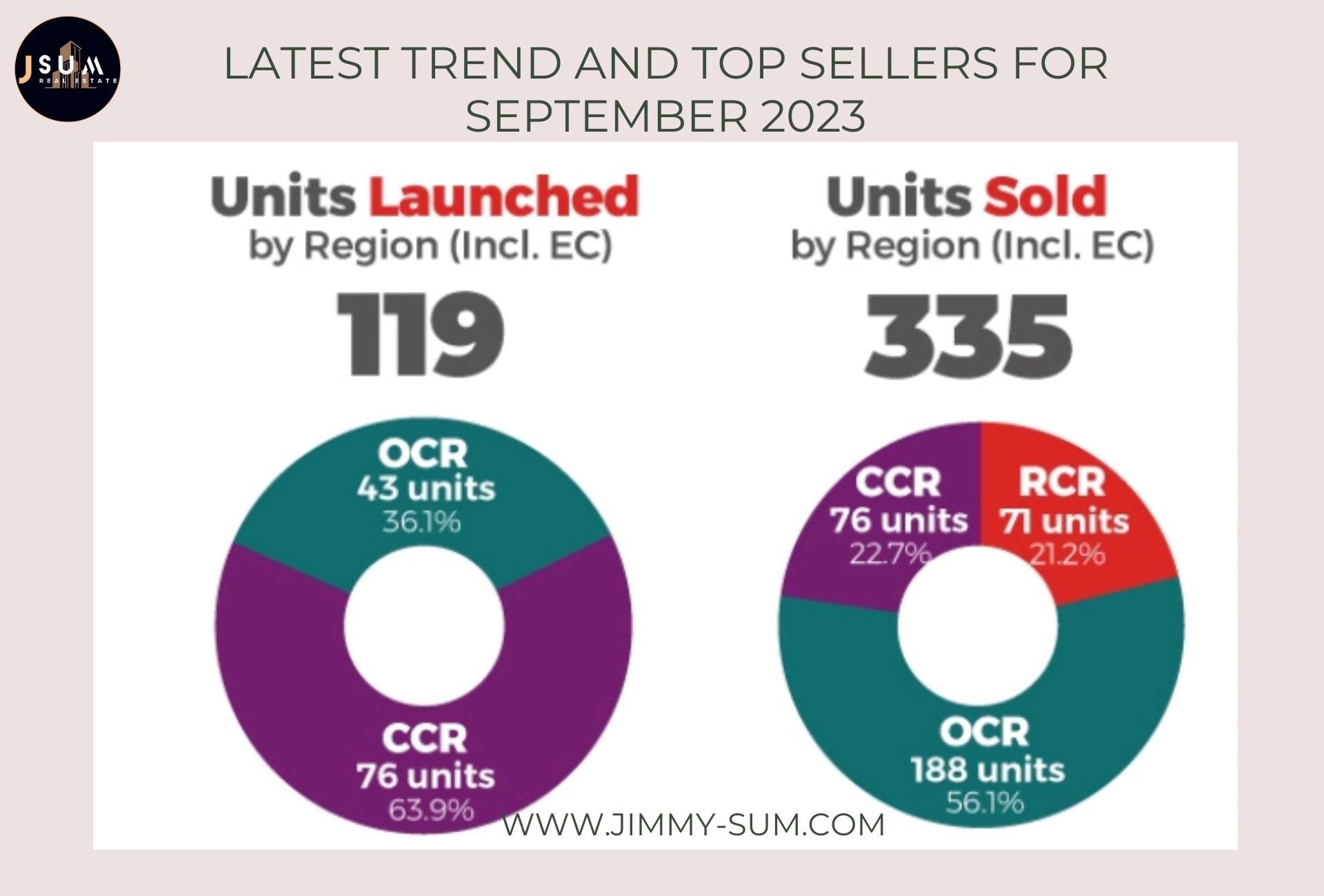

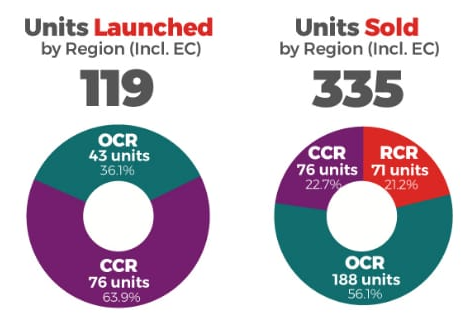

The Singapore real estate market is dynamic, often influenced by various factors, including economic conditions, location desirability, and changing buyer preferences. In September 2023, it was revealed that 119 new units, including Executive Condominiums (EC), were launched, while an impressive 335 units, including EC, were successfully sold. Notably, despite a decrease in the number of units launched, there continues to be a strong demand for well-located projects.

Let’s delve into the details of these recent trends, analyzing sales figures and exploring the top-selling properties in each region of Singapore. Also, we will take a sneak peek at the exciting upcoming launches that are set to shape the Singapore real estate market further.

