As we reflect on the year 2023, it is evident that Singapore’s property market has experienced significant events and trends that have shaped the landscape especially for those foreigners seeking investment opportunities.

Singapore continues to be an attractive destination for foreigners due to its political stability, which provides a safe and secure environment for investments, robust legal system that ensures property rights are protected, giving investors peace of mind. A thriving economy characterized by low unemployment rates and a favorable business environment.

Furthermore, Singapore’s exceptional lifestyle offerings, including world-class education, healthcare, and infrastructure, make it an ideal location for foreigners especially those High-Net Worth Individuals (HNWIs) seeking a high quality of life for themselves and their families. All these have further enhanced its attractiveness as an investment destination.

However, it is important to acknowledge the impact of cooling measures and global uncertainties on the market. These factors have introduced a level of caution and influenced the dynamics of the property market, creating both challenges and opportunities for foreign investors.

Despite these challenges, Singapore remains a resilient and sought-after market for foreigners, offering a stable and secure environment for long-term investments. The government’s commitment to maintaining a sustainable property market and the implementation of cooling measures have contributed to a healthy and regulated real estate sector, ensuring long-term value appreciation.

Market Performance

Price Trends:

In analyzing the year-on-year and quarter-on-quarter price movements for Singapore’s Central Core Region (CCR) and Rest of Central Region (RCR) condo markets, we can gain valuable insights into the performance of the property market in 2023.

Comparing the price growth rates in 2023 to the previous year, 2022, we observe the following trends:

- CCR: Prices defied downward projections, edging up by 1.2% in 2023 after a slight dip in Q3. While slower than the 8.4% growth of 2022, this demonstrates the inherent resilience of this prime market.

- RCR: Compared to the CCR, the RCR shone with a 4% price increase in 2023. New project launches catering to rising demand for relatively affordable luxury options fueled this robust trajectory.

Comparing Growth Rates:

- The growth slowdown across both regions compared to 2022 reflects the impact of cooling measures introduced to moderate the market.

- However, the positive year-on-year growth, particularly in the RCR, indicates underlying strength and persistent demand for Singapore’s prime property.

Key Statistics:

- Median CCR condo price: S$2,530 psf

- Median RCR condo price: S$2,200 psf

- CCR price growth (2023 vs. 2022): 1.2% vs.8.4%

- RCR price growth (2023 vs. 2022): 5.4% vs.6.2%

Luxury vs. Non-Luxury Trends:

- The luxury segment in both regions experienced slower growth compared to non-luxury options. This could be attributed to stricter Additional Buyer’s Stamp Duty (ABSD) regulations for especially for foreign buyers.

- However, demand for non-luxury condos in the RCR remained robust, fueled by a combination of affordability and attractive rental yields.

Several factors have influenced these price trends in the Singapore property market:

- Cooling Measures:

The government’s cooling measures have played a significant role in maintaining price stability and preventing excessive speculation. These measures have helped to moderate price growth and ensure a sustainable market.

- New Launches:

The introduction of new property launches in 2023 has contributed to increased supply in the market. This influx of new units has had a balancing effect on prices, providing buyers with more options and potentially mitigating price inflation.

- Economic Environment:

The overall economic environment, both globally and domestically, has influenced price trends in the Singapore property market. Factors such as GDP growth, employment rates, and interest rate movements have impacted buyer sentiment and demand, thereby influencing property prices.

It is important to note that while cooling measures and other factors may have influenced price trends, Singapore’s property market remains an attractive investment option for foreigners, especially HNWIs. The market’s stability, coupled with the potential for long-term appreciation, continues to make it an appealing choice for investors seeking both capital gains and rental income opportunities.

