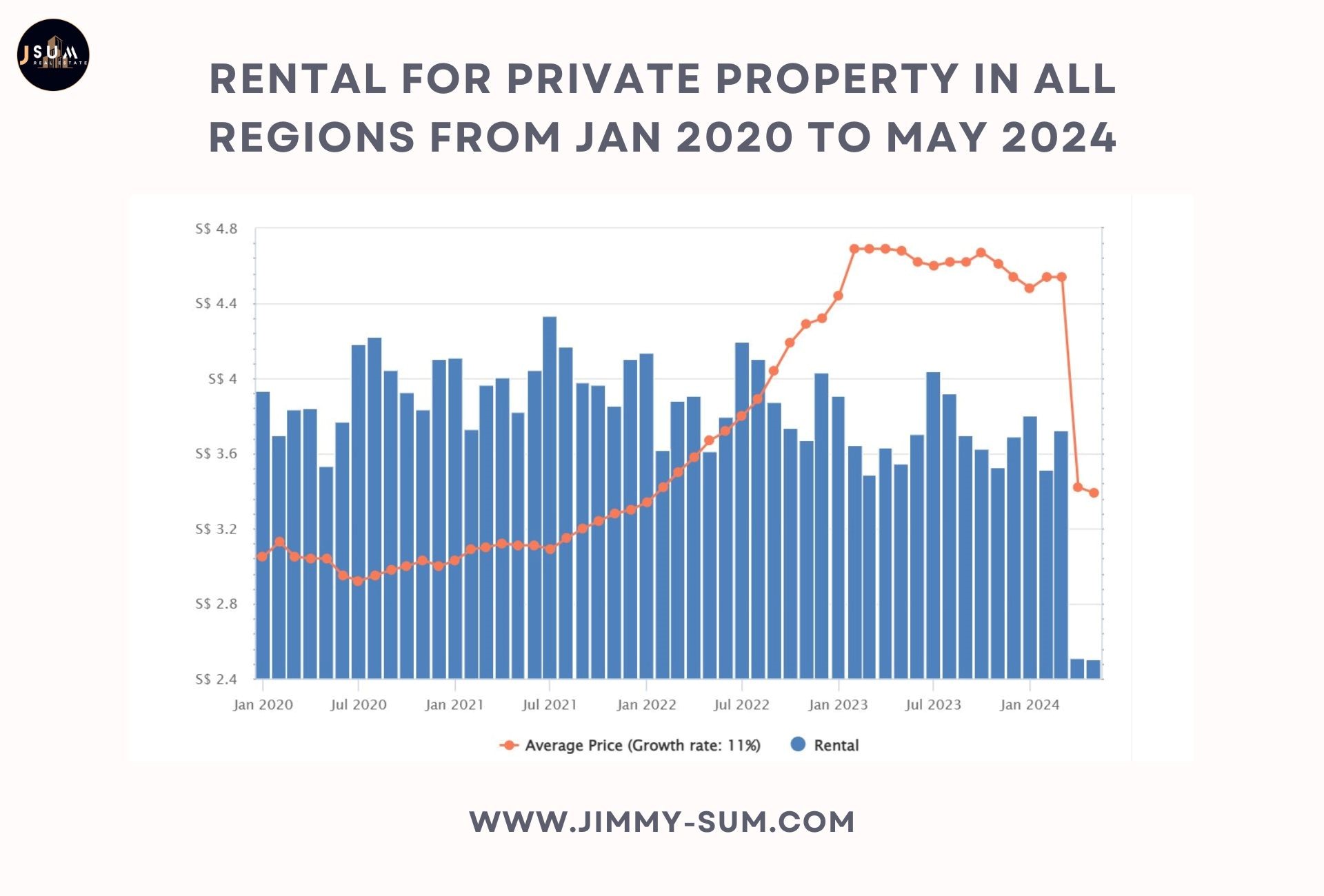

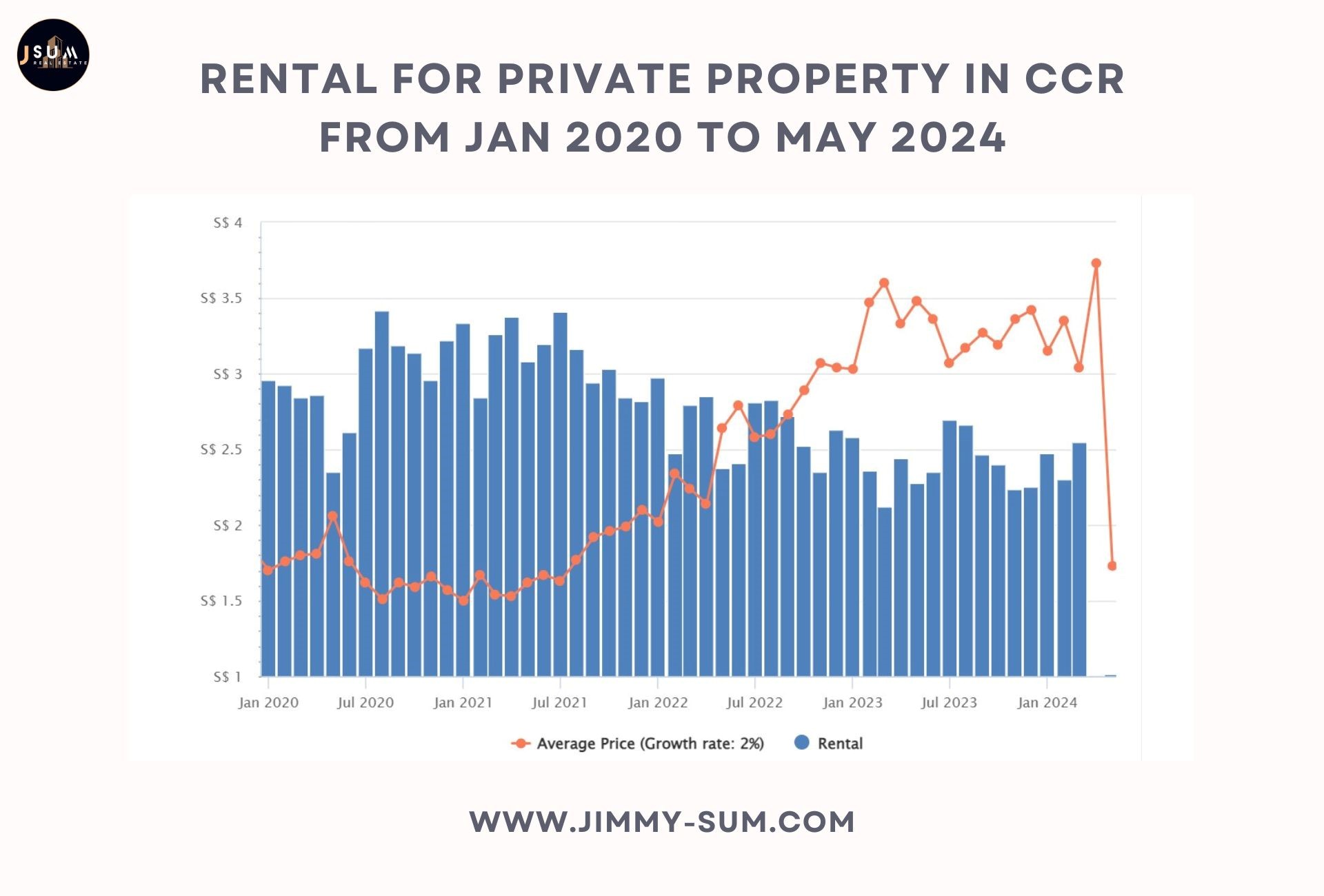

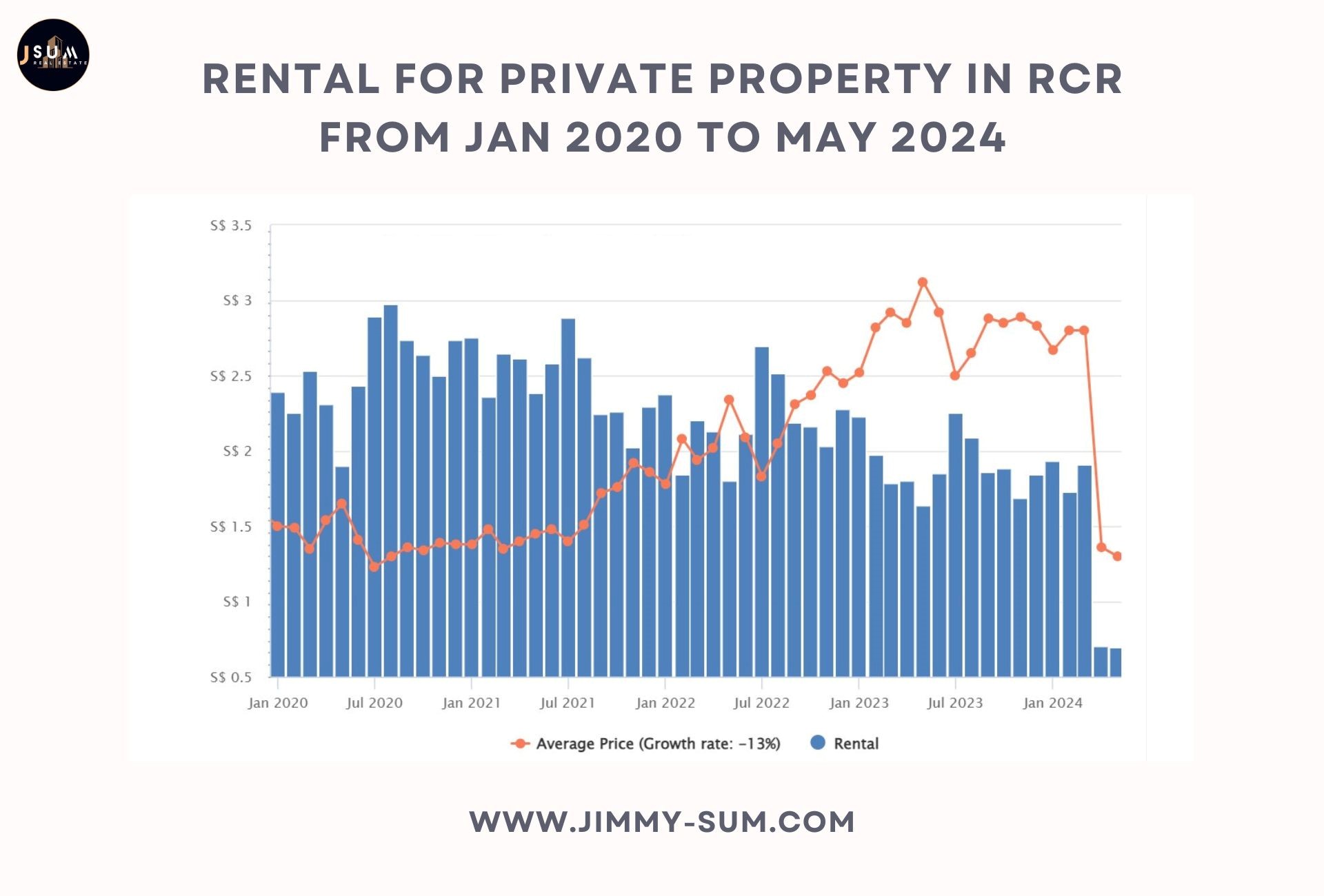

Singapore’s rental market has been on a roller coaster ride in recent years, with rents soaring to unprecedented heights. But now, the ride seems to be slowing down. signaling a shift in the market dynamics.

This cooling trend is raising concerns for landlords who have become accustomed to a steady stream of eager tenants and skyrocketing rental prices. The days of multiple offers above asking price seem to be fading, replaced by a more cautious and discerning renter pool.