Market Overview

In the current Singapore real estate landscape, 119 units, encompassing Executive Condominiums (EC), were introduced to the market. Among these, 335 units from the Outside Central Region (OCR) found eager buyers.

Interestingly, despite the relatively fewer units launched, there remains a robust demand from potential buyers. Also, September 2023 witnessed a notable shift in market dynamics. The number of units sold, encompassing both standard units and EC, registered a significant 58.9% decline compared to the average sales volume of the preceding six months. This shift in sales activity suggests a potential adjustment in buyer preferences or other influencing factors.

Historical Sales Analysis

The sales figures over the recent months shed light on the market’s dynamics:

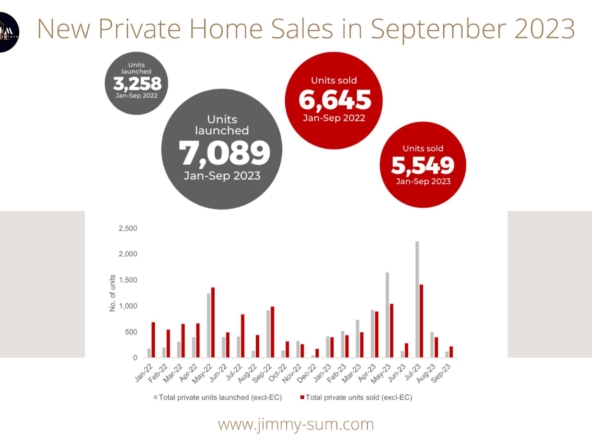

- March (513 units): March witnessed a steady influx of interested buyers, with 513 units successfully finding owners.

- April (912 units): The momentum continued into April, with a significant uptick in sales, reaching 912 units.

- May (1056 units): May marked a notable surge in sales activity, with 1056 units being snapped up by eager buyers.

- June (297 units): June saw a dip in sales, with 297 units changing hands in the market.

- July (1471 units): July experienced a resurgence in activity, with a substantial 1471 units sold during the month.

- August (649 units): The market maintained its pace, with 649 units finding new owners.

- September (335 units): However, there was a noticeable decline in September, where 335 units were sold, representing a 58.9% decrease compared to the average sales of the preceding six months.

This data indicates a fluctuating yet resilient real estate market influenced by various factors such as economic conditions, buyer sentiment, and project location.

Month-on-Month Analysis

In August 2023, a total of 649 units, including Executive Condominiums (EC), changed hands. However, the market experienced a notable decline in September 2023, with only 335 units sold. This indicates a substantial 48.4% decrease in sales from August to September of the same year.

Year-on-Year Comparison

Comparing September 2022 to September 2023, there was a significant shift in market dynamics. In September 2022, 992 units, inclusive of EC, were sold. This number decreased dramatically by 66.2% to 335 units in September 2023. This data highlights a substantial year-on-year decline in new home sales.

These statistics underscore the importance of considering short-term trends and long-term market behavior when making real estate decisions. Understanding these patterns can help stakeholders navigate the market more effectively.