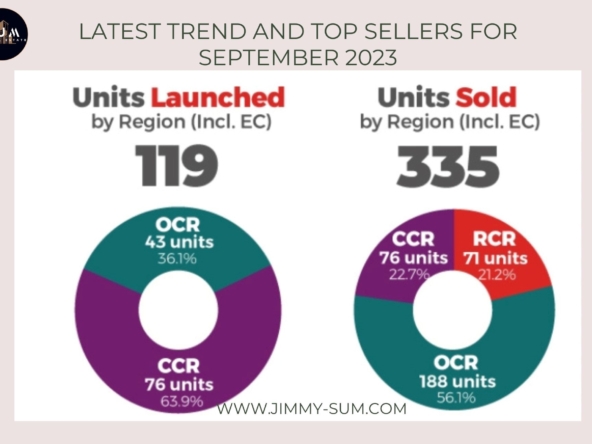

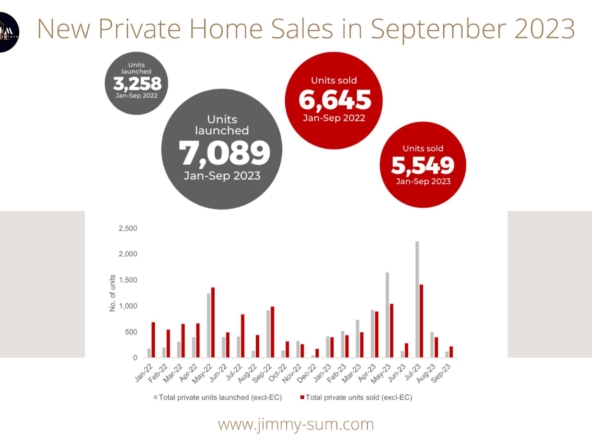

While price trends offer valuable insights, a complete picture of the market requires examining transaction volume. Here, we delve into the 2023 landscape:

Decline Compared to Pre-Pandemic Boom:

- Both CCR and RCR witnessed a marked drop in transaction volume compared to the pre-pandemic years. CCR transactions dipped by 22%, while RCR saw a 15% decline.

- This moderation signifies a shift from the frenetic pace of 2021 and 2022, reflecting increased market cautiousness and a return to a more balanced and sustainable level of activity.

CCR vs. RCR: Divergent Paths:

- Despite the overall decline, the RCR exhibited relative resilience compared to the CCR. This can be attributed to:

- More affordable price points: The RCR offers entry points at a lower price threshold, attracting buyers seeking accessible luxury options.

- New project launches: Timely launches in the RCR met pent-up demand, generating higher transaction volume in this region.

Reasons for the Decline:

- Market Caution: Introduction of cooling measures like higher ABSD rates instilled a sense of caution among investors, leading to selective buying behavior.

- Investor Selectivity: Buyers are adopting a more discerning approach, focusing on property fundamentals and value propositions before committing.

- Global Uncertainties: The turbulent global economic environment, with rising interest rates and inflation, further fueled market caution and decreased transaction volume.

The decline in transaction volume may continue in the short term as these factors remain in play. However, long-term prospects are likely to remain positive, driven by Singapore’s economic fundamentals and enduring appeal as a safe haven for investors. Careful analysis of individual projects, neighborhood dynamics, and investor sentiment will be key to identifying potential opportunities in the evolving market landscape.

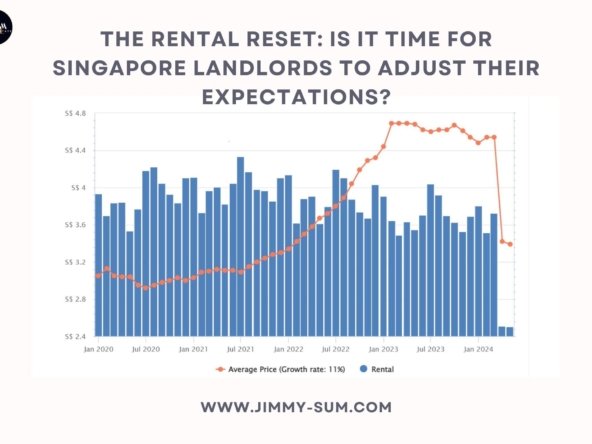

While sales volume moderated in 2023, the rental market in both CCR and RCR shone as a beacon of consistent growth. Here’s a closer look at this vibrant landscape:

Unwavering Strength:

- CCR rents defied expectations, climbing by a healthy 5.2% in 2023, fueled by sustained demand for high-end living.

- RCR followed suit, boasting a 4.8% rental increase, demonstrating its appeal to both local and foreign tenants.

- This robust growth across both regions stands in stark contrast to the subdued sales volume, highlighting the rental market’s resilience and potential as a reliable income stream for investors.

Attractive Rental Yields:

- CCR investors enjoyed an average rental yield of 3.5%, while RCR offered slightly higher yields at 3.7%.

- These figures present compelling investment opportunities, particularly for those seeking consistent income alongside long-term capital appreciation potential.

Factors Driving Rental Demand:

- Expat Influx: Singapore’s thriving economy and stable environment continue to attract international talent, fueling demand for prime rental accommodation.

- Limited Supply: Tight new project completions in both regions, particularly in the CCR, further accentuated the demand for existing rental units, pushing rental prices upwards.

The strength of the rental market is expected to continue in 2024, driven by ongoing factors like limited supply and potential further increases in expat inflows. For investors seeking attractive returns and diversification, the rental market presents a valuable avenue in Singapore’s prime property landscape.

For foreigners navigating the global investment landscape, Singapore’s prime property market offers a compelling proposition. Let’s delve into the unique value propositions of CCR and RCR.