So, what does this mean for landlords?

The rental landscape is changing, and it’s time for landlords to adjust their expectations and adapt their strategies to thrive in this new reality. This article will delve into the factors behind the rental slowdown, explore the challenges and opportunities it presents, and offer practical advice for landlords to navigate this evolving market.

The Changing Landscape of Singapore’s Rental Market

Pre-2024 Boom

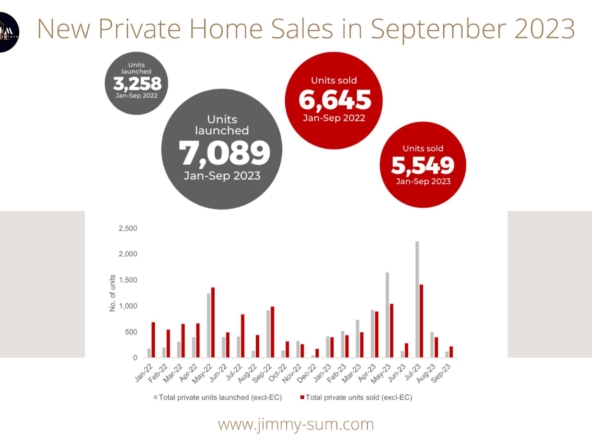

In the years leading up to 2024, Singapore’s rental market experienced an unprecedented boom. Fueled by historically low interest rates and a surge in demand from both local and foreign tenants, rental prices skyrocketed across the island. Expatriates returning after pandemic-related travel restrictions eased, coupled with a delay in Build-To-Order (BTO) flat completion, further exacerbated the demand.

Landlords rejoiced as they enjoyed multiple offers, often above asking prices, and bidding wars became commonplace. Properties were snapped up within days, if not hours, of being listed. This frenzied market created a sense of urgency among tenants, who were willing to pay top dollar to secure a home in the Lion City.

