Qn 3: We have plan to get married. However, how early we get married is dependent on when we get our house. We are contemplating between 3rm BTO or resale 3rm HDB. Our monthly combined income is approximately $11K. Do share your professional opinions with us. Thanks.

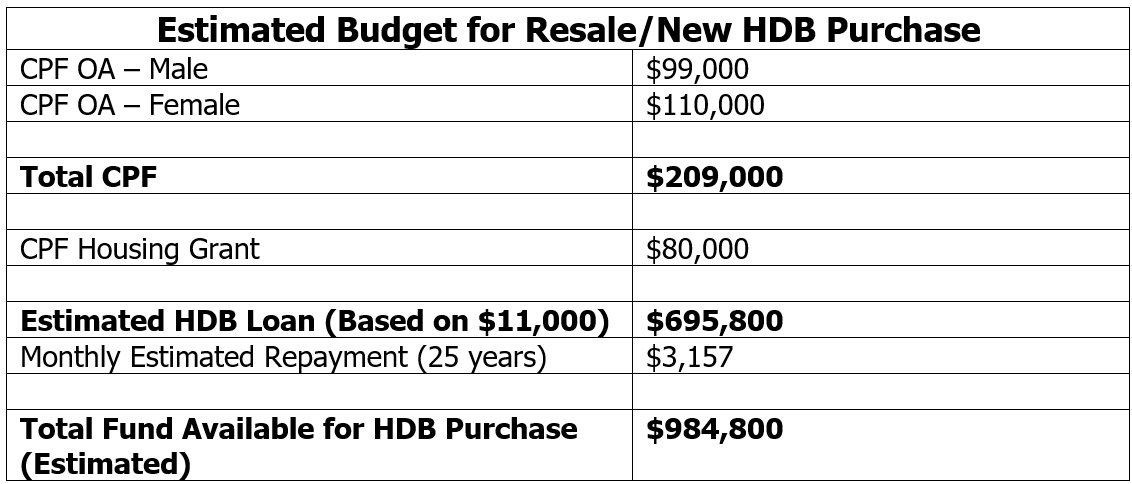

In order for us to do a rough calculation on your HDB loan, below are the assumptions that we have made:

- Both of you are 30 years (Born in 1994)

- Male:

- Earns $6K monthly

- Has accumulated $99K in CPF so far (Started working at age 24 after NS. Assumed starting pay till now is $6K. 37% CPF contribution with 62.17% allocation to OA for 6 years)

- Female:

- Earns $5K monthly

- Has accumulated $110K in CPF so far (Started working at age 22. Assumed starting pay till now is $5K. 37% CPF contribution with 62.17% allocation to OA for 6 years)

- First timer to buying HDB

- CPF housing grant – Up to $80,000

- CPF proximity grant – Up to $30,000 if stay near parents

The estimated HDB loan stated above is based on some assumptions made by us. We can always create an accurate budget plan when we are able to get the necessary information from you 😊

Get Ready Your HFE

Regardless of whether you are plan to buy a BTO or a resale HDB, it is crucial to apply for your HFE first. You need HFE to understand the amount of loan you are getting from HDB, the amount of CPF grants that you are eligible to receive. Lastly, you need your HFE before you can commit a unit that both of you like and decide to purchase it.

It takes approximately up to a month for HDB to process and approve it with a validity period of 9 months from the date of issue.

Please go ahead and do it now even before you decide your next step.

Your HFE is done! One item tick off your to-do list. The next thing that you need to consider is the time period that you are willing to wait to get your new home.

Is it in years or in months?

With your combined income of $11,000, you can get an estimated HDB loan of $695,800 and with an assumed CPF of $209,000 and grant of up to $80,000, you can look at HDB with a purchase price of $984,000. You can be spoilt for choices.