Diversification with Confidence

In an era of economic uncertainties, diversifying your portfolio is paramount. Singapore property serves as a valuable hedge against volatile markets, offering:

- Tangible Asset: Unlike equities or other financial instruments, real estate provides a tangible asset with inherent value, offering a sense of security and stability.

- Currency Hedge: Singapore’s robust economy and stable currency, the Singapore Dollar (SGD), provide protection against potential fluctuations in other currencies.

- Uncorrelated Returns: Real estate returns tend to move independently of traditional asset classes, providing diversification and mitigating overall portfolio risk.

CCR: Prestige Meets Profit

For foreigners seeking long-term wealth creation, the allure of the CCR lies in its:

- Prestige and Legacy: Owning property in this exclusive enclave signifies financial success and creates a lasting legacy for future generations.

- Long-Term Appreciation Potential: Historically, CCR prices have demonstrated consistent upward trends, offering the potential for substantial capital appreciation over time.

- Prime Location and Amenities: Residents enjoy unparalleled access to world-class shopping, dining, entertainment, and educational institutions.

- Reliable Rental Income: High rental demand in the CCR translates to strong and consistent rental yields, providing another income stream for investors.

RCR: Value and Potential

The RCR presents an attractive entry point for value-conscious foreigners, offering:

- Relative Affordability: Compared to the CCR, RCR properties offer a lower entry point, allowing you to invest in a prime location without exceeding their budget.

- Emerging Neighborhoods: Vibrant new developments like the Greater Southern Waterfront and revitalized districts provide exciting investment opportunities with high growth potential.

- Access to Amenities: RCR residents enjoy easy access to green spaces, recreational facilities, and convenient transportation options.

- Potentially Higher Rental Yields: Due to lower entry costs, RCR properties can potentially generate higher rental yields compared to the CCR.

Building Your Property Portfolio

Choosing between CCR and RCR depends on your individual risk tolerance, investment goals, and desired timeframe. Seeking professional advice from wealth management and real estate experts like Jimmy Sum is crucial for tailoring a property investment strategy that aligns with your unique financial objectives.

By factoring in diversification needs, long-term potential, and your personal lifestyle preferences, you can unlock the immense value propositions that Singapore’s prime property market holds for discerning investors like yourself.