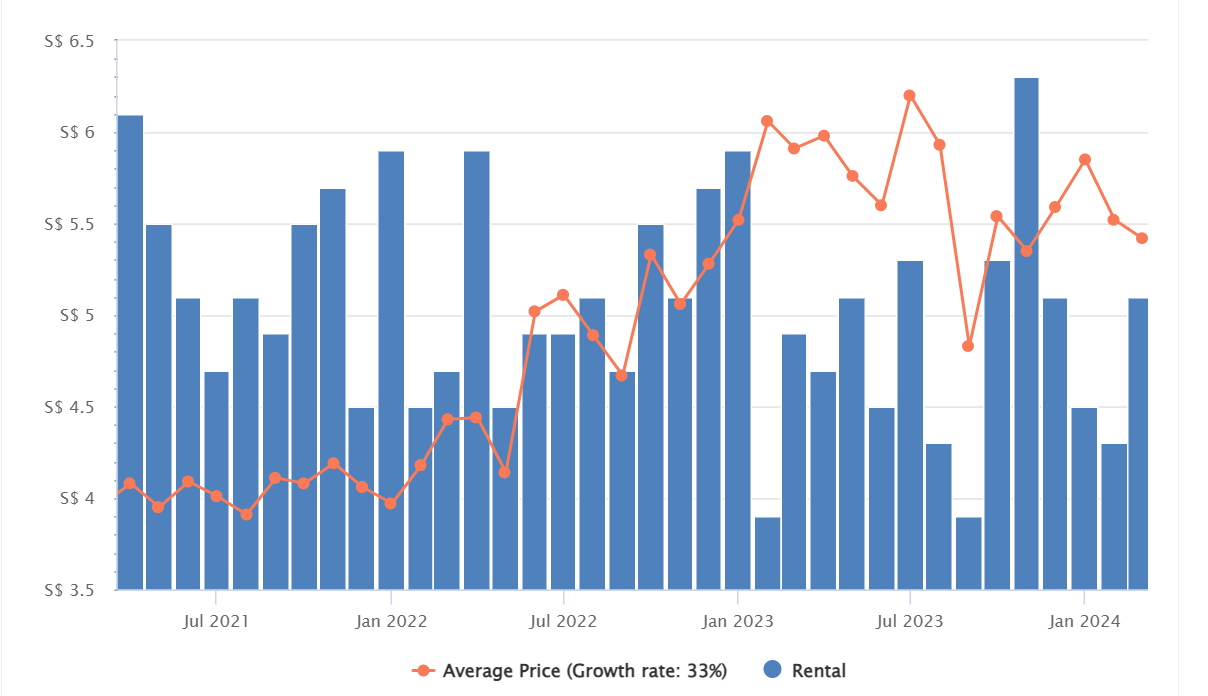

The graph below shows the rental trend for Ascentia Sky located in District 3. You can see that there has been a steep increase in 2022 and slowly tapers off in early 2023.

The 2024 Correction

However, the tide began to turn in 2024. Rental prices, which had been on an unrelenting upward trajectory, started to show signs of cooling down. According to data from Savills Singapore, the rent for private residential properties is expected to fall by 5% year-on-year in 2024.

The vacancy rate, a key indicator of market tightness has also climbed up. This means that a growing number of rental properties are sitting empty for longer periods, putting pressure on landlords to lower their asking prices.

The average time-on-market for rental properties increases. Properties that were once leased out within days now take weeks or even months to find tenants. This shift in market dynamics is forcing landlords to re-evaluate their pricing strategies and adjust their expectations.

Key Drivers of the Slowdown

- Increased Housing Supply

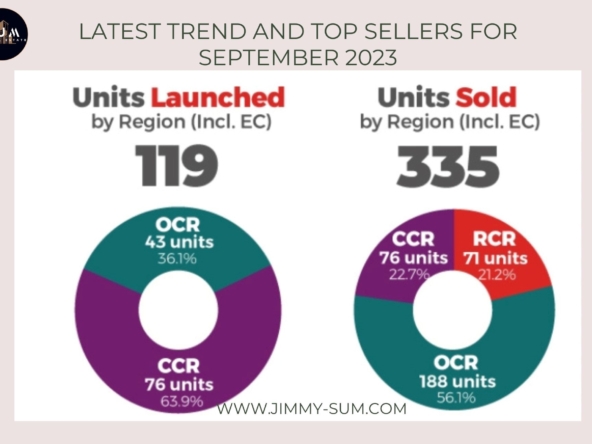

One of the primary factors contributing to the rental market cooldown is the significant increase in housing supply. In recent years, Singapore has seen a surge in the completion of new condominium projects, particularly in areas like the Outside Central Region (OCR). This influx of new units has expanded the pool of available rental properties, giving tenants more options and reducing the urgency to secure a lease at any cost.

The upcoming supply of new homes is also expected to remain robust, with several major projects slated for completion in the next few years. This continued growth in supply could further ease pressure on rental prices and give tenants even more bargaining power.

- Economic Uncertainty

Global economic headwinds, such as rising inflation and interest rates, are also playing a role in the rental market slowdown. These factors have put a strain on household budgets, making it more challenging for some tenants to afford high rents.

As interest rates rise, mortgage payments for homeowners increase, leading some to rent out their properties to offset the additional costs. This further adds to the supply of rental units, intensifying competition and potentially driving down prices.

- Shifting Tenant Preferences

The COVID-19 pandemic has also triggered a shift in tenant preferences. With remote work becoming more prevalent, tenants are increasingly seeking smaller, more affordable units that are well-suited for work-from-home arrangements. They are also prioritizing flexible lease terms and amenities that cater to their changing lifestyles.

This shift in preferences is putting pressure on landlords who own larger, more expensive units that may not meet the current demands of the market. To remain competitive, landlords may need to adapt their offerings to cater to the evolving needs of tenants.