Now, let’s take alook at each option and then you can decide thereafter which one suits you the best

Buying BTO HDB

At the point of answering your question right now, there are several BTO exercises coming up in October 2024 in the areas below:

- Ang Mo Kio (2-room flexi, 4-room)

- Bedok (2-room flexi, 3-room, 4-room)

- Bukit Batok (2-room flexi, 3-room, 4-room, 5-room, 3Gen)

- Geylang (Community care apartment, 4-room)

- Jurong West (2-room flexi, 3-room, 4-room, 5-room, 3Gen)

- Kallang/Whampoa ((2-room flexi, 3-room, 4-room)

- Pasir Ris (2-room flexi, 3-room, 4-room, 5-room, 3Gen)

- Sengkang (2-room flexi, 3-room, 4-room, 5-room)

- Woodlands (4-room, 5-room)

Although you are buying BTO at a much cheaper prices as compared to resale HDB, you got to be really honest how long can you wait in order to get the keys for your BTO. The average waiting time is around 3-4 years. Can you wait that long?

However, the good thing about buying BTO is the potential capital appreciation that it can bring you when you decide to sell after it reaches Minimum Occupation Period (MOP) especially when it is well located like for instance at Ang Mo Kio, Bedok or even Kallang/Whampoa.

Let’s do a rough timeline calculation. Both of you are assumed to be 30 now. With 4 years of waiting time to get your BTO and waiting to MOP, that will be 9 years in total. By then, both of your will be around 39 years old.

At that age, you still have the option to:

- Cash out to upgrade to a bigger HDB or a private property.

- Keep your HDB and buy another property under both or single name for own stay or investment. You need to pay the Additional Buyer’s Stamp Duty (ABSD) for your second property. Renting out your current HDB to cover its monthly mortgage or to receive some passive income from it.

You still have around 26 years as loan tenure for your next property.

The drawback for BTO is the potential opportunity cost in riding on favourable market conditions should it arise during your commitment to your HDB as well as affecting your loan tenure for your next property if you are sure that this is just a stepping stone to your next property upgrade!

When come to property purchase, beside your financial strength, your age plays an important role too. The longer tenure you can stretch, the lower monthly loan amount you can get.

Is Resale HDB a Better Option for You?

In your question submitted to us, you did not mention any specific areas that you are looking at for your resale HDB. Let us assume that you prefer one in the matured estate where the amenities and transportation are already in place!

Some of the matured estate that are pretty popular include:

- Ang Mo Kio

- Bedok

- Clementi

- Queenstown

- Bukit Merah

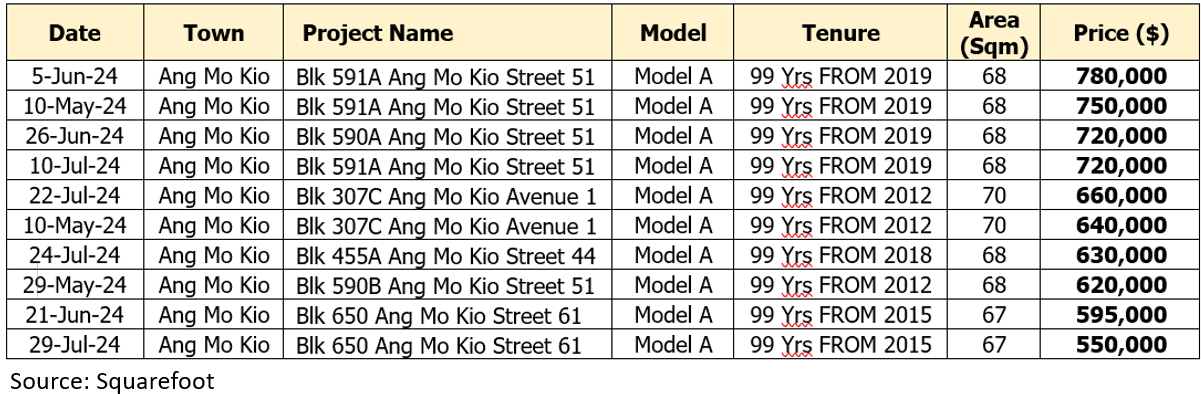

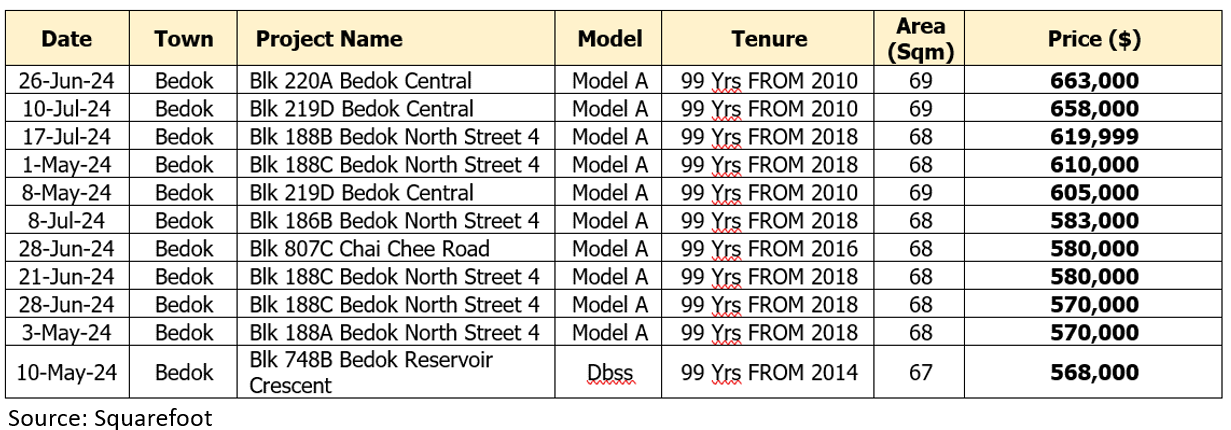

There is a rising demand for older resale HDB right now in these matured estates due to its affordability and space. Flats that are of age around 10 years old or less are commanding at a price range of $700K to $800K, dependent of its location. With such a high price tag, that explains why more young couples like you are turning older HDB.

Below is an example of an old HDB located at Clementi. Being a corner 3-rm HDB, its layout is really good and you can really design it to your own preference.

Of course, there are some valid concerns that you will have for older HDB such as:

- Lease decay – With shorter lease left when you buy over the property, what’s next? Will there be any value left when you want to sell in 5 or 8 years’ time?

- Higher renovation cost

- Can your CPF be fully utilized when you buy older HDB? Your CPF can be fully utilized as long as the remaining lease of the HDB is able to cover the youngest buyer to age 95. Else, the CPF usage needs to be pro-rated.