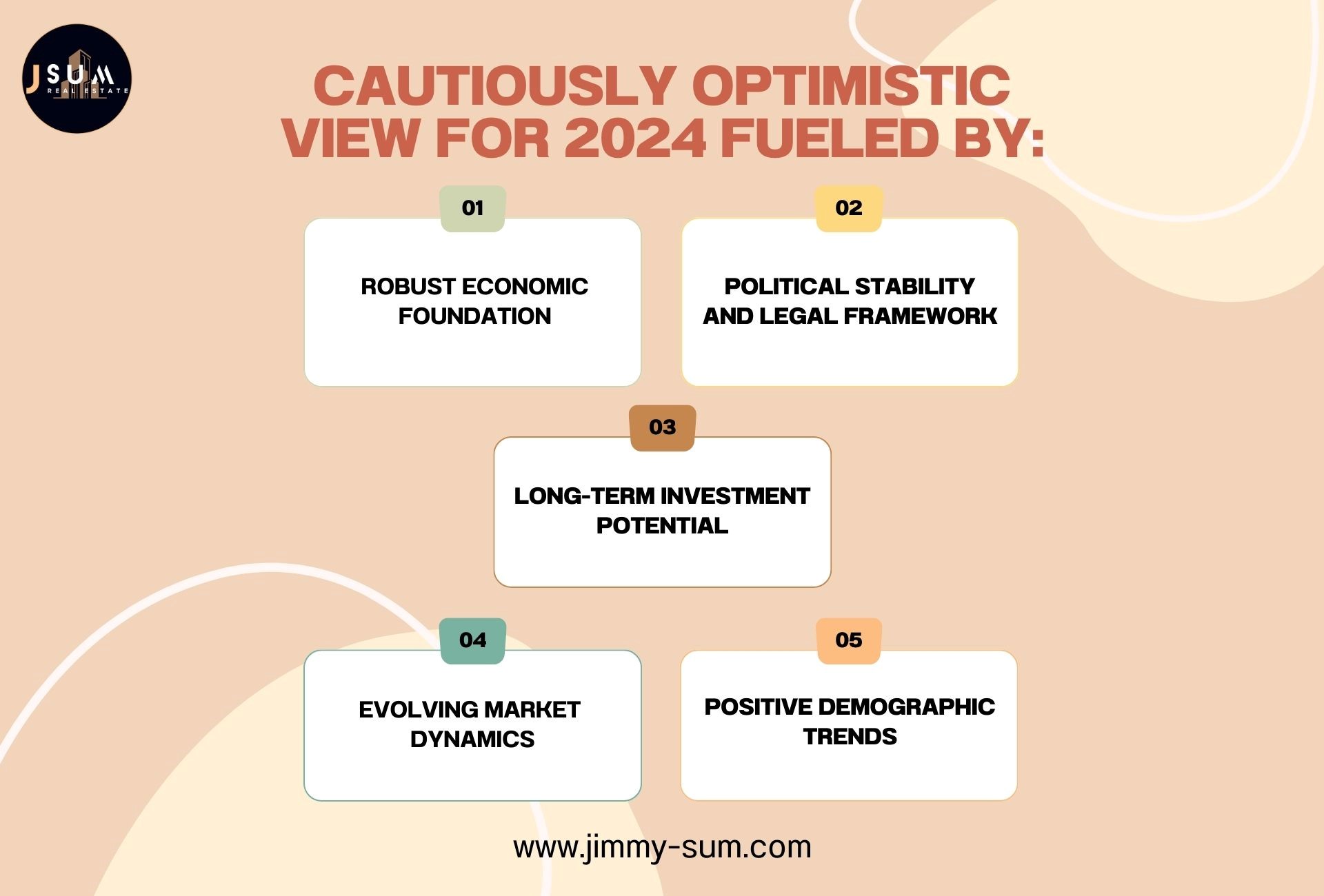

While 2023 brought adjustments to Singapore’s prime property market, the underlying fundamentals remain remarkably strong. Rather than painting a dire picture, we embrace a cautiously optimistic view for 2024, fueled by these key factors:

Robust Economic Foundations: Singapore’s robust economy, buoyed by its diversified financial sector and strategic trade position, is projected to maintain stable growth in 2024. This economic stability provides a solid foundation for sustained demand within the prime property market.

Political Stability and Legal Framework: Renowned for its political stability and transparent legal system, Singapore continues to attract investors seeking a safe haven for their assets. This unwavering trust in the country’s infrastructure provides a crucial advantage over volatile global markets.

Long-Term Investment Potential: While price growth may stabilize or moderate in the short term, the long-term appreciation potential of Singapore’s prime property remains undeniable. Historical trends and the city’s consistent development plans like Jurong Lake District, point towards continued value creation for discerning investors.

Evolving Market Dynamics: The market is adapting to the new landscape, with developers offering more diverse project types and tailoring their offerings to cater to changing buyer preferences. This adaptability ensures the market remains dynamic and responsive to evolving needs.

Positive Demographic Trends: Singapore’s growing population and influx of skilled professionals, particularly in high-earning sectors, will continue to fuel demand for high-quality housing in prime locations. This sustained demand reinforces the long-term viability of the market.

Conclusion: Cautious Optimism with Calculated Decisions

In conclusion, Singapore’s prime property market in 2024 presents both challenges and opportunities. By adopting a cautiously optimistic outlook, understanding the underlying strengths, and making informed decisions, property investors can navigate this evolving landscape and unlock the significant potential this market holds.

With the right approach, it can become a cornerstone of your diversified portfolio, offering long-term wealth creation and reliable income streams.

However, navigating this dynamic landscape requires expert guidance. Seeking professional advice from qualified wealth managers and professional real estate agent like Jimmy Sum is crucial for tailoring an investment strategy that aligns with your individual goals and risk tolerance. He can help you:

- Identify the ideal property options: From prestigious CCR penthouses to high-yielding RCR gems, Jimmy can pinpoint properties that cater to your specific needs and aspirations.

- Navigate the complexities of the market: He can decipher government policies, analyze market trends, and provide valuable insights to empower informed decision-making.

- Structure the optimal investment approach: Whether you seek capital appreciation, rental income, or a combination of both, Jimmy can design a personalized strategy for maximum success.

Remember, investing in Singapore’s prime property is not just about acquiring assets; it’s about securing your financial future and creating a lasting legacy. With the right guidance, you can unlock the immense potential this market holds for foreign investors like yourself.

The future of Singapore’s prime property market is bright. Embrace the cautious optimism, leverage professional guidance, and approach your investment decisions with confidence. By doing so, you can not only tap into the remarkable potential this market offers but also chart a secure and prosperous path for your financial future.

Remember, the journey to unlocking your Singapore property potential starts now. Take the first step and seek professional advice from Jimmy Sum today. Together, let’s navigate this exciting landscape and make your Singapore property dreams a reality.

The information provided in this content is for general informational purposes only and should not be construed as financial, legal, or tax advice. It is essential to consult with qualified professionals before making any investment decisions. While we have made every effort to ensure the accuracy of the information provided, we cannot guarantee its completeness or suitability for any particular purpose. The authors and publishers of this content disclaim all liability for any damages or losses incurred as a result of the use of this information.