Why Landlords Need to Adjust Their Expectations

The “New Normal”:

The heady days of double-digit rental growth and bidding wars are likely behind us. While Singapore’s property market remains resilient, the exceptional circumstances that fueled the pre-2024 boom are no longer in play. Interest rates are rising, cooling measures are in effect, and the influx of new housing supply has shifted the balance of power towards tenants.

Landlords must acknowledge this “new normal” and adjust their expectations accordingly. The days of easy money and sky-high rental yields may be over, at least for the foreseeable future. Instead, landlords should anticipate a more moderate growth trajectory and focus on sustainable, long-term strategies.

Increased Competition

With the completion of numerous new condominium projects and the rise of alternative housing options like co-living spaces, the rental market has become increasingly competitive. Tenants now have a wider array of choices, allowing them to be more selective and discerning.

Landlords can no longer rely solely on location or basic amenities to attract tenants. They need to differentiate their properties, offer competitive pricing, and provide exceptional service to stand out in a crowded market.

Changing Tenant Priorities

The pandemic and evolving work trends have significantly impacted tenant preferences. Remote work and hybrid work arrangements have reduced the need to live in close proximity to the city center, leading to increased demand for properties in suburban areas with more space and amenities.

Tenants are also prioritizing flexible lease terms, pet-friendly policies, and sustainable features in their rental homes. Landlords who fail to adapt to these changing preferences risk losing out to competitors who are more attuned to the needs of modern renters.

Strategies for Landlords to Navigate the Rental Reset

Realistic Pricing

In a cooling rental market, it’s crucial for landlords to be realistic about their pricing expectations. Thoroughly research current market rates for comparable properties in your area to gauge what tenants are willing to pay. Online platforms like PropertyGuru and 99.co provide valuable insights into rental trends and average prices for different property types and locations.

Property Upgrades

Enhancing your property’s appeal can make it stand out in a crowded market. Invest in minor renovations or upgrades, such as a fresh coat of paint, new flooring, or updated kitchen appliances. These improvements can significantly increase your property’s desirability and justify a higher rental price.

Prioritize eco-friendly appliances and energy-efficient features. These not only appeal to environmentally conscious tenants but can also help lower utility bills, making your property more attractive and cost-effective in the long run.

Effective Marketing

Crafting a compelling listing is essential to attract potential tenants. Engaging the services of professional real estate agents like Jimmy Sum will understand the importance of having high-quality photos that showcase your property’s best features and write detailed descriptions highlighting its unique selling points. Putting your listing on relevant online platforms are also important to have the maximum exposure on your listing.

Consider partnering with reputable real estate agents such as Jimmy Sum who has extensive knowledge of the local market and can effectively market your property to his network of potential tenants. His expertise can help you secure quality tenants faster and at a better price.

Tenant Retention

Retaining existing tenants is often more cost-effective than finding new ones. Foster positive relationships with your tenants by being responsive to their needs, addressing maintenance requests promptly, and showing appreciation for their tenancy through your representative real estate agent.

The rental landscape is evolving, and those who are willing to adjust their expectations and embrace new approaches will be best equipped to thrive in this new reality.

Conclusion

The winds of change are blowing through Singapore’s rental market, and landlords who cling to outdated expectations risk being left behind. The era of effortless high rental yields and bidding wars may be over, but that doesn’t spell doom for property owners. Instead, it signals a call for adaptation and a shift towards more sustainable strategies.

By embracing the “new normal,” landlords can navigate the evolving landscape and continue to generate attractive returns on their investments. This involves understanding the current market conditions, acknowledging changing tenant preferences, and adopting proactive approaches to pricing, property management, and marketing.

Those who are willing to adjust their expectations, invest in their properties, and prioritize tenant satisfaction will not only weather the storm but thrive in this new era of Singapore’s rental market. The future may hold a different kind of success, one marked by steady, sustainable growth and a focus on building long-term relationships with tenants.

The rental reset is not a crisis, but an opportunity for landlords to refine their strategies, adapt to evolving demands, and ultimately secure their place in a dynamic and ever-changing market.