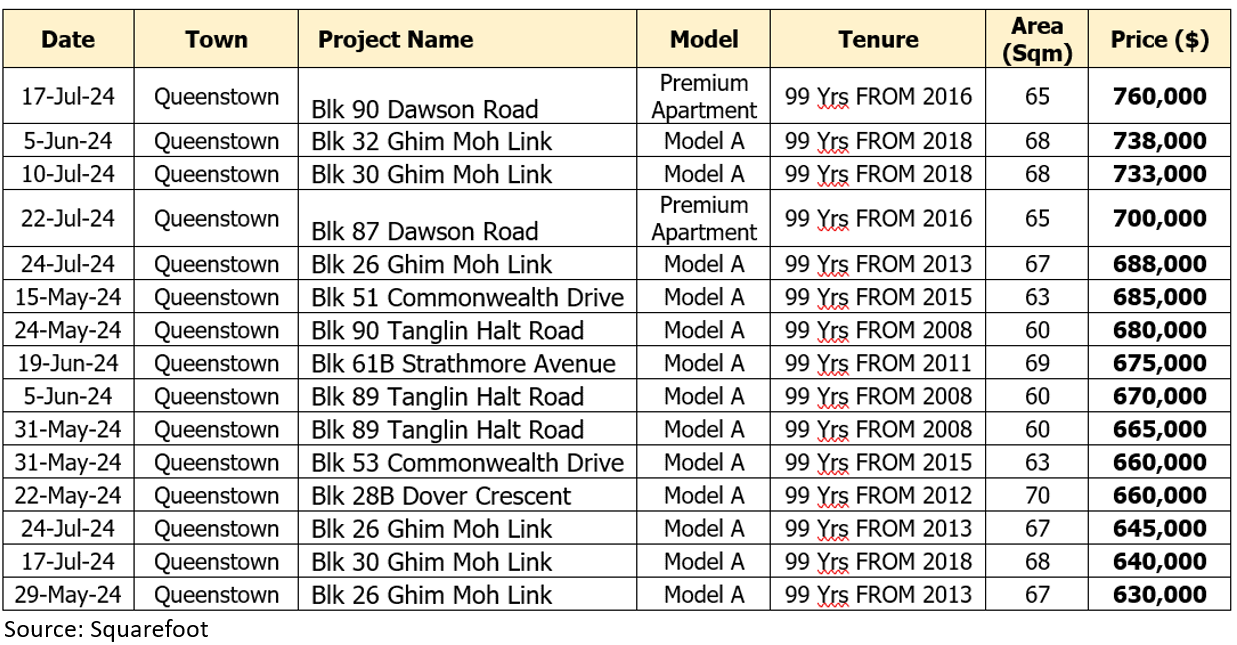

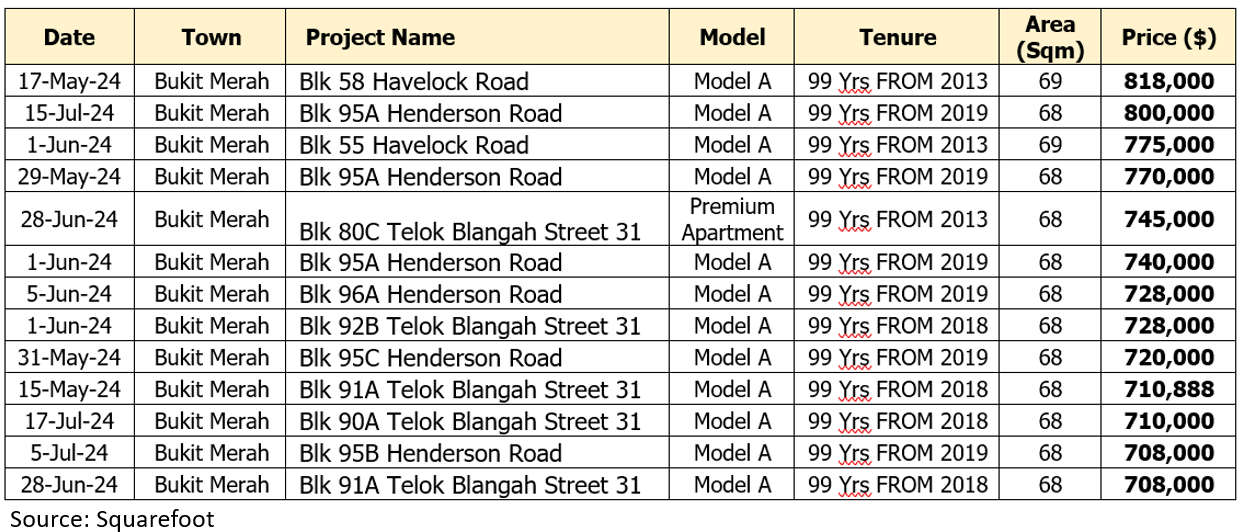

Below are the recent transactions for newer HDB located in the matured estate mentioned above.