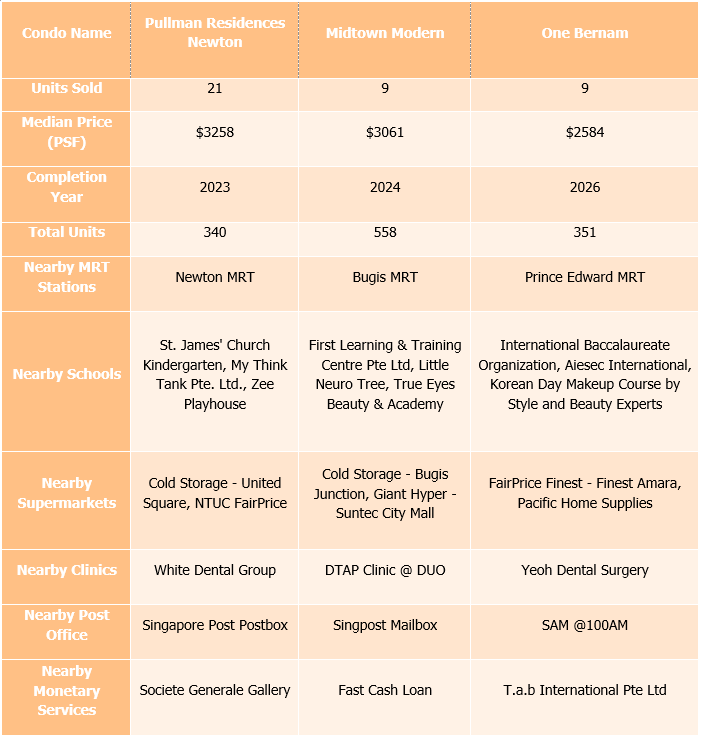

Top 3 Best Sellers by Region

1. CCR Region

2. RCR Region

3. OCR Region

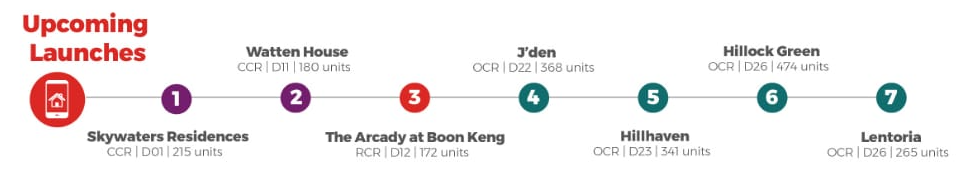

Upcoming Launches

1. Skywaters Residences

Skywaters Residences, a 99-year leasehold condominium on Prince Edward Road in District 1, is slated for completion in 2028. It features one block with 215 units and offers easy access to Tanjong Pagar MRT stations, ensuring seamless travel around Singapore.

Families will find schools like Nanyang Institute of Management, IAS, and Oxford Tuition nearby. Essential amenities, including supermarkets and clinics, are conveniently located. For leisure and relaxation, residents can enjoy the nearby Tanjong Pagar Park.

2. Watten House

Watten House, a forthcoming freehold condominium on Shelford Road in District 11, is scheduled for completion in 2027. Comprising five blocks with 180 units, it offers convenient access to Tan Kah Kee MRT stations.

Families will appreciate its proximity to schools like The Little Things, Raffles Girls’ Primary School, and Brettschneider’s Baking & Cooking School. Essential amenities, including supermarkets and clinics, are readily available in the vicinity. For leisure and relaxation, residents can enjoy the nearby Adam Park.

3. The Arcady at Boon Keng

The Arcady is a new freehold condominium located at Serangoon Road in District 12. With convenient access to Boon Keng MRT stations, residents enjoy seamless connectivity to various parts of Singapore. The development is near St Francis Court, Regent Residences, and St Francis Lodge.

There are nearby schools like Canaan Church Kindergarten, MOE Kindergarten @ Bendemeer, and Bendemeer Primary School. Essential amenities, including supermarkets and clinics, are readily available. Residents can visit the Beng Wan Road Playground for leisure and relaxation.

4. Jden

J’den is an upcoming 99-year leasehold condominium at Jurong East Central 1 in District 22. With an anticipated completion date in 2027, the development consists of a single block housing 368 units.

Its prime location offers convenient access to Jurong East MRT/LRT stations, providing seamless connectivity to various parts of Singapore. The vicinity also has notable landmarks, including Jurong Lake District, J Gateway, and Ivory Heights. Families will appreciate its proximity to esteemed educational institutions like LCentral English and Spring College International.

Also, residents will find essential amenities such as supermarkets and clinics within easy reach, ensuring a comfortable and accessible living experience. For leisure activities, the nearby Plantui Smart Garden LLP offers a refreshing outdoor space for relaxation.

5. Hillhaven

Hillhaven, a 99-year leasehold condominium at Hillview Rise in District 23, is expected to be completed by 2027. The development consists of one block housing 335 units, offering convenient access to Hillview MRT stations.

It is close to other condos like The Hillier, Midwood, and Hillview Heights. Essential amenities, including supermarkets and clinics, are readily available. For leisure and relaxation, residents can enjoy the nearby Fuyong Interim Park.

6. Hillock Green

Hillock Green is an upcoming leasehold condominium at Lentor Central in District 26. Anticipated for completion in 2027, it consists of a single block housing a total of 474 units. Located near Lentor MRT stations, residents can easily access various parts of Singapore.

The development is near Lentor Hills Residences, Lentor Modern, and Thomson Grove. Essential amenities, including supermarkets and clinics, are readily available in the vicinity. For leisure and relaxation, residents can visit the nearby Lentor Hillock Park.

7. Lentoria

Lentoria, a forthcoming 99-year leasehold condominium situated on Lentor Hills Road in District 26, is slated for completion in 2027. Featuring a single block with 267 units, residents will enjoy convenient access to Lentor MRT stations.

There are esteemed schools like My Canopy Montessori and Mayflower Primary School nearby. Essential amenities, including supermarkets and clinics, are readily available in the area. Residents can take advantage of the nearby Lentor Hillock Park for leisure and relaxation.

Conclusion

The real estate market has seen notable shifts in recent months, with varying levels of activity in unit launches and sales. While September 2023 witnessed a dip in sales compared to the preceding months, it’s crucial to contextualize this data within the broader market landscape.

Year-on-year comparisons reveal a substantial decline in new home sales, indicating evolving buyer preferences or external influences. These insights emphasize the necessity for both buyers and sellers to stay informed about market trends and make decisions based on a comprehensive understanding of the factors at play. By doing so, stakeholders can navigate the real estate landscape with greater confidence and efficacy.

Disclaimer: This information is provided solely on a goodwill basis and does not relieve parties of their full responsibility to verify the information or seek advice from relevant professionals such as valuers, financial advisers, and lawyers.