Apart from the higher price that newer HDB command, they do not require much renovation as they are still pretty new. Nonetheless, some renovation will still need to be done to suit your preference. Full CPF can be utilized and you can be pretty sure that there is still a good amount of lease left should you decide to sell after staying for a couple of years or opportunity knocks for a property upgrade!

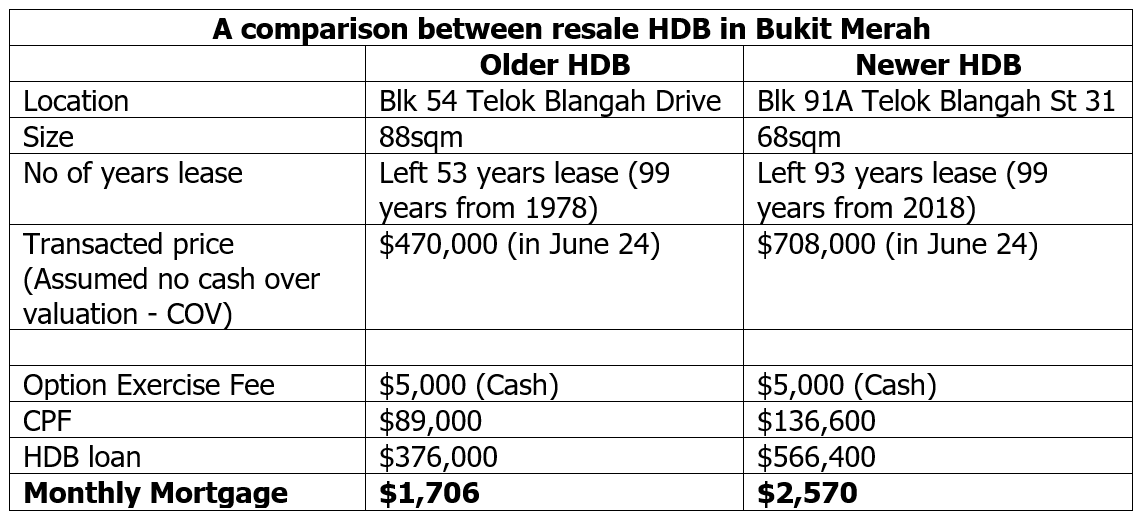

Let’s do a quick comparison between buying a newer 3 HDB and a much older HDB along the same street.

From the comparison done above, it makes more sense to go for the older HDB since it gives you more space at a much lower price. But, having said that, I do understand that newer HDB can still a better choice even though it is more expensive.

Like we have always said to our clients, there is no 100% foolproof solution. It all boils down to your current needs and preference. Any choice made is a good choice so long it meets what you are looking for. At least, there is a comparison for you to have a clearer understanding on the options available.

Conclusion

At this point, we believe that you are in a better position to decide which option is better for both of you. Is BTO still the better choice for you? After all, the advantage of having BTO as your first property is the potential capital appreciation that you can realize should you decide to sell after MOP.

On other hand, resale HDB cut short the waiting time from owning your first home from years to just months. The only problem is that whether you are willing to pay for the price tag for a 3-rm that is pretty new but uncertain how long it takes to realize a profit out of it.

Even though an older HDB is attractive in term of its price but you may be worried about lease decay when you want to sell in a couple of years’ time.

Guess that at the end of the day, there is no best of everything. Both of you need to sit down and discuss what your priorities are right now. Price sensitive? Time constraint? Get these sorted out and you are good to go!

While waiting, get your HFE done first. Without this, you can’t go anywhere!

Lastly, if you need any professional advice, do drop us a Whatsapp at 9091 8188 and we are glad to help 😊

Disclaimer: This information is provided solely on a goodwill basis and does not relieve parties of their full responsibility to verify the information or seek advice from relevant professionals such as valuers, financial advisers and lawyers.

We are not responsible for any actions taken based on the information in this blog post. This post is for informational purposes only and should not be construed as financial or legal advice.